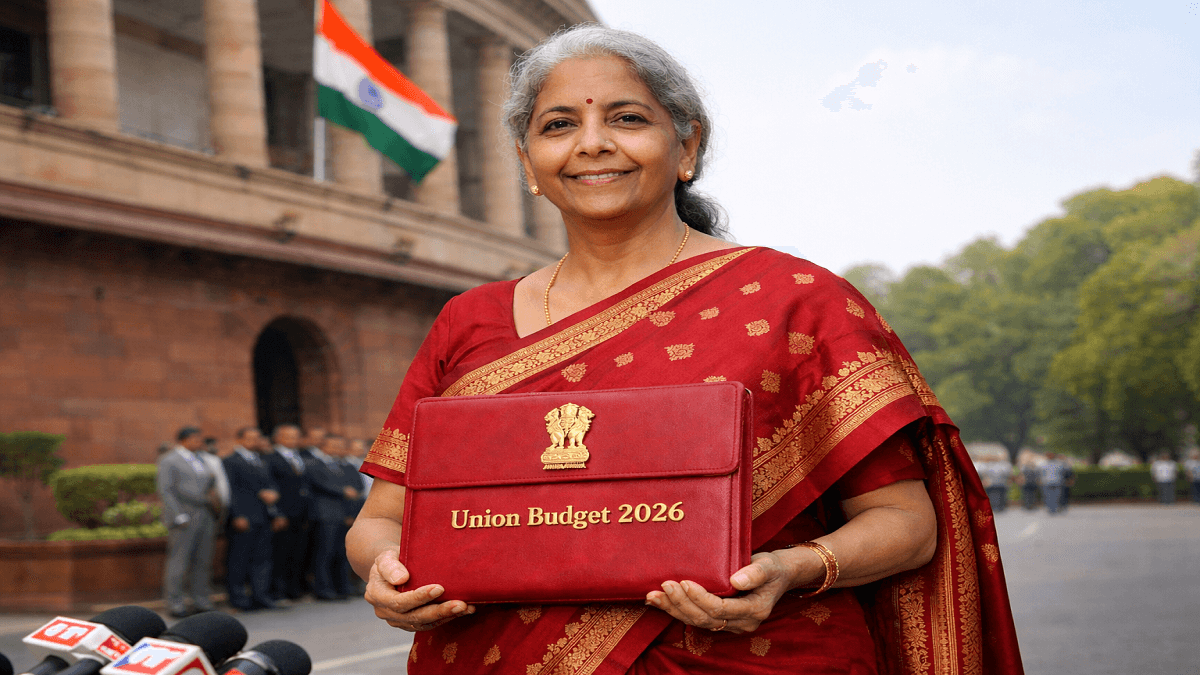

Finance Minister Nirmala Sitharaman present her ninth Budget in the Parliament today (February 1, 2026). This is the first time in the history of India that the Union Budget is being presented on a Sunday. The Cabinet meet ahead of the Union Budget presentation has approved the Budget.

Union Budget 2026 Live: Big Announcements & Key Highlights

Defence

- India’s annual defence production has crossed ₹1.3 lakh crore for the first time, marking a major milestone in the country’s push for self-reliance in defence manufacturing.

- Defence exports have seen a sharp rise — growing from less than ₹2,000 crore in 2015 to over ₹21,000 crore in FY25. This reflects India’s increasing presence in the global defence market.

- In the previous budget, the defence outlay stood at around ₹6.81 lakh crore, registering a nearly 9.5% year-on-year increase. This continued rise in allocation highlights the government’s focus on modernization and preparedness.

- A significant shift toward domestic industry has also been achieved, with over 65% of defence procurement now sourced from Indian suppliers, boosting local manufacturing and technology development.

- The private sector’s role in defence production has expanded as well, now contributing about 23% of total defence manufacturing output, indicating stronger participation from Indian companies.

- Looking ahead, India has set ambitious targets to reach ₹3 lakh crore in defence production and ₹50,000 crore in defence exports by 2029, aiming to become a major global defence manufacturing hub.

- These developments underline India’s steady progress toward Atmanirbhar Bharat in defence, stronger exports, and greater private sector participation.

