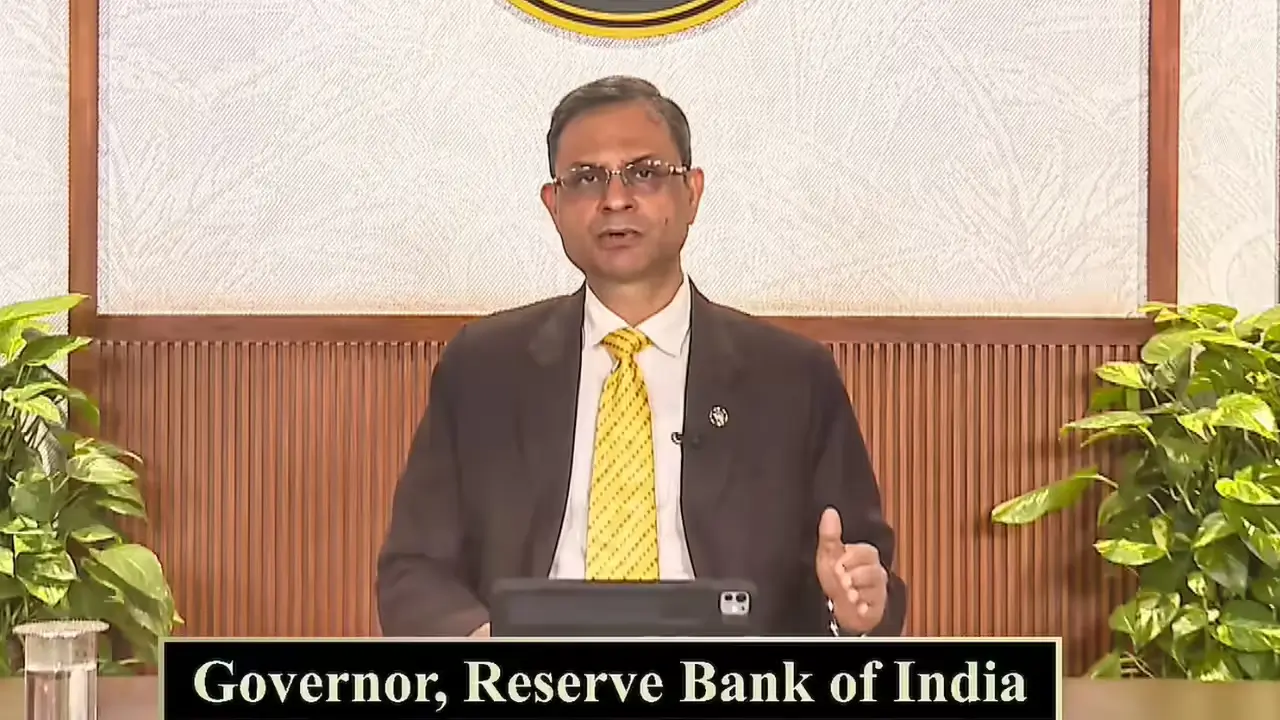

India’s journey toward universal financial inclusion entered a new milestone with the release of the National Strategy for Financial Inclusion (NSFI) 2025–30. Approved by the Sub-Committee of the Financial Stability and Development Council (FSDC-SC) in its 32nd meeting, the strategy was formally launched on December 01, 2025, by the Governor of the Reserve Bank of India, Shri Sanjay Malhotra. This strategy aims to strengthen access, usage, and delivery of financial services for citizens across the country, especially underserved households and enterprises.

Vision and Focus of NSFI 2025–30

The latest national strategy highlights a synergistic ecosystem approach that not only expands access to financial services but ensures their effective and meaningful use. It stresses improvement in service delivery at the last mile and sets out a structured five-objective framework, referred to as the Panch-Jyoti, supported by 47 action points to guide implementation.

Panch-Jyoti: Five Strategic Objectives

The Panch-Jyoti framework outlines the priorities shaping the national inclusion agenda for the next five years. Its first objective focuses on expanding the availability and responsible use of a diverse, affordable, and suitable bouquet of financial services. The emphasis is on improving financial safety and security for households and micro-enterprises, enabling them to save, invest, and protect themselves.

A key highlight of the new strategy is its gender-sensitive approach, promoting women-led financial inclusion. The strategy aims to improve the financial resilience of households by paying special attention to and designing programmes for vulnerable and underserved groups.

Skill development, livelihood enhancement, and ecosystem linkages also take centre stage. The strategy seeks to integrate financial services with skilling and income generation initiatives, ensuring financial access leads to productive outcomes for individuals and enterprises.

Financial literacy remains a critical pillar. NSFI 2025-30 stresses the need to use financial education as a driver of financial discipline and behaviour change, equipping citizens with the knowledge to access, manage, and benefit from formal finance.

The strategy also reinforces customer protection and grievance redressal mechanisms, promising higher reliability, transparency, and quality of service. Strengthening trust in the financial system is seen as essential for sustainable inclusion.

How the Strategy Was Developed

The framing of NSFI 2025–30 resulted from extensive, nationwide consultations involving multiple financial regulators, government bodies, and development institutions. These discussions were led by the Technical Group on Financial Inclusion and Financial Literacy (TGFIFL) and included stakeholders such as the Department of Economic Affairs, Department of Financial Services, SEBI, IRDAI, PFRDA, NABARD, National Skill Development Corporation, and the National Centre for Financial Education. This collaborative approach ensured that the strategy addresses gaps and aligns with field realities.

Building on the Gains of NSFI 2019–24

The previous five-year strategy (2019–24) significantly strengthened access to formal banking services, digital payments, insurance, pensions, and credit. Improvements were visible across all dimensions of financial inclusion—access, usage, and quality. The new strategy aims to consolidate these achievements while expanding outreach, enhancing service quality, and deepening inclusion.

NSFI 2025–30 recognises that financial inclusion is not merely about opening accounts but about ensuring meaningful and productive financial participation. With a robust ecosystem approach, gender focus, strong customer safeguards, and emphasis on education, India aims to create a financially empowered and resilient society.

PhonePe Launches AI-Powered Natural Lang...

PhonePe Launches AI-Powered Natural Lang...

ICICI’s New Swasthya Pension Scheme: A S...

ICICI’s New Swasthya Pension Scheme: A S...

RBI’s New Rulebook: UTI Required for All...

RBI’s New Rulebook: UTI Required for All...