In a landmark move marking the largest cross-border deal in the Indian banking sector, State Bank of India (SBI) along with seven private banks have collectively sold a 20% stake in Yes Bank to Japan’s Sumitomo Mitsui Banking Corporation (SMBC) for ₹13,482 crore. The strategic transaction not only signals growing global interest in Indian banking but also highlights Yes Bank’s strong turnaround since its 2020 crisis.

Why in News?

This stake sale is significant as it marks the entry of SMBC, one of Japan’s biggest banking groups, into a major Indian private bank, further globalising India’s banking sector. The ₹13,482 crore deal is the largest foreign acquisition in Indian banking history, showcasing the growing investor confidence in the Indian financial system.

Transaction Highlights

- Stake sold: 20% in Yes Bank

- Value of deal: ₹13,482 crore (~$1.62 billion)

- Price per share: ₹21.50 (18% premium to market price)

- Valuation of Yes Bank: $7.9 billion

Stakeholders selling

- SBI: 13.19% stake for ₹8,889 crore

- Private banks (HDFC, ICICI, Axis, Kotak Mahindra, Federal, IDFC First, Bandhan): 6.81% for ₹4,594 crore

Post-deal shareholding

- SBI: 10.78%

- Other 7 banks: 2.93%

- SMBC: 20%

Background

- In 2020, Yes Bank faced a severe crisis; RBI superseded its board and appointed an administrator.

- SBI led a rescue effort by investing ₹7,250 crore.

- Other banks (HDFC, ICICI, Axis, Kotak, etc.) also contributed.

- Initially, SBI held a 49% stake post-reconstruction.

SMBC’s Profile

- Subsidiary of SMFG (Sumitomo Mitsui Financial Group), Japan’s 2nd largest banking group.

- SMFG has $2 trillion in assets (as of Dec 2024).

- SMBC is a major foreign bank in India, also operates NBFC “SMFG India Credit”.

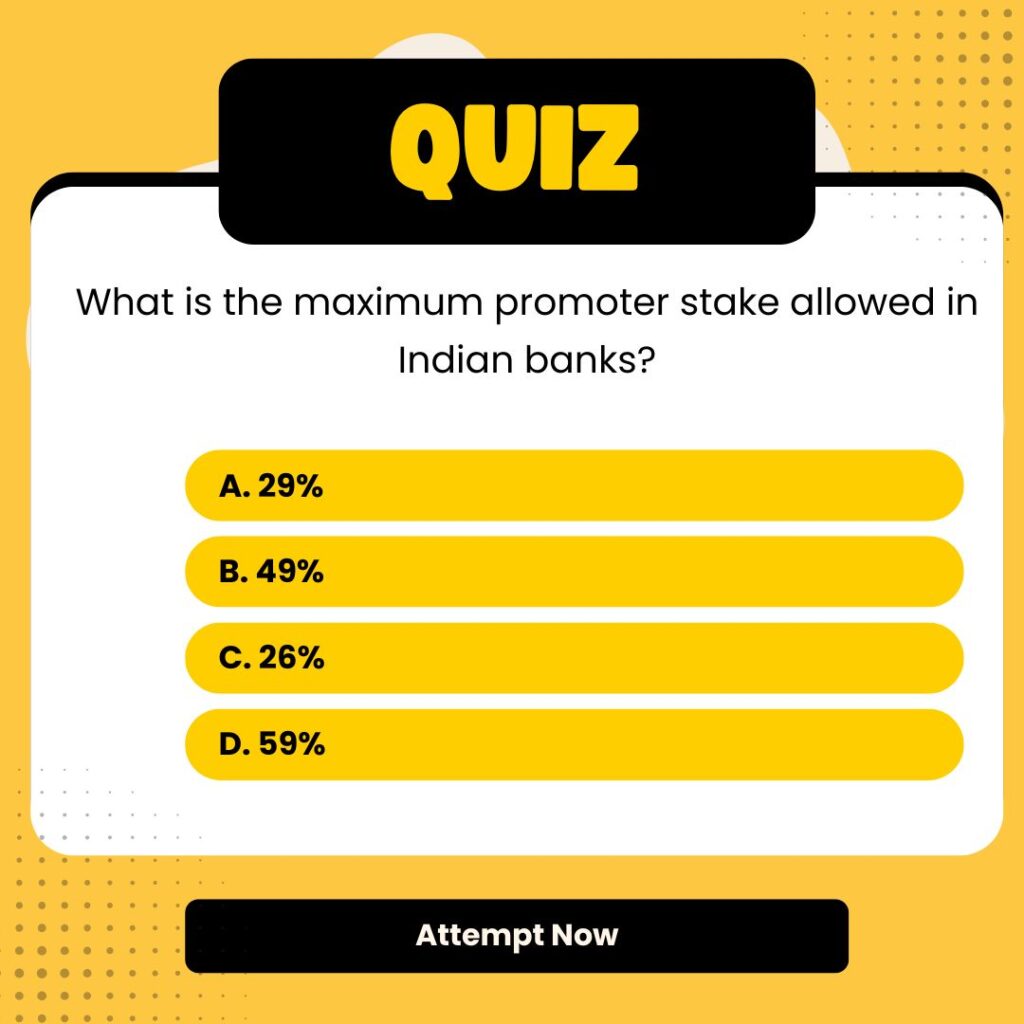

Regulatory Considerations

- RBI approval required for foreign investment in Indian banks.

- Stake kept below 26% limit to avoid mandatory open offer under SEBI rules.

Strategic Significance

- SMBC’s entry boosts Yes Bank’s transformation and global linkages.

- The deal is seen as a vote of confidence in India’s banking reforms.

- Expected to enhance governance, global best practices, and profitability.

| Summary/Static | Details |

| Why in the news? | SBI, Private Lenders Sell 20% of Yes Bank to Japan’s SMBC for ₹13,482 Cr |

| Deal Participants | SBI, 7 private Indian banks & Japan’s SMBC |

| Stake Sold | 20% in Yes Bank |

| Deal Value | ₹13,482 crore |

| SBI Stake Sold | 13.19% for ₹8,889 crore |

| New SMBC Stake | 20% (below 26% regulatory limit) |

| Valuation of Yes Bank | $7.9 billion |

| Yes Bank’s New Major Investor | SMBC, subsidiary of Japan’s SMFG |

| Regulatory Approvals Needed | RBI, Competition Commission of India (CCI) |

SEBI Revamps New Mutual Fund Rules 2026 ...

SEBI Revamps New Mutual Fund Rules 2026 ...

PhonePe Launches AI-Powered Natural Lang...

PhonePe Launches AI-Powered Natural Lang...

ICICI’s New Swasthya Pension Scheme: A S...

ICICI’s New Swasthya Pension Scheme: A S...