The Union Budget 2025-26 outlines a comprehensive roadmap for India’s economic growth, emphasizing infrastructure expansion, fiscal prudence, and inclusive development. With a total expenditure of ₹50.65 lakh crore, the budget prioritizes capital investment, social sector spending, and tax reforms while aiming to reduce the fiscal deficit to 4.4% of GDP. Key allocations include significant funding for railways, highways, defence, and rural development, reinforcing the government’s commitment to long-term economic stability and job creation.

Key focus of the 2025-2026 Budget includes:

Agriculture & Rural Prosperity

- Programs like the National Mission on High Yielding Seeds and Makhana Board aim to improve agricultural productivity.

- Enhanced credit for farmers, with short-term loans through Kisan Credit Cards (KCC) and the launch of missions to promote pulses production and sustainable cotton farming.

Support for MSMEs

- Revision of MSME classification to encourage growth with revised investment and turnover limits.

- Credit guarantees and customized credit cards for micro-enterprises, supporting up to 10 lakh micro-businesses.

- Focus on labor-intensive sectors, including footwear, leather, toy, and food processing industries to create jobs.

Infrastructure & Urban Development

- The Urban Challenge Fund allocates ₹1 lakh crore for redeveloping cities and water management.

- Support for states through a ₹1.5 lakh crore outlay for capital expenditure, including interest-free loans.

Technological & Educational Advancements

- Expansion of medical education, artificial intelligence initiatives, and Atal Tinkering Labs.

- Broadband connectivity in rural schools, Centers of Excellence for skilling, and development of IITs.

Tax Reforms

- Proposals for rationalizing tax structures and extending the deadline for filing updated returns.

- Income tax reform focused on the middle class, with deductions for senior citizens and adjustments in TDS limits for rent payments.

Financial Sector Reforms

- Increased foreign direct investment limits for the insurance sector and revamped credit score frameworks for rural areas.

- Introduction of the Grameen Credit Score to serve rural credit needs, and revamped KYC registry for speedier approvals.

Rupee Comes From (Budget 2025-26)

The government’s total revenue comes from various sources, categorized as follows:

- Corporation Tax – 17%

- Income Tax (includes Securities Transaction Tax) – 22%

- Customs Duty – 4%

- Union Excise Duties – 5%

- Goods & Services Tax (GST) & Other Taxes – 18%

- Non-Tax Receipts – 9%

- Non-Debt Capital Receipts – 1%

- Borrowings & Other Liabilities – 24%

Rupee Goes To (Budget 2025-26)

The government’s expenditure is divided into multiple categories:

- Central Sector Schemes (excluding Defence & Major Subsidies) – 16%

- Interest Payments – 20%

- Defence – 8%

- Major Subsidies (Food, Fertilizer, Petroleum, etc.) – 6%

- Finance Commission & Other Transfers – 8%

- State Share of Taxes & Duties – 22%

- Pensions – 4%

- Other Expenditure – 8%

- Centrally Sponsored Schemes – 8%

Total Revenue and Expenditure

Revenue Estimates

- Total Revenue Receipts: ₹34,20,409 crore

- Tax Revenue (Net to Centre): ₹28,37,409 crore

- Non-Tax Revenue: ₹583,000 crore

- Capital Receipts (including borrowings): ₹16,44,936 crore

Expenditure Estimates

- Total Expenditure: ₹50,65,345 crore

- Revenue Expenditure: ₹39,44,255 crore

- Capital Expenditure: ₹11,21,090 crore

- Effective Capital Expenditure: ₹15,48,282 crore

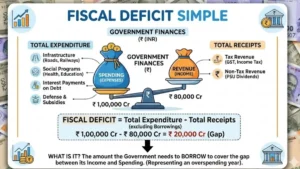

Deficit Indicators

Key Deficit Figures

- Fiscal Deficit: ₹1,56,89,36 crore (4.4% of GDP)

- Revenue Deficit: ₹5,23,846 crore (1.5% of GDP)

