RBI’s Monetary Policy 2023

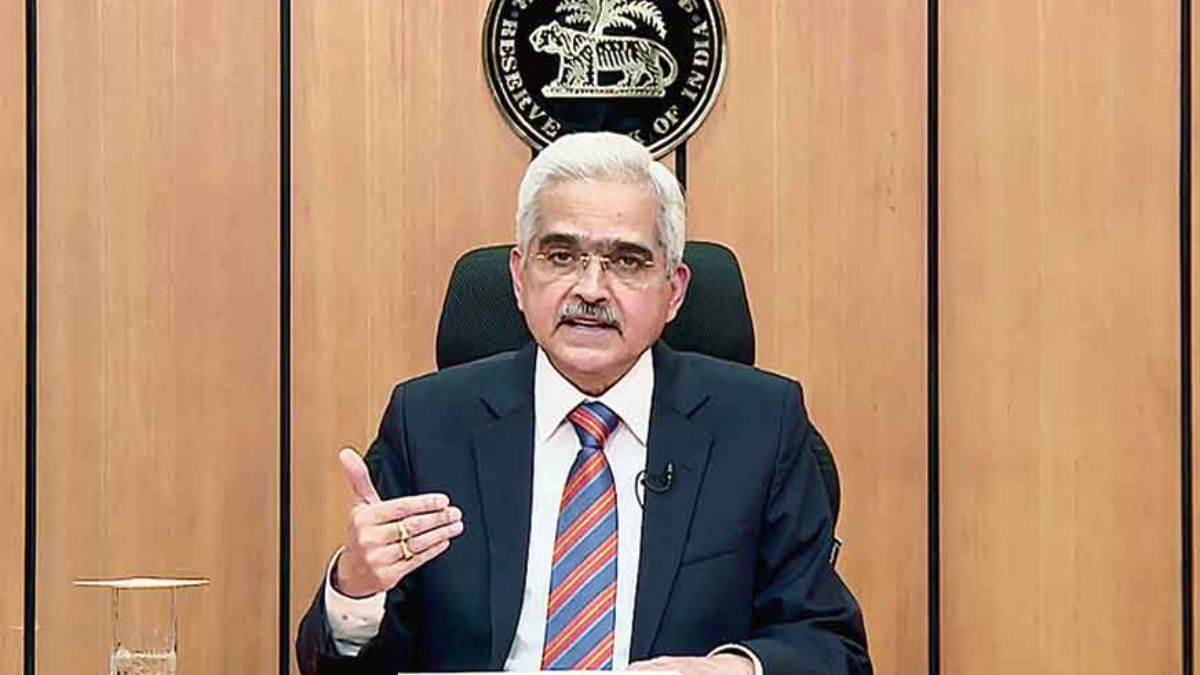

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has announced its policy decision. The 2nd bi-monthly monetary policy meeting of FY24 was held from June 6 to 8 and its outcome will be announced on June 8. The next meeting of the MPC is scheduled during August 8-10, 2023. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra, and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 percent.

RBI Monetary Policy 2023 Important Points

- The Reserve Bank of India (RBI) governor Shaktikanta Das said that the net Foreign portfolio investment (FPI) inflows stand at USD 8.4 billion during the current financial year upto June 6 as against net outflows in the proceeding two years where USD 14.1 billion in 2021-22 and 5.9 billion in 2022-23.

- Th rupee remained stable since January this year and India’s foreign exchange reserves stood at $595.1 billion as on June 2.

- RBI projects consumer price index inflation for FY24 at 5.1%.

- Real GDP growth projections for the financial year 2023-24 is projected at 6.5 percent with Q1 projections being 8 percent, Q2 projections being 6.5 percent, Q3 projections being 6 percent and Q4 projections being 5.7 percent.

- Monetary Policy Committee decides to keep repo rate unchanged at 6.5%, Standing Deposit Facility Rate remains at 6.25%.

- Marginal Standing Facility Rate and Bank Rate unchanged at 6.75%.

- To providing greater flexibility for managing the money market borrowings, it has been decided that Scheduled Commercial Banks (excluding Small Finance Banks) can set their own limits for borrowing in Call and Notice Money Markets within the prudential limits for inter-bank liabilities prescribed by the Reserve Bank of India.

- RBI has proposed to expand the scope and reach of e-RUPI vouchers by permitting non-bank Prepaid Payment Instrument (PPI) issuers to issue e-RUPI vouchers and enabling issuance of e-RUPI vouchers on behalf of individuals.

- In order to expand payment options for Indians travelling abroad, RBI has been decided to allow issuance of RuPay Prepaid Forex cards by banks in India for use at ATMs, PoS machines and online merchants overseas. Further, RuPay Debit, Credit, and Prepaid Cards will be enabled for issuance in foreign jurisdictions, which can be used internationally, including in India.

- With an aim of broadening the issuance of e-rupee vouchers, the Reserve Bank of India Governor Shaktikanta Das on Thursday (June 8) announced that now non-bank companies can also issue e-rupee vouchers.

- The Sensx was trading 149.21 points, or 0.24%, higher at 63,292.17, while the Nifty gained 42.60 points, or 0.23%, to 18,769.00.

Find More News Related to Banking

What is the Strait of Hormuz? Know About...

What is the Strait of Hormuz? Know About...

Which Country is the Largest Consumer of...

Which Country is the Largest Consumer of...

Amol Palekar to Receive META Lifetime Ac...

Amol Palekar to Receive META Lifetime Ac...