Unified Payments Interface (UPI) achieved a record-breaking 14.04 billion transactions in May, marking a significant increase from the 13.30 billion transactions recorded in April. This reflects a 49% year-on-year growth. The total transaction value reached Rs 20.45 lakh crore, with an average daily transaction count of 453 million and an average daily transaction value of Rs 65,966 crore.

Expansion and Reach

The National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI) are actively exploring new use cases for UPI, focusing on extending its reach into the rural economy. UPI has already expanded internationally, being operational in countries such as Singapore and the UAE.

UPI Infrastructure and Stakeholder Meeting

On May 8, RBI Governor Shaktikanta Das met with key stakeholders in the UPI ecosystem to discuss strategies for further expansion. This meeting included representatives from banks, NPCI, third-party application providers, and technology service providers. Discussions centered on scaling up UPI infrastructure, expanding the product portfolio, addressing ecosystem challenges, and integrating new users into the digital payments system.

Monthly Transaction Analysis

In April, UPI experienced a slight dip with 13.3 billion transactions, a 1% decline from March’s 13.44 billion transactions. However, May saw a resurgence, with UPI transactions reaching 14.04 billion. The transaction value also increased from Rs 19.64 lakh crore in April to Rs 20.45 lakh crore in May.

DBT Marks 40 Years; Dr Jitendra Singh La...

DBT Marks 40 Years; Dr Jitendra Singh La...

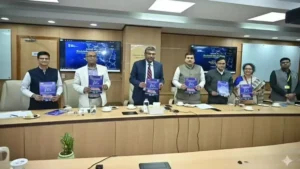

MeitY Launches ‘Blockchain India Challen...

MeitY Launches ‘Blockchain India Challen...

Cabinet Approves MSP for Raw Jute for 20...

Cabinet Approves MSP for Raw Jute for 20...