Reserve Bank of India (RBI) released its final directions on the ‘Maintenance of Cash Credit Accounts, Current Accounts and Overdraft Accounts by Banks’. These guidelines introduce important relaxations while continuing with a principle-based regulatory framework aimed at improving credit discipline and transparency.

The directions are highly relevant for banking awareness, financial regulation, and competitive exams, as they clarify how different types of transaction accounts will be maintained across seven categories of regulated entities.

Background of the RBI Directions

Earlier, the RBI had issued draft norms on October 1, 2025, seeking stakeholder feedback. These draft rules focused on regulating the opening and maintenance of transaction accounts—especially Current Accounts (CA) and Overdraft Accounts (OD)—to prevent diversion of funds and ensure better monitoring of borrower exposure.

After reviewing feedback, the RBI finalized the norms with select relaxations, especially regarding Cash Credit (CC) accounts.

Regulated Entities Covered

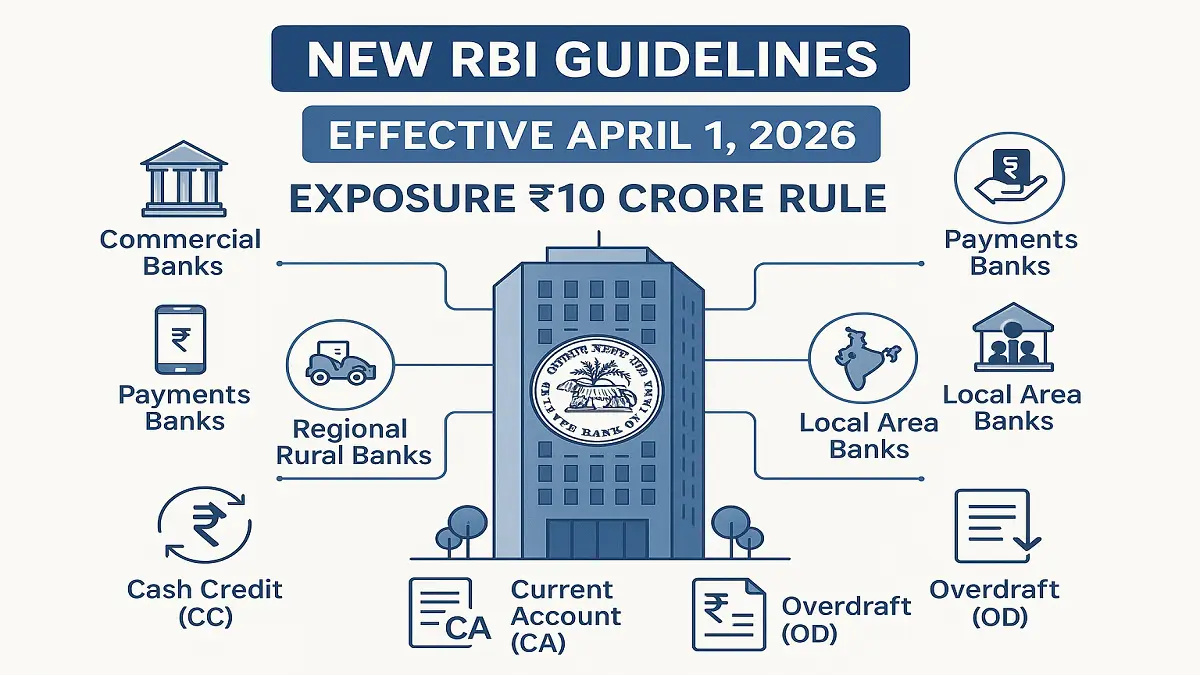

The final directions apply to the following seven categories of regulated entities:

- Commercial Banks (CBs)

- Small Finance Banks (SFBs)

- Payments Banks (PBs)

- Local Area Banks (LABs)

- Regional Rural Banks (RRBs)

- Urban Co-operative Banks

- State Co-operative Banks

These entities collectively form the backbone of India’s banking system.

Effective Date of the Guidelines

- Effective from: April 1, 2026

- Banks are allowed to implement the directions earlier if they choose to do so in full.

Key Highlights of the RBI Guidelines

1. Cash Credit (CC) Accounts – Major Relaxation

The RBI has excluded Cash Credit (CC) accounts from restrictions applicable to other transaction accounts.

Why this change?

- CC accounts are working capital facilities

- They are linked to the value of current assets, such as inventory and receivables

- Unlike CA or OD accounts, CC accounts are need-based and asset-backed

New Rule

Banks can provide CC facilities freely, based on customer requirements

No restrictions apply, regardless of borrower exposure

This move provides greater operational flexibility to businesses, especially MSMEs.

2. Current Account (CA) and Overdraft (OD) Accounts

The RBI has categorized rules based on the aggregate exposure of the banking system to a borrower.

A. Exposure Less Than ₹10 Crore

-

If the total banking system exposure to a customer is below ₹10 crore:

No restriction on opening or maintaining CA or OD accounts

Any bank may offer these accounts based on customer needs

B. Exposure Equal to or More Than ₹10 Crore

For borrowers with aggregate exposure of ₹10 crore or more, stricter norms apply.

A bank may maintain a CA or OD account only if it satisfies either of the following conditions:

- Holds at least 10% share in the banking system’s total exposure to the borrower OR Holds at least 10% share in the banking system’s fund-based exposure to the borrower

This ensures that only meaningfully exposed lenders manage transaction flows, improving credit monitoring and risk control.

Other Important Provision

Remittance Window – No Change

Despite requests from stakeholders for relaxation, the RBI has retained the existing rule:

- Funds collected in collection accounts must be transferred to designated transaction accounts (CC/OD/CA)

- Timeline: Within two working days

This continues to support timely fund movement and transparency.

Why These Guidelines Matter

- Encourage better credit discipline

- Prevent fund diversion

- Simplify rules for small borrowers

- Provide operational ease for working capital financing

- Strengthen banking system oversight

For government job aspirants, these norms are important for exams related to:

- RBI & Banking Awareness

- Financial Regulation

- Economic Reforms

About the Reserve Bank of India (RBI)

- Governor: Sanjay Malhotra

- Headquarters: Mumbai, Maharashtra

- Established: April 1, 1935

- Role: Central bank responsible for monetary policy, bank regulation, and financial stability in India

RBI’s New Rulebook: UTI Required for All...

RBI’s New Rulebook: UTI Required for All...

What Is a Type II Non-Deposit NBFC? Airt...

What Is a Type II Non-Deposit NBFC? Airt...

RBI Releases Draft Directions on Foreign...

RBI Releases Draft Directions on Foreign...