- Defence-related capital expenditure is expected to increase to ₹2.3 lakh crore, up from ₹1.8 lakh crore last year, according to estimates reported by Bloomberg. This rise signals continued focus on modernisation of military equipment and infrastructure.

- However, data cited by BMI shows that defence spending as a share of total central government expenditure has largely remained stagnant since 2020, after witnessing a sharp decline between 2018 and 2020. This suggests that while overall defence budgets are growing in absolute terms, their proportion within total government spending has not significantly increased.

Budget 2026 Key Updates

- The government has proposed an income tax exemption for non-residents engaged in supplying capital goods and related services within bonded zones. This step is aimed at encouraging global manufacturers and service providers to operate from India’s special trade and manufacturing hubs.

- To promote component manufacturing, a safe harbour provision will be introduced for non-residents operating in bonded warehouses, allowing them to be taxed at a prescribed profit margin of 2%. This provides certainty in taxation and reduces disputes.

- In a major boost to the digital economy, the Finance Minister Nirmala Sitharaman proposed a tax holiday until 2047 for any foreign company providing global cloud services using data centre infrastructure located in India. This move is expected to attract large-scale data centre investments and strengthen India’s role in global digital services.

- Further, safe harbour rules for IT services will now be approved through an automated process, making compliance faster and more transparent.

- Recognising India’s leadership in software and technology services, the government has proposed to club various related segments—including software development services, knowledge process outsourcing (KPO), sourcing services, and contract R&D in software—under a single category of “Information Technology Services.” These will have a common safe harbour margin, simplifying transfer pricing rules and reducing litigation.

- Together, these steps aim to attract foreign investment, promote electronics and IT manufacturing, strengthen India’s cloud and data centre ecosystem, and provide tax certainty to global technology service providers.

Budget 2026 Key Updates

- The IT sector will now be clubbed under the broader category of IT-enabled services for taxation purposes, with a safe harbour margin of 15.5%. This provides greater clarity and reduces transfer pricing disputes for companies operating in this segment.

- Finance Minister Nirmala Sitharaman also proposed a three-year tax exemption on dividend income received by a notified National Cooperative Federation from its investments. This move is aimed at strengthening cooperative institutions and supporting their financial sustainability.

- In the agriculture sector, the government has extended tax deductions to suppliers of cotton seeds and cattle feed. This step will help reduce input costs, support agribusinesses, and indirectly benefit farmers through a stronger supply chain.

- These measures focus on reducing tax disputes in the IT industry, supporting the cooperative sector, and strengthening agricultural input supply systems.

Changes to Taxation

- Finance Minister Nirmala Sitharaman said that income tax forms are being redesigned to make them simpler and more user-friendly for ordinary citizens, reducing errors and compliance burden.

- To provide relief on overseas spending, the government has proposed to reduce the Tax Collected at Source (TCS) rate on overseas tour packages to 2%, without any minimum transaction limit.

- Similarly, under the Liberalised Remittance Scheme (LRS), the TCS rate for education and medical expenses abroad will be reduced from 5% to 2%, making foreign education and treatment more affordable.

- For service providers, TDS on manpower services will be rationalized, with rates set in the 1–2% range, improving cash flow for businesses in staffing and workforce supply sectors.

- A special scheme for small taxpayers will be introduced, based on a rule-based automatic process, to simplify tax compliance and reduce disputes.

- Taxpayers will also get more time to revise their income tax returns by paying a nominal fee, giving them a chance to correct genuine mistakes.

- The government will stagger the tax filing timeline, and ITR-1 and ITR-2 forms can be filed until July 31, helping reduce last-minute rush and system overload.

- In a key procedural reform, TDS on the sale of immovable property by Non-Resident Indians (NRIs) will now be deducted and deposited by resident buyers, simplifying compliance for overseas sellers.

- Special attention is being given to practical issues faced by small taxpayers, including students, young earners, and technology professionals, to make the system more supportive and less complex.

- Finally, a one-time six-month foreign assets disclosure scheme will be introduced for individuals who previously failed to report overseas income or assets, allowing them to comply without severe penalties.

