The World Bank, in its latest India Development Update, has revised its retail inflation forecast for India for the fiscal year 2023-24. The new projection stands at 5.9 percent, up from the earlier estimate of 5.2 percent made in April. This upward revision is attributed to certain factors which caused a sharp increase in food prices in July 2023.

Monsoon-Induced Inflation Spike

The World Bank highlighted the impact of abnormal rainfall on food prices during the monsoon season. While there was a temporary easing of food prices in August, the bank expects this situation to continue to influence headline inflation throughout the fiscal year.

Factors Influencing Inflation

Despite some moderation in inflation, the consumer price index-based inflation remained at 6.83 percent in August, following a peak of 7.44 percent in July. This reduction was primarily due to a decline in vegetable prices. Additionally, oil prices have moderated since their peak in 2022, which is expected to help stabilize inflation, although they are anticipated to remain higher than pre-pandemic levels.

The Role of RBI’s Monetary Policy

The Reserve Bank of India (RBI) has been actively managing inflation through its monetary policy. Over the past year, the RBI has withdrawn accommodation and raised the policy interest rate, helping to rein in core inflation. This approach is expected to lead to a gradual deceleration of core inflation.

Economic Growth Forecast Remains Steady

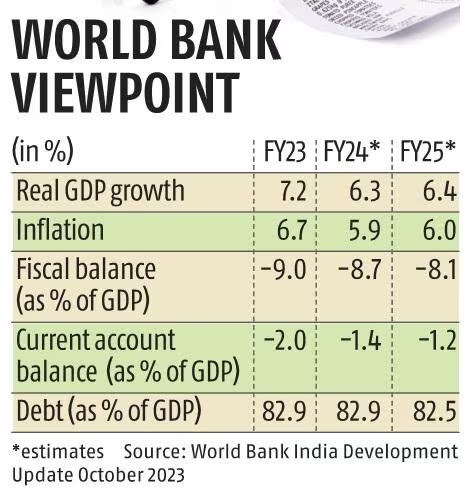

While the inflation forecast has been revised upwards, the World Bank’s economic growth projection for India in 2023-24 remains steady at 6.3 percent. This growth is underpinned by robust investment growth in the country.

Implications for RBI’s Monetary Policy

The World Bank’s updated estimates come ahead of the RBI’s monetary policy review, scheduled for October 6. With food inflation now under control, it is anticipated that the RBI will maintain the status quo. In its August policy review, the central bank had projected retail inflation to be 5.4 percent for FY24.

Temporary Nature of Inflation

The World Bank emphasizes that the rising inflation in India, primarily driven by adverse weather and supply-side disruptions, is a temporary phenomenon. It is expected to affect certain components of GDP, particularly consumption. However, overall conditions are conducive to private investment.

Focus on Infrastructure Investment

The World Bank highlights the government’s continued focus on infrastructure investment as a key driver of economic growth. This emphasis on infrastructure is expected to attract private sector investment as well, further bolstering economic prospects.

Challenging External Conditions

The moderation in India’s growth compared to the previous year (7.2 percent) is attributed to challenging external conditions and waning pent-up demand. An adverse global environment is expected to pose challenges in the short term.

Fiscal Outlook

The World Bank projects an overall fiscal deficit (combining the Centre and states) of 8.7 percent of GDP. It also expects public debt to stabilize at 83 percent of GDP. The bank asserts that there are no risks of fiscal slippages due to upcoming elections, citing the government’s commitment to fiscal consolidation.

Current Account Deficit and Foreign Investment

On the external front, the current account deficit is expected to narrow to 1.4 percent of GDP in FY24. This deficit will be adequately financed by foreign investment flows and supported by India’s large foreign reserves.

Addressing Unemployment and Gender Disparities

The report also addresses labor market dynamics in India. It notes that unemployment rates have declined significantly for men and youth but highlights that an increase in the women’s worker population ratio has been driven by unpaid family work. The World Bank underscores the importance of addressing this gender disparity and states that India will need to grow at a faster pace, around 8 percent, to achieve its target of becoming a high-income country by 2047, which cannot be realized without an increase in female labor force participation.

President Droupadi Murmu Inaugurates Nat...

President Droupadi Murmu Inaugurates Nat...

Haryana to Launch CM Shri Schools on PM ...

Haryana to Launch CM Shri Schools on PM ...

Top 10 highest-revenue unlisted Indian c...

Top 10 highest-revenue unlisted Indian c...