The 49th GST Council Meeting was held on 18th February 2023 in New Delhi under the Chairmanship of Finance Minister Nirmala Sitharaman. This meeting is being conducted within a span of three weeks from the Union Budget 2023. The Union Finance Minister, Union Minister of State for Finance Pankaj Chaudhary, besides the finance ministers of states and Union Territories (with legislature) and senior officers from the Union government and states, attended the meeting, according to the finance ministry’s official handle.

Buy Prime Test Series for all Banking, SSC, Insurance & other exam

Key Takeaways of 49th GST Council Meeting:

| Key Information | |

|---|---|

| Date of the Meeting | February 18, 2023 |

| Location | New Delhi |

| Chairperson | Finance Minister Nirmala Sitharaman |

| Key Agendas | Appellate tribunals, mechanisms to curb tax evasion, tax rate changes on cement, reports on taxation of pan masala and sand mining |

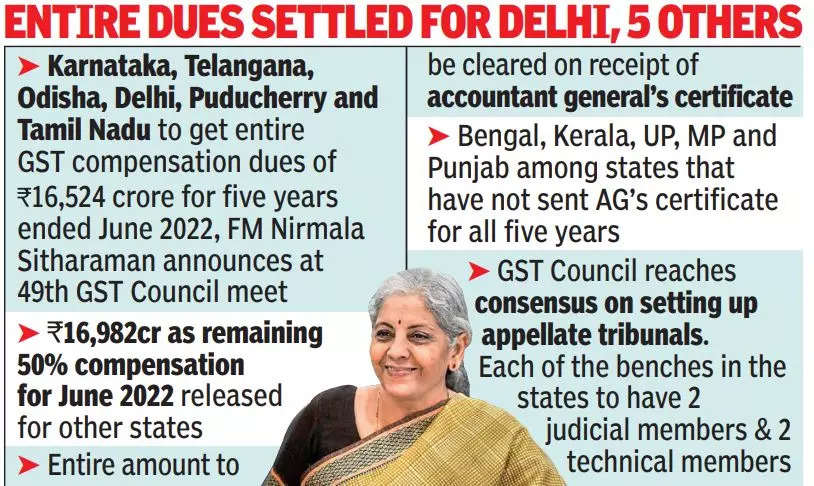

GST Appellate Tribunals – Recommendations of GoM on setting up GST Appellate Tribunals have been accepted with certain amendments.

GST Compensation Cess – Entire GST Compensation Cess of Rs 16,982 crores will be cleared today. The Centre shall release the payments from their funds and recoup from the future collection.

Special Composition Scheme – For certain industries, a special composition scheme will be introduced. i.e. PAN masala, Gutkha, Tobacco etc

GST Rate Rationalization of some products:

- Raab (liquid jaggery) rate was reduced from 18% to Nil (if loose)

- Raab (liquid jaggery) rate was reduced from 18% to 5% (if packaged & pre-labeled)

- Pencil Sharpener rate was reduced from 18% to 12%.

- Data Loggers rate was reduced from 18% to 0.

Rationalization of late fees:

Late Fees u/s 47 for the delay in filing of GST Annual Return in Form GSTR 9 for small taxpayers for FY 2022-23 and onwards has been rationalized.

- Taxpayers whose AATO is up to Rs 5 Crores will be Rs 50 per day(Rs 25 CGST+Rs 25 SGST)

- Taxpayers whose AATO is between Rs 5 Crores to Rs 20 Crores will be Rs 100 per day (Rs 50 CGST+Rs 50 SGST)

Subject to a maximum of 0.04% of turnover (0.02% CGST + 0.02% SGST) for taxpayers whose AATO is up to Rs 20 crores.

GST Amnesty Scheme for pending returns:

For pending, GST returns amnesty schemes giving conditional waiver/reduction shall be announced

- GSTR 4 – Annual Return of Composition Taxpayers

- GSTR 9 – Annual Return of Regular Taxpayers

- GSTR 10 – Final Return

Best Judgement Assessment (Sec 62):

- The time period of furnishing return in Form GSTR 3B or GSTR 10 in response to notice u/s 62(1) was increased from 30 days to 60 days. Such a time period is extendable to a further period of 60 days.

- Amnesty scheme from best judgement assessment orders – In past cases where non-filers could not file concerned returns within 30 days but had filed up to a specified date along with interest and late fees then it will be considered as deemed withdrawn even if the appeal was filed or decided.

Applicability of RCM – GST will be applicable on an RCM basis on commercial services provided by the Court.

Application for Revocation – The time limit for making an application for revocation of cancellation of registration is increased to 90 days from 30 days. The period to file an application for revocation can be further increased by another 90 days by the Commissioner or an officer authorized by Commissioner.

The following were not part of this meeting agenda:

- GST on online gaming

- GST rate on cement

- GST rate on NUV

You may also read: Forex Reserves decline by $8.31 bn to $566.94 bn

India’s GDP likely to grow at 6.2% in FY24, says Morgan Stanley

Which Place is known as the Diamond Capi...

Which Place is known as the Diamond Capi...

List of Major LPG Gas Companies in India...

List of Major LPG Gas Companies in India...

WHO Foundation and Novo Nordisk Launch I...

WHO Foundation and Novo Nordisk Launch I...