- These reforms focus on simplifying tax compliance, reducing TCS/TDS burdens, supporting small taxpayers, and improving transparency in foreign asset reporting.

- The government has proposed a one-time compliance scheme for foreign income and assets, which will apply to two categories of taxpayers who previously failed to disclose overseas income or assets.

- Under Category A, the scheme will cover cases where the limit of undisclosed foreign income or asset is up to ₹1 crore.

- Under Category B, the scheme will apply to individuals with undisclosed foreign assets valued up to ₹5 crore. In such cases, immunity from prosecution will be provided if the person discloses the assets and pays the prescribed fee and taxes.

- To further reduce tax litigation, the government will allow taxpayers to update their returns even after reassessment proceedings by paying the due taxes along with an additional 10% tax over and above the applicable rate. This step is aimed at resolving disputes quickly and encouraging voluntary compliance.

- In another relief measure, penalties for technical or procedural defaults—such as minor compliance errors—are proposed to be converted into a simple fee, similar to the treatment of a cheque bounce charge, instead of harsher penalties.

- These measures are designed to encourage voluntary disclosure, reduce prolonged legal disputes, and make the tax system more taxpayer-friendly while improving transparency.

- The government has proposed that there will be no penalty and no prosecution for non-disclosure of foreign non-immovable assets if the total value is less than ₹20 lakh. This provides relief in cases involving small-value overseas assets.

- Under the new Income Tax Act, the non-production of accounts and documents in certain cases will be decriminalised. Instead of prosecution, only a monetary fine will apply for such minor technical offences, reducing fear and stress for small taxpayers.

- The government has also proposed to rationalise the prosecution framework under the Income Tax Act, ensuring a balanced approach. Serious tax evasion cases will still face strict action, while minor, unintentional, or procedural defaults will be handled with lighter penalties.

- These reforms aim to make the tax system less punitive, more trust-based, and focused on voluntary compliance rather than criminal proceedings for small errors.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman announced that simplified income tax rules and a new, easier tax return form will be notified soon, making compliance more straightforward for taxpayers.

- She also confirmed that the new Income Tax Act will come into effect from April 1, 2026, marking a major reform aimed at modernizing and simplifying India’s direct tax system.

- On the borrowing front, the government has projected gross market borrowing at ₹17.2 lakh crore, which will help finance development expenditure while maintaining fiscal balance.

- For FY27, the government’s Net Domestic Revenue (NDR) is estimated at ₹36.5 lakh crore, while total expenditure is projected at ₹53.5 lakh crore, reflecting continued public investment in infrastructure, welfare, and growth-oriented sectors.

- The Finance Minister stated that the government has fulfilled its commitment to reduce the fiscal deficit to below 4.5% of GDP. The fiscal deficit for FY26 is estimated at 4.4% of GDP, in line with the government’s revised fiscal prudence and debt consolidation roadmap.

- These announcements highlight a focus on tax reform, fiscal discipline, and sustained public spending to support economic growth.

Budget 2026 Key Updates

- The Finance Minister Nirmala Sitharaman stated that India’s debt-to-GDP ratio is estimated at 55.6% in the Budget Estimates for FY27. This indicates a gradual move toward fiscal stability while continuing development spending.

- She noted that a declining debt-to-GDP ratio will help free up financial resources, enabling more funds to flow toward priority sector lending such as agriculture, MSMEs, housing, and education.

- On fiscal policy, the government reaffirmed its path of fiscal consolidation, emphasizing that it is meeting its fiscal deficit and borrowing commitments without cutting back on essential social welfare and development programmes.

- Regarding centre–state financial relations, the government has accepted the recommendations of the 16th Finance Commission to maintain the states’ share in central taxes at 41%. For FY27, a total of ₹1.4 lakh crore has been provided to states as part of this devolution, strengthening their ability to fund development and welfare schemes.

- These measures underline a balanced approach of fiscal discipline, continued social spending, and stronger financial support to states.

Budget 2026 Key Updates

- The government will begin the development of the East Industrial Corridor starting from Durgapur, strengthening industrial growth and connectivity in eastern India. To support sustainable urban mobility along such growth corridors, 4,000 electric buses (e-buses) will be introduced, promoting cleaner public transport.

