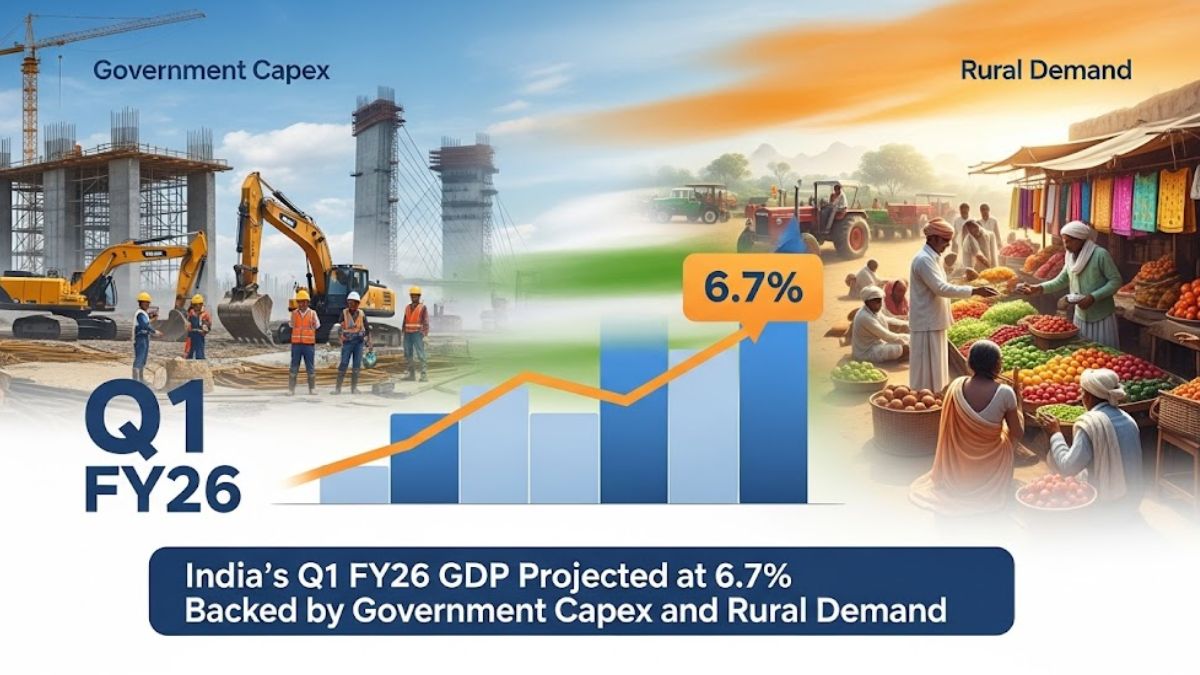

India’s economy is projected to grow at a robust 6.7% in the first quarter (Q1) of FY26, according to a median estimate by economists. The growth is underpinned by strong government capital expenditure, reviving rural consumption, and a resilient services sector. This estimate aligns closely with the Reserve Bank of India’s forecast of 6.5%, suggesting stable economic momentum in the post-pandemic recovery phase.

Key Growth Drivers

Government-Led Capital Expenditure

A significant boost in public spending has fueled infrastructure activity, with capital expenditure rising nearly 52% year-on-year in Q1. This has provided a strong foundation for economic expansion, especially in the absence of large-scale private investment.

Rural Demand Recovery

Improved agricultural output and higher rural income levels have supported consumption demand in rural areas, helping offset moderation in urban consumer spending. This rural uplift is vital for sustaining broad-based growth across sectors.

Services Sector Momentum

The services industry, particularly segments like finance, IT, and transport, continues to support GDP expansion. Growth in aviation cargo traffic, GST collections, and steel production has contributed positively to the overall performance.

Sectoral Highlights

- Construction and agriculture showed strong performance.

- Steel output, cargo traffic, and tax collection metrics added momentum to economic activity.

Emerging Challenges

Despite the overall positive trend, certain sectoral and macroeconomic headwinds were evident in Q1,

- Industrial Output Deceleration: The Index of Industrial Production (IIP) growth slowed to 2% from 5.4% in the previous quarter, with manufacturing output easing to 3.4% from 4.2%.

- Climate and Trade Disruptions: Unseasonal monsoon patterns affected mining, while global uncertainties and trade tensions dampened sentiment in export-linked sectors.

- These challenges may moderate future growth if not counterbalanced by sustained fiscal support or a pickup in private investments.

Which is the Largest Banana Producing St...

Which is the Largest Banana Producing St...

Shashi Tharoor Conferred Honorary D.Litt...

Shashi Tharoor Conferred Honorary D.Litt...

Big Change at Rashtrapati Bhavan! Lutyen...

Big Change at Rashtrapati Bhavan! Lutyen...