What is Union Budget?

In accordance with Article 112 of the Constitution of India, the government is mandated to present the Union Budget at the Parliament before the commencement of each financial year. This budget outlines the projected receivables and payables for the upcoming fiscal year, running from April 1st to March 31st.

An Overview of Capital Budget

The Union Budget comprises two major components: the capital budget and the revenue budget. The capital budget deals with government-related capital payments and receipts. Capital receipts include loans from the public or the Reserve Bank of India (RBI), while capital payments encompass expenses related to health facilities, development, equipment maintenance, and educational facilities.

An Overview of Revenue Budget

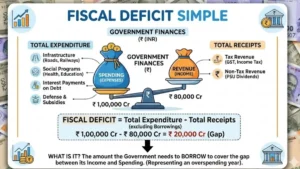

The revenue budget focuses on revenue expenditure and receipts. If the government’s expenses exceed its receipts, a revenue deficit occurs.

Understanding the Importance of a Union Budget

The Union Budget plays a pivotal role in shaping the economic trajectory of India, aiming for rapid and balanced growth, social justice, and equality. The following key objectives underscore its significance:

a. Ensure Efficient Allocation of Resources

Optimal allocation of resources is crucial for maximizing government profits and promoting public welfare.

b. Reduce Unemployment and Poverty

The budget strives to eradicate poverty and create employment opportunities to meet citizens’ basic needs for food, shelter, clothing, healthcare, and education.

c. Reduce Wealth and Income Disparities

Through subsidies and taxes, the budget influences income distribution, levying higher taxes on the wealthy to reduce income disparities.

d. Check on Prices

The Union Budget helps control economic fluctuations, managing inflation and deflation to maintain economic stability. Surplus budget policies are implemented during inflation, while deficit budget policies are devised during deflation.

e. Change in Tax Structure

The budget dictates changes in direct and indirect taxes, including alterations to income tax rates and tax brackets, shaping the financial landscape of the country. For instance, the income tax slab for the fiscal year 2020-21 is determined by the budget.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...