- Tourism development will also receive attention with plans to expand the Buddhist Circuit in the Northeast, aiming to attract both domestic and international visitors while boosting local economies.

- Focusing on inclusion, the Finance Minister Nirmala Sitharaman highlighted efforts to ensure dignified livelihood opportunities for persons with disabilities (Divyangjan). Employment support will be expanded in sectors such as Information Technology, AVGC (Animation, Visual Effects, Gaming and Comics), hospitality, and food & beverage services.

- The government will also support the scaling up of artificial limb production and assistive devices, improving accessibility and mobility for people with disabilities.

- In the healthcare sector, plans were announced to set up NIMHANS–2 as an expansion of the National Institute of Mental Health and Neurosciences, and to upgrade national health institutes in Ranchi and Tezpur, strengthening mental health and specialized medical services.

- District hospitals across the country will see capacity enhancement for emergency and trauma care, ensuring quicker and more effective treatment for accident and critical care patients.

- Additionally, a new Divyangjan Kaushal Yojana will be launched to provide skill development and employment opportunities for persons with disabilities, helping them achieve financial independence and social inclusion.

- These measures combine industrial growth, green transport, tourism promotion, inclusive employment, and strengthened healthcare infrastructure.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman announced the introduction of ‘SHE’ (Support for Her Enterprise) marks for rural women-led enterprises, building on the success of the Lakhpati Didi programme. This initiative aims to provide recognition, branding support, and better market access to products made by women self-help groups and rural entrepreneurs.

- In the agriculture sector, the government will roll out a dedicated programme for cashew and coconut production and processing, with a strong focus on exports. The goal is to develop Indian cashew and coconut as premium global brands by 2032, increasing farmer incomes and strengthening India’s presence in international markets.

- A special initiative will also be launched to restore the ancient Indian sandalwood ecosystem, supporting conservation, sustainable cultivation, and value-added processing.

- To further enhance rural prosperity, the government will implement targeted income support programmes for farmers engaged in coconut, cashew, and similar plantation crops, helping improve productivity and market linkages.

- In a major step toward agri-tech adoption, the government will launch Bharat Vistaar, a multilingual AI-powered agricultural tool. This platform will provide farmers with region-specific advice, weather insights, crop planning support, and risk reduction strategies, helping boost farm productivity and reduce uncertainties.

- These measures focus on empowering rural women entrepreneurs, promoting high-value plantation crops, restoring traditional ecosystems, and leveraging AI technology to support farmers.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman said the government’s third “kartavya” (duty) is to increase farmers’ income and promote rural entrepreneurship. Targeted efforts will focus on raising farm productivity, improving technology adoption, and strengthening market access so that farmers can earn more from their produce.

- In the fisheries sector, the government will work to strengthen the value chain in coastal areas, covering storage, processing, and marketing. There will also be efforts to strengthen Fish Farmer Producer Organisations (FFPOs) so that small fishers can benefit from collective bargaining and better access to markets.

- Under animal husbandry, the focus will be on generating rural employment. A credit-linked subsidy programme will support investments in dairy, poultry, and livestock-related activities, helping farmers diversify income sources.

- In sports, the Khelo India Mission will be expanded to promote a stronger sporting culture across the country. The programme will emphasize the systematic development of coaching and support staff, ensuring better training systems for athletes.

- For tourism and hospitality, the government proposed establishing a National Institute of Hospitality by upgrading the existing National Institute of Hotel Management. This will help improve the quality of hospitality education and meet the growing demand for skilled professionals in the tourism sector.

- A pilot upskilling scheme for 10,000 tourist guides will be launched across 20 major tourist sites, offering 12-week training programmes to enhance language skills, heritage knowledge, and visitor management.

- Eco-friendly tourism will also be promoted through trekking and hiking initiatives along sustainably developed mountain trails in Uttarakhand, Jammu & Kashmir, and Himachal Pradesh, boosting local employment while protecting the environment.

- India will host the first summit of the International Big Cat Alliance, launched in 2024, where 19 countries will come together to discuss big cat conservation and wildlife protection.

