In the Union Budget 2025, Finance Minister Nirmala Sitharaman introduced significant changes to the income tax system aimed at providing relief to the middle class and boosting economic growth. These changes are expected to increase disposable income, enhance consumer spending, and contribute to India’s economic development, with particular focus on simplifying the tax structure and ensuring a more progressive tax environment. Here’s a breakdown of the key changes are mentioned below.

Income Tax Exemption for Up to ₹12 Lakh Income

- Individuals earning up to ₹12 lakh will not need to pay any income tax under the new tax regime.

- For salaried individuals, the exemption limit is ₹12.75 lakh, considering the standard deduction of ₹75,000.

Revised Tax Slabs

- The government has restructured tax slabs to reduce the burden on the middle class and promote savings, consumption, and investment.

- The following are the new income tax slabs.

| Income | Tax% |

| ₹0-4 Lakh | No tax |

| ₹4-8 Lakh | 5% tax |

| ₹8-12 Lakh | 10% tax |

| ₹12-16 Lakh | 15% tax |

| ₹16-20 Lakh | 20% tax |

| ₹20-24 Lakh | 25% tax |

| Above ₹24 Lakh | 30% tax |

Tax Rebate for earning Up to ₹12 Lakh

- For those earning up to ₹12 lakh (excluding special rate income such as capital gains), a tax rebate is provided, resulting in zero tax liability.

Impact on Various Income Groups

- A person earning ₹12 lakh will benefit from a tax reduction of ₹80,000.

- Someone earning ₹18 lakh will see a tax benefit of ₹70,000.

- A person earning ₹25 lakh will receive a tax benefit of ₹1,10,000.

Key Advantages of the New Tax Regime

- Increased Disposable Income: The changes are designed to leave more money in the hands of middle-class citizens, enabling increased consumption and savings.

- Relief for Senior Citizens: The tax structure includes measures such as an increase in the TCS threshold limit from ₹7 lakh to ₹10 lakh and a doubling of the TDS threshold for senior citizens.

Overall Economic Impact

- These changes are expected to significantly boost demand in sectors like FMCG, automobiles, and retail, driving economic growth.

- The tax reforms aim to increase consumer confidence, simplify the tax system, and foster a progressive tax environment.

| Summary/Static | Details |

| Why in the news? | Income Tax Budget 2025: No income tax for upto ₹12 lakh in new tax regime |

| Income Tax Exemption | Individuals earning up to ₹12 lakh will pay no income tax (₹12.75 lakh for salaried individuals). |

| Revised Tax Slabs | ₹0 – ₹4 Lakh Nil ₹4 Lakh – ₹8 Lakh 5% ₹8 Lakh – ₹12 Lakh 10% ₹12 Lakh – ₹16 Lakh 15% ₹16 Lakh – ₹20 Lakh 20% ₹20 Lakh – ₹24 Lakh 25% |

| Tax Rebate for Earnings Up to ₹12 Lakh | Tax rebate for earnings up to ₹12 lakh, resulting in zero tax liability. |

| Impact on ₹12 Lakh Income | Tax benefit of ₹80,000. |

| Impact on ₹18 Lakh Income | Tax benefit of ₹70,000. |

| Impact on ₹25 Lakh Income | Tax benefit of ₹1,10,000. |

| Increased Disposable Income | Designed to boost savings, consumption, and economic growth. |

| Relief for Senior Citizens | Increase in TCS threshold to ₹10 lakh, doubling TDS threshold. |

| Economic Sectors Affected | Sectors like FMCG, automobiles, and retail to benefit from increased consumer spending. |

| Overall Impact | Boost to consumer confidence, simplified tax system, and progressive tax environment. |

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

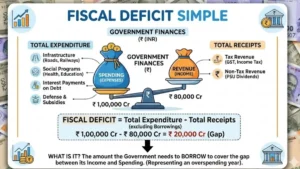

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...