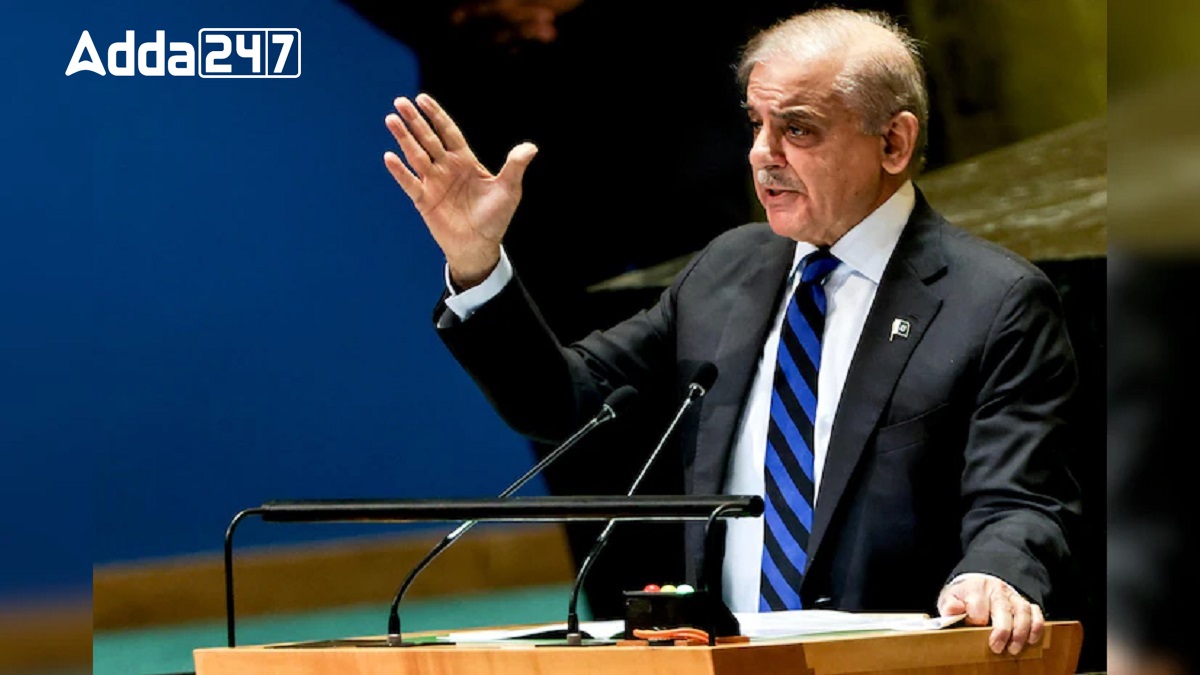

Pakistan is witnessing widespread protests after the government raised taxes by 40% as part of a $7 billion bailout deal with the International Monetary Fund (IMF). This move, aimed at stabilizing a faltering economy plagued by high inflation and depleted foreign reserves, has pushed many citizens to the brink, exacerbating an already critical cost of living crisis. As basic necessities become increasingly unaffordable, the population’s patience wears thin, posing a significant challenge for Prime Minister Shehbaz Sharif’s coalition government.

Economic Context

The IMF bailout comes amid a backdrop of severe economic distress, including soaring inflation rates that have forced many families to allocate over half their income to food. Essential items, such as milk and electricity, have skyrocketed in price, leaving citizens like Niaz Muhammad, a produce seller in Islamabad, struggling to meet their basic needs. In recent years, Pakistan has faced multiple crises, including political unrest and natural disasters, leading to Asia’s highest inflation rate at times.

Public Frustration and Response

Finance Minister Muhammad Aurangzeb has acknowledged the “transitional pain” that comes with the IMF agreement, urging the necessity of structural reforms to ensure long-term recovery. Despite the IMF’s defense of the bailout conditions, public dissent is palpable. Protests against the tax hikes are escalating, with citizens feeling betrayed by a political establishment perceived to have exploited them for decades. The government now faces the challenge of maintaining social stability while implementing necessary reforms.

Potential for Future Unrest

With the threat of protests reminiscent of recent unrest in Kenya, which led to the reversal of tax hikes tied to IMF austerity measures, Pakistan must tread carefully. Moody’s Ratings warns that rising social tensions could hinder the government’s ability to implement the reforms required by the IMF. The increased tax burden on the middle class and a lack of cuts to state expenses have ignited public outrage, prompting multinational companies to adopt “shrinkflation” strategies to cope with the financial strain. As economic conditions worsen, the outlook for the middle and lower middle classes remains bleak, signaling that the struggles facing Pakistani citizens are far from over.

Pakistan Protests and IMF Bailout: Key Points

| Key Points | Details |

|---|---|

| Why in News | Widespread protests in Pakistan due to a 40% tax hike as part of a $7 billion IMF bailout to stabilize the economy. |

| IMF Bailout | $7 billion agreement with the IMF to stabilize Pakistan’s economy, amidst high inflation and depleted reserves. |

| Tax Hike Impact | A 40% tax increase is leading to protests, as basic necessities like milk and electricity become unaffordable. |

| Inflation Crisis | Pakistan faces soaring inflation, with families allocating over half their income to food. |

| Public Response and Protests | Protests are escalating due to perceived exploitation, with citizens demanding change from the government. |

| Government Response | Finance Minister acknowledges transitional pain but defends the IMF agreement, emphasizing the need for reforms. |

| Potential for Unrest | Moody’s warns that rising social tensions could hinder IMF-required reforms, recalling past protests in Kenya. |

| Social Stability Concern | The government struggles to maintain social stability while implementing IMF-driven austerity measures. |

India, Bangladesh Among 40 Nations Hit b...

India, Bangladesh Among 40 Nations Hit b...

India, Nepal Sign New MoU to Boost Fores...

India, Nepal Sign New MoU to Boost Fores...

Historic Recognition: Modi Becomes First...

Historic Recognition: Modi Becomes First...