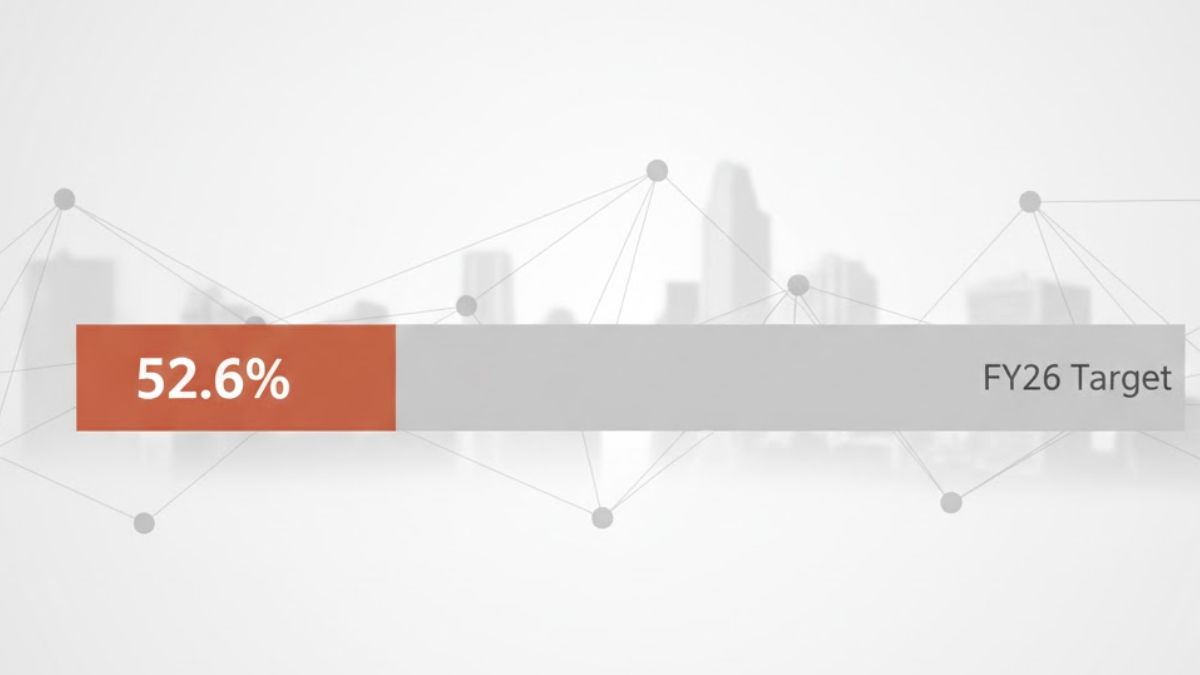

India’s fiscal deficit for April–October 2025 stood at ₹8.25 lakh crore, accounting for 52.6% of the full-year target for FY26, according to official data released by the Ministry of Finance. The figure reflects the government’s elevated capital spending and a slight dip in net tax receipts compared to the previous fiscal year. This mid-year fiscal snapshot highlights the challenges in balancing infrastructure investment and revenue mobilization, especially as the government aims to maintain growth momentum while managing its deficit prudently.

Key Fiscal Figures (April–October 2025)

- Fiscal Deficit: ₹8.25 lakh crore (52.6% of FY26 target)

- Net Tax Receipts: ₹12.74 lakh crore, slightly down from ₹13.05 lakh crore in April–October 2024

- Non-Tax Revenue: ₹4.89 lakh crore, up from ₹4 lakh crore last year

- Total Expenditure: ₹26.26 lakh crore, compared to ₹24.7 lakh crore in the same period last year

- Capital Expenditure (Capex): ₹6.18 lakh crore, significantly higher than ₹4.7 lakh crore in April–October 2024

Higher Capital Spending Signals Infrastructure Push

A key takeaway from the fiscal data is the government’s continued emphasis on capital expenditure, which rose by over 31% year-on-year. With ₹6.18 lakh crore already spent in the first seven months, the Centre is maintaining its strategy of investing in physical infrastructure—including roads, railways, and urban development—as a catalyst for long-term economic growth.

Such investments are expected to have multiplier effects across sectors, boosting employment and private sector participation.

Dip in Net Tax Revenue Raises Concerns

While overall expenditure rose, net tax collections declined slightly, reaching ₹12.74 lakh crore compared to ₹13.05 lakh crore in the same period last year. This dip could be attributed to higher devolution to states or slower-than-expected GST and direct tax inflows, despite strong macroeconomic indicators.

On the other hand, non-tax revenue showed a healthy increase, rising to ₹4.89 lakh crore, possibly due to higher dividend payouts from public sector enterprises and licence fees from telecom and mining sectors.

Implications for Fiscal Consolidation

With the fiscal deficit crossing 50% of the annual target within seven months, questions remain about the Centre’s ability to stick to its fiscal consolidation roadmap. The target for FY26 is to limit the deficit to 5.1% of GDP, as outlined in the Union Budget.

Maintaining this path will require a balance between stimulus spending and disciplined borrowing, especially as global borrowing costs remain high and fiscal prudence is closely watched by rating agencies.

Key Takeaways

- Fiscal Deficit (April–October 2025): ₹8.25 lakh crore (52.6% of FY26 target)

- Net Tax Revenue: ₹12.74 lakh crore (down from ₹13.05 lakh crore)

- Non-Tax Revenue: ₹4.89 lakh crore (up from ₹4 lakh crore)

- Total Expenditure: ₹26.26 lakh crore (vs ₹24.7 lakh crore last year)

- Capital Expenditure: ₹6.18 lakh crore (31% increase YoY)

- Fiscal focus: Infrastructure-led growth

- Concern: Revenue shortfall amid rising spending

RBI Reports Sharp Fall in India’s Curren...

RBI Reports Sharp Fall in India’s Curren...

FPI Inflows Surge to 17 Month High at ₹2...

FPI Inflows Surge to 17 Month High at ₹2...

India’s GST Collections Hit ₹1.83 Lakh C...

India’s GST Collections Hit ₹1.83 Lakh C...