- Effective Revenue Deficit: ₹96,654 crore (0.3% of GDP)

- Primary Deficit: ₹2,92,598 crore (0.8% of GDP)

Deficit Financing

- Market Borrowings: ₹11,53,834 crore

- Securities against Small Savings: ₹343,382 crore

- External Debt: ₹23,490 crore

Sector-Wise Allocation

Major Expenditures

- Interest Payments: ₹12,76,338 crore

- Defence: ₹4,91,732 crore

- Pension: ₹2,76,618 crore

Subsidies:

- Food: ₹203,420 crore

- Fertilizer: ₹167,887 crore

- Petroleum: ₹12,100 crore

Key Infrastructure and Development Allocations

- Rural Development: ₹2,66,817 crore

- Education: ₹1,28,650 crore

- Healthcare: ₹98,311 crore

- Urban Development: ₹96,777 crore

- Transport Infrastructure: ₹5,48,649 crore

Transfer to States & UTs

Total Transfer to States & UTs: ₹25,01,284 crore

- State Devolution: ₹14,22,444 crore

- Finance Commission Grants: ₹1,32,767 crore

- Centrally Sponsored Schemes: ₹541,850 crore

- Other Grants & Loans: ₹3,74,725 crore

Key Government Schemes and Allocations

Agriculture & Rural Development

- PM-KISAN: ₹63,500 crore

- Mahatma Gandhi NREGA: ₹86,000 crore

- PM Awas Yojana (Grameen & Urban): ₵74,626 crore

Education & Employment

- PM Schools for Rising India (PM SHRI): ₹7,500 crore

- Samagra Shiksha: ₹41,250 crore

- Skill Development & Apprenticeships: ₹13,560 crore

Health & Social Welfare

- Ayushman Bharat – PMJAY: ₹9,406 crore

- POSHAN 2.0 (Nutrition Mission): ₹21,960 crore

- Social Assistance Programs: ₹9,652 crore

Infrastructure & Industrial Development

- Jal Jeevan Mission: ₹67,000 crore

- PM Gram Sadak Yojana: ₹19,000 crore

- Production Linked Incentive (PLI) Schemes: ₹2,445 crore

Budget Allocations for All Ministries (2025-26):

Top Ministries by Budget Allocation

- Ministry of Finance – ₹19,39,001.26 crore

- Ministry of Defence – ₹6,81,210.27 crore

- Ministry of Consumer Affairs, Food & Public Distribution – ₹2,15,767.09 crore

- Ministry of Railways – ₹2,55,445.18 crore

- Ministry of Road Transport & Highways – ₹2,87,333.16 crore

Key Ministry Allocations

Infrastructure & Development

- Ministry of Housing & Urban Affairs – ₹96,777.00 crore

- Ministry of Power – ₹21,847.00 crore

- Ministry of Ports, Shipping & Waterways – ₹3,470.58 crore

Social Sectors

- Ministry of Education – ₹1,28,650.05 crore

- Ministry of Health & Family Welfare – ₹99,858.56 crore

- Ministry of Women & Child Development – ₹26,889.69 crore

- Ministry of Rural Development – ₹1,90,405.53 crore

Scientific Research & Technology

- Department of Space – ₹13,416.20 crore

- Ministry of Science & Technology – ₹38,613.32 crore

- Ministry of Electronics & IT – ₹26,026.25 crore

Agriculture & Industry

- Ministry of Agriculture & Farmers Welfare – ₹1,37,756.55 crore

- Ministry of Commerce & Industry – ₹18,446.05 crore

- Ministry of Chemicals & Fertilizers – ₹1,61,965.21 crore

Law & Governance

- Ministry of Home Affairs – ₹2,33,210.68 crore

- Ministry of Law & Justice – ₹5,850.37 crore

- Ministry of External Affairs – ₹20,516.61 crore

India’s GST Collections Hit ₹1.83 Lakh C...

India’s GST Collections Hit ₹1.83 Lakh C...

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...