- To promote heritage tourism, 15 major archaeological sites, including Lothal and Dholavira, will be developed as tourist destinations. Excavated heritage sites will also be opened to the public, improving access while preserving cultural history.

- These initiatives together aim to boost farmer incomes, rural jobs, sports development, tourism growth, wildlife conservation, and heritage promotion across India.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman announced that five university townships will be developed near major logistics and industrial corridors. These townships will strengthen the link between higher education, industry, and employment opportunities.

- To promote gender inclusion in technology fields, the government will provide capital support for girl students in STEM (Science, Technology, Engineering, and Mathematics), encouraging more women to pursue careers in high-growth technical sectors.

- Through a challenge-based route, a new Institute of Design will be established in the eastern region of India, aiming to boost innovation, design skills, and creative entrepreneurship.

- The government also proposed setting up an Indian Institute of Creative Technology focused on the AVGC (Animation, Visual Effects, Gaming, and Comics) sector. As part of this push, AVGC content labs will be introduced in 15,000 schools and 500 colleges to nurture creative and digital skills from an early stage.

- Highlighting the potential of the orange economy (creative and cultural industries), the Finance Minister noted that the AVGC sector is rapidly growing and is expected to require around 2 million professionals by 2030, creating large employment opportunities for youth.

- In the field of animal husbandry, the government plans to increase the availability of veterinary professionals by over 20,000. A support scheme will help expand veterinary colleges, hospitals, laboratories, and related facilities in the private sector, improving animal healthcare and supporting the livestock economy.

- These initiatives focus on building future-ready education systems, expanding creative industry opportunities, promoting women in STEM, and strengthening veterinary infrastructure to support rural and agricultural growth.

Budget 2026 Key Updates

- The Union Budget 2026 proposes a ₹10,000 crore investment in the biopharma sector over the next five years. Biopharmaceuticals (biologics) are advanced medicines made from living cells, organisms, or tissues instead of chemical processes. This investment aims to boost research, domestic manufacturing, and India’s position in the global life sciences industry.

- In healthcare, the government will upgrade institutions for allied health professionals and establish new ones in the public sector. Existing institutes will be strengthened in fields such as optometry, radiology, anesthesia, and behavioural health, improving the quality and availability of skilled healthcare workers.

- A major workforce initiative will train 1.5 lakh caregivers over the next five years, addressing the growing demand for support staff in hospitals and home-based care services.

- To strengthen medical infrastructure and employment, the government will launch a scheme to set up five regional medical hubs in partnership with the private sector. These hubs will generate diverse job opportunities for doctors and allied health professionals (AHPs) and improve access to specialized care.

- The budget also announced the establishment of three new All India Institutes of Ayurveda, expanding education and research in traditional Indian medicine systems.

- To improve quality and global credibility, AYUSH pharmacies and drug testing laboratories will be upgraded to meet higher certification standards, while more skilled personnel will be trained in traditional medicine.

- Further, the WHO Global Centre for Traditional Medicine in Jamnagar will be upgraded to strengthen evidence-based research, training, and awareness in traditional medical systems at the international level.

- The Finance Minister emphasized that these steps will help India become a global leader in the services sector, with a target of achieving a 10% share in global services exports by 2047.

- To better connect education with employment and entrepreneurship, a high-powered standing committee will be set up. This body will focus on aligning education, skill development, and enterprise creation, ensuring that young people have clear pathways to careers and business opportunities.

- The government also announced a renewed emphasis on key service sectors, aiming to provide stronger pathways for individuals to fulfil their career and entrepreneurial ambitions.

- Together, these initiatives strengthen India’s push in biopharma innovation, healthcare workforce expansion, traditional medicine leadership, and service-sector growth.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman said that the adoption of technology must benefit everyone, especially farmers, women, and divyangjan (persons with disabilities). The government’s digital push will focus on inclusive access so that vulnerable and underserved groups can fully participate in economic growth.

- In the investment space, PROIs (Portfolio Investment Route Investors) will now be allowed to invest in Indian listed companies. To improve the ease of doing business and attract more capital, the government has proposed to raise the investment limit for PROIs from 5% to 10%.

- For MSMEs, the existing scheme under Amrit, which provides incentives for bond issuances of up to ₹200 crore, will continue. This ensures that small and medium firms still have access to market-based funding support.

