As the US dollar rises due to the speculation that the Federal Reserve will continue to tighten repo rates, it has bogged down the Indian Rupee. The need to tackle a free fall in the value of the Rupee, was bound to trigger a sell off of foreign currency by the Reserve Bank of India. This may have triggered a $8.31 billion in India’s foreign exchange reserves for the week that ended on February 10. This has taken the reserves down to $566.94 billion.

Buy Prime Test Series for all Banking, SSC, Insurance & other exam

More About The Decline in Forex Reserves:

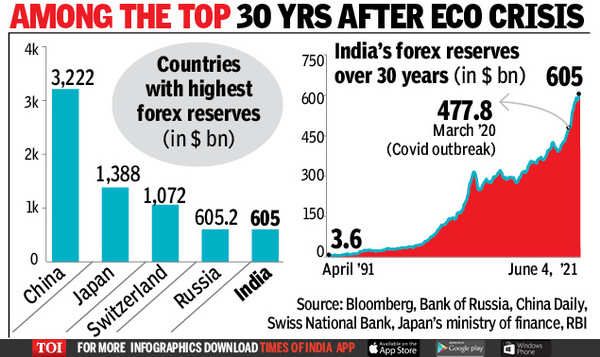

India’s foreign exchange reserves experienced its biggest decline in over 11 months, dropping by 8.3 percent in the week ending February 10, according to the Reserve Bank of India’s (RBI) statistical supplement released.

After rising for three weeks, forex reserves had started dropping from the week that ended on February 3. This has taken the reserves down to $566.94 billion, of which $500.59 billion are foreign currencies, down $7.11 billion from the previous week.

About The Components of Forex Reserves:

At the same time gold reserves lost $919 million, to hit $42.86 billion. Special drawing rights of $18.35 billion are also included in the forex reserves. These SDRs are monetary reserve currencies created by the International monetary funds, as alternatives to gold and dollars as assets for settling cross border accounts.

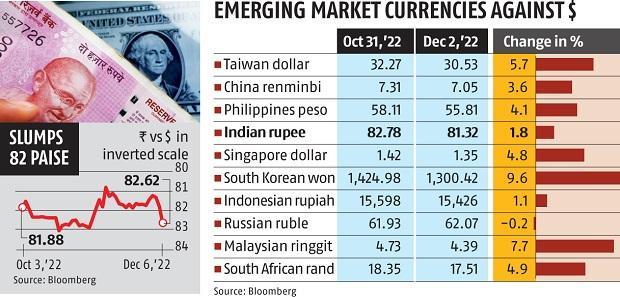

Relative Performance of The Rupee:

The rise of forex reserves between October 2022 and January 2023, allowed the RBI to spend foreign assets for tackling the Rupee’s fall, which was lesser than other Asian currencies. Despite the depriciation, RBI governor Shaktikanta Das has called the Rupee’s performance impressive in the face of volatility.

You may also read: Gross Direct Tax Collection Registered Growth of 30% in 2022-23

India’s GDP likely to grow at 6.2% in FY24, says Morgan Stanley

Sharing is Caring!!!

Indian Olympic Medal Winners List Till N...

Indian Olympic Medal Winners List Till N...

Who is the Inventor of the Gramophone?

Who is the Inventor of the Gramophone?

HS Dhaliwal Appointed New DGP Of Andaman...

HS Dhaliwal Appointed New DGP Of Andaman...