The new Income Tax Bill is expected to be tabled in Parliament on February 13, 2025. It aims to simplify the existing Income Tax Act, 1961, making tax laws more understandable for the common taxpayer and reducing litigation. Over the years, the Income Tax Act, 1961 has undergone modifications through 66 Budgets (including two interim Budgets), making it increasingly complex. While the new tax bill intends to bring clarity, many taxpayers are concerned about its actual impact.

Overview of the New Income Tax Bill

Why the Changes?

The government has introduced the new Income Tax Bill, 2025, to modernize and streamline taxation laws. The new bill focuses on simplifying language, restructuring sections, and improving compliance for individual taxpayers and businesses alike.

Key Highlights

- Simplification of tax laws to enhance ease of understanding.

- Reduction of litigation through clear and structured provisions.

- Integration of modern compliance mechanisms like AI-based tax scrutiny.

- No change in tax slabs, residency laws, or ITR filing deadlines.

10 Key Takeaways from the New Income Tax Bill

1. Introduction of the ‘Tax Year’ Concept

The new Income Tax Bill is expected to introduce the concept of a Tax Year, merging the terms Assessment Year (AY) and Financial Year (FY). This aims to reduce confusion among taxpayers when filing their Income Tax Returns (ITRs) and depositing taxes.

2. Financial Year Remains Unchanged

While the Tax Year concept is new, the Financial Year (FY) will continue to run from April 1 to March 31. The new tax bill will not align the tax year with the calendar year.

3. Changes in Section Numbers

To improve readability, the section numbers in the Income Tax Act will change. For instance:

- ITR filing (previously under Section 139) may be renumbered.

- New tax regime (previously under Section 115BAC) may have a different reference. This restructuring aims to create a more logically ordered tax code.

4. No Changes in Residency Laws

The residency laws determining whether an individual is an Ordinarily Resident, Non-Ordinarily Resident, or Non-Resident remain unchanged. However, tax experts believe these laws should be reformed, as they currently require looking back 10 years to determine residential status.

5. Comprehensive Tax Law Expansion

The new Income Tax Bill is significantly more detailed than the 1961 Act:

- Current Income Tax Act: 298 sections, 14 schedules.

- New Income Tax Bill: 536 sections, 16 schedules (over 600 pages). This restructuring enhances clarity while integrating digital governance and compliance mechanisms.

6. Simplified Interpretation for Taxpayers

- Removal of complex legal jargon such as explanations and provisos.

- Introduction of a single section for all salary deductions (e.g., standard deduction, gratuity, leave encashment).

- Straightforward depreciation formula for businesses.

7. Easier TDS Compliance

- All TDS-related provisions are consolidated under one clause.

- While this simplifies compliance, businesses may need to update their tax reporting systems to align with the new structure.

8. No Changes in ITR Filing Deadlines, Tax Slabs, or Capital Gains

Despite expectations, the new bill does not alter tax slabs, ITR filing deadlines, or capital gains taxation. This ensures stability and predictability in tax planning.

9. Stricter Penalties for Non-Compliance

- Higher fines for late tax filings and non-compliance.

- Improved AI-based scrutiny to detect tax evasion.

10. Implementation from April 1, 2026

The new Income Tax Bill is expected to be implemented from FY 2026-27 (April 1, 2026).

- Tax calculations for FY 2024-25 and FY 2025-26 will still be governed by the existing Income Tax Act, 1961.

How These Changes Will Impact You

Who Benefits the Most?

- Salaried employees: Easier understanding of deductions.

- Businesses: Streamlined tax compliance procedures.

- Taxpayers in general: Simplified interpretation of tax laws.

Potential Challenges

- Adapting to new section numbers and compliance requirements.

- Software updates needed for businesses handling TDS and tax filings.

- Need for awareness campaigns to help taxpayers transition smoothly.

Tips for Taxpayers to Adapt to the New Bill

- Stay Updated: Follow government notifications and expert analyses.

- Use AI-Based Tax Tools: Leverage digital tax platforms for smooth compliance.

- Seek Professional Help: Consult tax experts for clarity on the new sections.

- Prepare for TDS Changes: Businesses must update their compliance systems.

- File Taxes on Time: With stricter penalties, timely filing is more critical than ever.

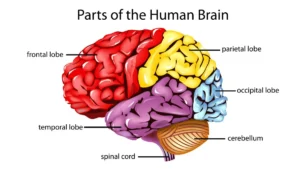

Which is the Largest Part of the Brain? ...

Which is the Largest Part of the Brain? ...

Which City is known as the Science City ...

Which City is known as the Science City ...

Which District of Punjab is known as the...

Which District of Punjab is known as the...