- To deepen India’s bond market, the government announced measures to strengthen municipal bonds. Large cities will be encouraged to issue higher-value bonds, with a provision of ₹100 crore support for a single bond issuance of ₹1,000 crore, helping cities finance infrastructure projects.

- In the corporate bond market, a market-making framework will be introduced. This will improve liquidity and provide better access to funds linked to corporate bond indices, making it easier for companies to raise long-term capital.

- As part of the broader Viksit Bharat vision, the government also outlined a roadmap for Non-Banking Financial Companies (NBFCs). The focus will be on scaling up and improving the efficiency of public sector NBFCs, including restructuring key institutions like Power Finance Corporation (PFC) and Rural Electrification Corporation (REC) to strengthen infrastructure financing.

- These steps aim to promote financial inclusion, stronger capital markets, MSME growth, urban infrastructure financing, and more efficient development finance institutions.

Budget 2026 Key Updates

Finance Minister Nirmala Sitharaman announced a comprehensive review of the foreign exchange management framework, especially covering non-debt instruments. This step aims to simplify regulations, attract stable foreign investment, and align India’s financial rules with evolving global practices.

- In the financial sector, the government will set up a high-level committee on banking as part of the vision for Viksit Bharat. The committee will conduct a comprehensive review of the banking sector and recommend reforms to ensure it supports India’s long-term economic growth effectively.

- Another high-level committee focused on the Viksit Bharat roadmap will also be established to align key sectors with the goal of transforming India into a developed nation in the coming decades.

- On the infrastructure front, the Finance Minister announced plans for seven new high-speed rail corridors between major cities. Key routes mentioned include:

-

Mumbai – Pune

-

Hyderabad – Bengaluru

-

Chennai – Bengaluru

-

Delhi – Varanasi

-

Varanasi – Siliguri

- These corridors are expected to reduce travel time, boost regional connectivity, and drive economic activity along their routes.

- Reinforcing the importance of urban development, the Finance Minister stated that cities are India’s engines of growth, with special emphasis on Tier II and Tier III cities. To accelerate their development, the government will provide ₹5,000 crore per city to strengthen urban infrastructure, services, and economic opportunities.

- Together, these measures focus on financial sector reforms, improved investment frameworks, high-speed transport connectivity, and the transformation of emerging cities into strong growth centres.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman emphasized that cities are the engines of India’s economic growth, with special focus on Tier II and Tier III cities. The government aims to further strengthen these emerging urban centres so they can contribute more effectively to national development through better infrastructure, services, and investment opportunities.

- In the area of green technology, the government will push forward Carbon Capture, Utilisation and Storage (CCUS) initiatives. Aligning with the 2025 national roadmap, CCUS projects will move toward higher technological readiness and practical end-use applications, supporting India’s climate goals while enabling cleaner industrial growth.

- To strengthen the aviation and manufacturing sectors, the Finance Minister announced incentives for indigenous manufacturing of seaplanes. This move is expected to improve connectivity to water-surrounded and remote regions while boosting domestic aircraft manufacturing capabilities.

- The government also plans to enhance last-mile and remote area connectivity to promote tourism. By improving transport links to difficult-to-reach destinations, the initiative aims to unlock tourism potential, generate local employment, and support regional economic development.

- These steps highlight a combined focus on urban growth, clean technology, domestic manufacturing, and tourism-led development.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman announced the development of new Dedicated Freight Corridors (DFCs) connecting Dankuni in West Bengal and Surat in Gujarat. These corridors are expected to improve freight movement, reduce logistics costs, and strengthen industrial supply chains across regions.

- The government will also develop 20 new national waterways over the next five years to promote affordable and environmentally friendly cargo transport. To support this, selected training institutes will be upgraded as regional centres for manpower development in the waterways sector, ensuring a skilled workforce for inland and coastal shipping.

- A ship repair ecosystem for inland waterways will be set up at Varanasi and Patna, which will strengthen maintenance infrastructure and generate local employment. In addition, a Coastal Cargo Promotion Scheme will encourage shifting cargo movement from rail and road to waterways, helping decongest traditional transport routes and cut logistics expenses.

