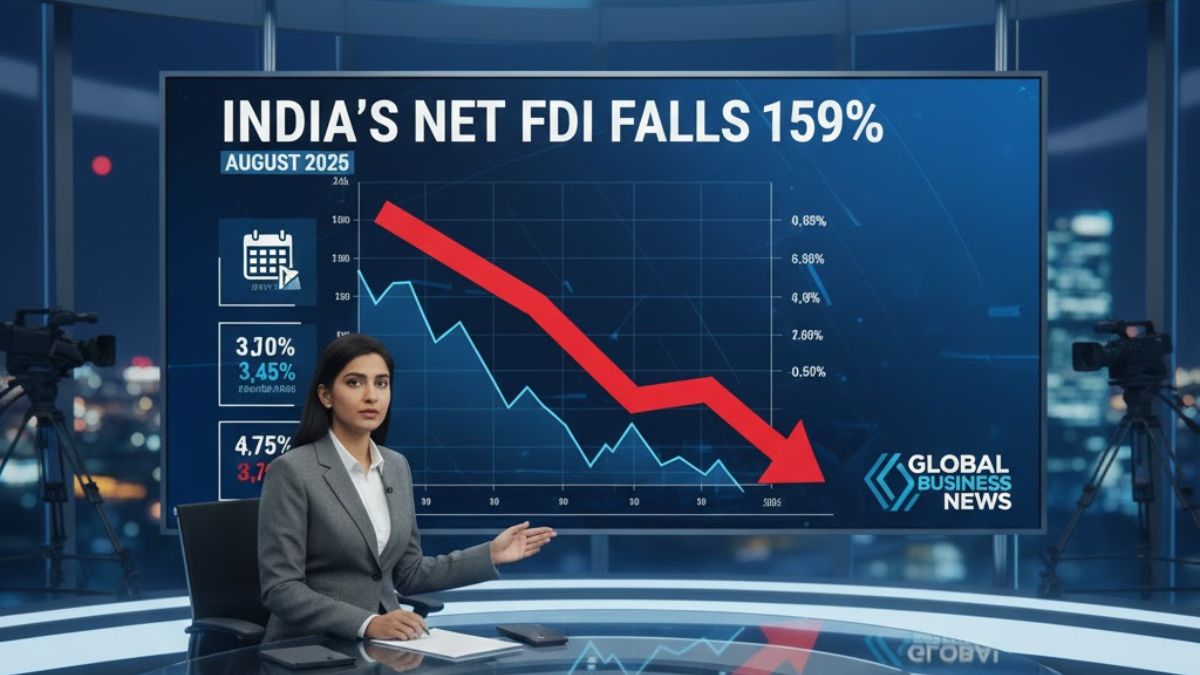

In a sharp reversal of capital trends, Net Foreign Direct Investment (FDI) into India fell by 159% in August 2025, marking the second time this financial year when outflows have exceeded inflows. This steep decline has raised concerns about the changing investment climate, global uncertainties, and the health of India’s external sector. Despite strong figures earlier in the year, the net FDI slump in August indicates a significant change in capital movement patterns, demanding close examination of the underlying components.

What is Net FDI and Why It Matters

Net FDI is a critical economic indicator that reflects the difference between gross FDI inflows (foreign investments into India) and total outflows, which include,

- Repatriation by foreign companies (profits, dividends, or sale proceeds)

- Outward FDI by Indian firms (investments made abroad)

- Mathematically: Net FDI = Gross FDI Inflows − (Repatriation + Outward FDI)

A positive net FDI shows more capital entering the country than leaving — indicating investor confidence. In contrast, negative or low net FDI suggests either capital withdrawal or a shift of domestic investments overseas, which could be a sign of concern.

August 2025: Sharp Drop in Inflows and Rising Outflows

According to official data,

- Gross FDI into India in August 2025 stood at $6,049 million, a 30.6% drop compared to August 2024.

- Net FDI fell by 159%, reflecting a reversal in capital movement, where outflows surpassed incoming investments.

- This is the second such instance in FY26 when India recorded negative net FDI.

The fall in gross inflows coupled with a rise in repatriation and outward FDI led to this decline. It also suggests that either foreign companies are pulling back capital or Indian firms are stepping up overseas investments.

April–August 2025: Strong Cumulative Performance

Interestingly, the cumulative data for the first five months of FY26 still reflects overall strength,

- Net FDI between April and August 2025 stood at $10,128 million, which is 121% higher than the same period last year.

- This indicates that the earlier months of FY26 had strong inflows, compensating for the dip in August.

- This mixed picture highlights the volatility in FDI flows, driven by both domestic policy dynamics and global economic conditions.

Unemployment Rises to 5%! Why India’s Jo...

Unemployment Rises to 5%! Why India’s Jo...

Sugar Exports Cross 2 Lakh Tonnes in 202...

Sugar Exports Cross 2 Lakh Tonnes in 202...

India’s Trade Deficit Jumps to $34.68 Bi...

India’s Trade Deficit Jumps to $34.68 Bi...