In today’s rapidly advancing digital world, many countries are moving away from the use of physical money and adopting modern, technology-driven payment methods. From online banking to mobile wallets, digital transactions have made payments faster, safer, and more convenient. This global shift toward a cashless economy is changing how people shop, travel, and manage their daily finances.

World’s First Cashless Country

The world’s first cashless country is Sweden. Almost all financial transactions there are done digitally through cards, mobile apps, or online banking. People rarely use coins or notes, and even small shops, buses, and churches accept only digital payments. With secure systems like Swish and strong government support, Sweden has become a global leader in promoting a fully cash-free economy.

How Sweden Became a Cashless Pioneer?

Sweden’s transformation didn’t happen overnight. The journey began in the early 2000s when the country started investing heavily in digital infrastructure and modern banking systems. Swedish citizens were quick to adapt to online services and card payments, paving the way for a society less dependent on coins and notes.

A major breakthrough came in 2012 with the launch of Swish, a mobile payment app created by Sweden’s leading banks. This app allowed people to transfer money instantly using just a phone number — no need for cash or even a card. Today, apps like Swish, Klarna, and BankID are part of everyday life in Sweden, even in small shops, markets, and local cafés.

Strong Government and Banking Support

The Swedish government and its central bank, Sveriges Riksbank, played a crucial role in promoting the digital transition. They introduced cybersecurity laws to protect online transactions and encouraged people to use contactless cards and mobile wallets for daily payments.

Most Swedish banks have stopped handling cash completely. In some regions, ATMs are almost gone, and it’s nearly impossible to withdraw physical money. The government’s focus is not just convenience — it’s also about reducing corruption, preventing theft, and ensuring financial transparency. Every transaction can now be tracked securely, creating a more accountable economy.

Everyday Life in Cashless Sweden

Living in Sweden today means embracing digital payments everywhere. From street performers and food stalls to public transport systems, everyone accepts digital money. Even small vendors and churches display QR codes for quick payments through Swish.

In restaurants, it’s common for friends to split bills instantly through payment apps, and taxis automatically charge customers through digital systems. This digital lifestyle has made Sweden one of the most efficient and technologically advanced economies in the world.

Fascinating Facts About Sweden’s Cashless Society

- Almost No Cash Left in Circulation: Cash in Sweden now makes up only 0.5% of the country’s GDP, compared to more than 8% in places like Japan or Germany. Many Swedes go weeks or months without touching a single banknote. ATMs are disappearing, and many towns have none at all.

- Digital Donations in Churches and Charities: Even churches and charities in Sweden have gone digital. Donation boxes have been replaced by QR codes and Swish payments, making contributions easier and more transparent. This shows how deeply digital culture has become part of everyday life.

- ”No Cash Accepted” Everywhere: Walk into a café, bus, or museum in Sweden, and you’ll likely see a sign saying “No Cash Accepted.” Businesses prefer digital payments because they are safe, quick, and easy to record. This shift has helped the country cut down on theft and counterfeit currency significantly.

- Sweden’s Own Digital Currency – The e-Krona: To ensure financial stability in a cash-free world, the Riksbank is developing the e-Krona, a central bank digital currency (CBDC). It will serve as a secure, government-backed digital form of money. Once launched, Sweden will be among the first countries to have its own official digital currency.

- Inspiring the World: Sweden’s success has encouraged other countries to move in the same direction. Nations like Norway, Finland, Denmark, China, and South Korea are rapidly increasing their digital payment systems. China’s WeChat Pay and Alipay are already replacing cash, while Norway aims to be 99% cashless by 2030.

Which Indian State Shares the Longest Bo...

Which Indian State Shares the Longest Bo...

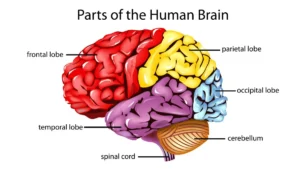

Which is the Largest Part of the Brain? ...

Which is the Largest Part of the Brain? ...

Which City is known as the Science City ...

Which City is known as the Science City ...