- The Finance Minister stated that India’s economic trajectory remains stable, highlighting steady growth and sound macroeconomic management. She also placed before Parliament two statements under the Fiscal Responsibility and Budget Management (FRBM) Act, 2003, reaffirming the government’s commitment to fiscal discipline and transparency.

- To speed up infrastructure development, the government will establish an Infrastructure Risk Guarantee Fund. This fund will provide faster credit guarantees to lenders, making financing easier for large infrastructure projects.

- Public capital expenditure is proposed to be increased to ₹12.2 lakh crore to maintain investment momentum. She noted that public capex has risen significantly over time — from about ₹2 lakh crore earlier to ₹11.2 lakh crore in the Budget Estimates for 2025–26 — showing a continued push toward infrastructure-led growth.

- The government will continue focusing on large-scale public infrastructure development, particularly in cities with populations above 5 lakh, to improve urban transport, housing, and civic amenities.

- To strengthen business support in smaller cities, the government will collaborate with the Institute of Chartered Accountants of India (ICAI) and the Institute of Cost Accountants of India (ICMAI). These institutions will design short-term modular courses to train “corporate mitras” in Tier II and Tier III towns, helping local enterprises access professional financial and compliance services.

- Together, these measures aim to boost logistics efficiency, infrastructure growth, urban development, skilled manpower, and overall economic stability.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman stated that the government proposes to increase public capital expenditure to ₹12.2 lakh crore to maintain the strong investment momentum in the economy.

- She highlighted that public capital expenditure has risen sharply over the years, increasing from about ₹2 lakh crore earlier to ₹11.2 lakh crore in the Budget Estimates for 2025–26, showing the government’s continued push for infrastructure-led growth.

- The government will also continue its large-scale efforts to strengthen public infrastructure, with special focus on developing cities with populations above 5 lakh, aiming to improve urban facilities, transport, and overall quality of life.

- To support employment and professional services in smaller towns, the government will work with institutions like Institute of Chartered Accountants of India (ICAI) and Institute of Cost Accountants of India (ICMAI) to design short-term modular courses. These courses will train “corporate mitras” in Tier II and Tier III towns, helping businesses access professional financial and compliance support.

- The Finance Minister also announced a new credit guarantee support mechanism, which will make it easier for businesses—especially small enterprises—to access loans without heavy collateral requirements.

- Focusing on the MSME sector, the government unveiled a plan for “Creating Champion SMEs.” This includes a scheme to revive and modernize 200 legacy industrial clusters to improve cost competitiveness and productivity, helping MSMEs grow into stronger national and global players.

- To further strengthen MSME financing, the government proposed to top up the Self-Reliant India Fund with ₹2,000 crore, providing additional growth capital to promising small businesses.

- On liquidity support, a transaction settlement platform will be leveraged to unlock the full potential of MSMEs by ensuring faster payment cycles and improved cash flow management.

- Additionally, the government reaffirmed its commitment to rejuvenating legacy industrial clusters, again emphasizing the focus on 200 industrial clusters across the country to boost manufacturing, employment, and regional development.

- These measures together aim to accelerate infrastructure growth, urban development, MSME expansion, and job creation across India.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman proposed setting up a dedicated manufacturing unit for sports shoes along with a special initiative for the sports goods sector. The goal is to boost domestic production and strengthen India’s position in global sporting goods manufacturing.

- In the textile sector, the government plans to establish Mega Textile Parks to create world-class manufacturing clusters. A new Textile Expansion and Employment Scheme will focus on job creation across the textile value chain, from raw materials to finished products.

- To support traditional artisans, a National Handloom and Handicraft Programme will enhance existing welfare and promotion schemes for weavers and craftspeople. In addition, the Mahatma Gandhi Gram Swaraj initiative will promote khadi, handloom, and handicrafts, helping rural industries grow and become more competitive.

- An integrated textile development programme with five key components will also be introduced. One of its major parts is the National Fibre Scheme, which aims to make India self-reliant in silk and wool production while strengthening the entire textile ecosystem to compete globally.

- In the strategic minerals sector, Odisha, Kerala, Tamil Nadu, and Andhra Pradesh will be included in a new rare earth corridor. This initiative will support the exploration, processing, and value addition of rare earth elements, which are vital for high-tech and clean energy industries.

- These steps are designed to expand manufacturing capacity, generate employment, support traditional sectors, and enhance India’s industrial competitiveness.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman proposed a dedicated manufacturing unit for sports shoes, along with a special initiative for the sports goods sector. This move aims to strengthen domestic production and make India a competitive hub for sporting equipment.

- In the textile sector, the government plans to establish Mega Textile Parks to create large-scale, modern textile manufacturing clusters. A new Textile Expansion and Employment Scheme will focus on generating jobs across the textile value chain.

- To support traditional sectors, a National Handloom and Handicraft Programme will strengthen existing schemes for weavers and artisans, ensuring better income opportunities and global market access. The government also announced the Mahatma Gandhi Gram Swaraj initiative to promote khadi, handloom, and handicrafts, helping rural industries grow sustainably.

- Additionally, the textile sector will see an integrated five-part programme, including a National Fibre Scheme aimed at achieving self-reliance in silk and wool production and building a globally competitive textile ecosystem.

- In the critical minerals sector, Odisha, Kerala, Tamil Nadu, and Andhra Pradesh will be included in a new rare earth corridor, boosting exploration, processing, and value addition of rare earth elements essential for advanced industries.

- On the infrastructure front, the government announced that tunnel boring equipment will now be manufactured in India. This will be supported under a scheme to enhance construction and infrastructure equipment manufacturing, reducing import dependence and supporting major projects like metros, highways, and tunnels.

- These measures collectively aim to expand manufacturing capacity, create employment, support traditional artisans, and strengthen India’s industrial and infrastructure base.

Budget 2026 Key Updates

- Finance Minister Nirmala Sitharaman announced a series of major initiatives aimed at strengthening India’s manufacturing and infrastructure sectors.

- The government will introduce a new scheme to support states in setting up three chemical parks under a plug-and-play model, making it easier for industries to begin production quickly with ready infrastructure.

- To boost domestic capabilities, a strong capital goods capacity-building push will focus on the construction and infrastructure equipment sector, encouraging local manufacturing and reducing import dependence.

- A ₹10,000 crore scheme has been unveiled to develop a container manufacturing ecosystem, which is expected to improve logistics efficiency and support India’s growing trade needs.

- Building on the Regional Economic Manufacturing (REM) scheme launched in 2025, the government will now establish dedicated REM corridors to strengthen industrial connectivity and regional growth.

- The electronics components manufacturing scheme has already received investment commitments exceeding initial targets, showing strong industry interest. In response, the government has decided to increase the scheme’s total outlay to ₹40,000 crore to accelerate growth in the electronics manufacturing sector.

- These measures aim to position India as a stronger global manufacturing hub while creating jobs and improving industrial infrastructure.

Budget 2026 Key Updates

- The Budget is driven by Yuvashakti and based on three kartavyas.

- FM proposes ₹10,000 crore outlay for Biopharma Shakti to support domestic innovation : FM

- India Semi-Conductor Mission : Will launch ISM 2.0 to produce equip,ment and material designs.

- Finance Minister Nirmala Sitharaman meets President Murmu at Rashtrapati Bhavan ahead of Union Budget 2026 presentation.

- FM Nirmala Sitharaman arrives at Parliament to attend Cabinet meeting ahead of Budget presentation.

Budget 2026 Live: Key officials shaping

- Anuradha Thakur - Economic Affairs Secretary

- Arvind Shrivastava - Revenue Secretary

- Vumlunmang Vualnam - Expenditure Secretary

- M Nagaraju - Financial Services Secretary

- Arunish Chawla - Secretary, Department of Investment and Public Asset Management (DIPAM)

- K Moses Chalai - Secretary, Department of Public Enterprises

- V Anantha Nageswaran - Chief Economic Adviser

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...

India’s Core Sector Growth Slows to 4% i...

India’s Core Sector Growth Slows to 4% i...

Unemployment Rises to 5%! Why India’s Jo...

Unemployment Rises to 5%! Why India’s Jo...