The 8th Pay Commission, approved by the Union Cabinet in January 2025, is set to roll out from January 1, 2026, ushering in a significant overhaul in the salary structure, allowances, and pensions for central government employees and pensioners. This long-anticipated move comes a decade after the implementation of the 7th Pay Commission in 2016, staying in line with the historical ten-year revision cycle observed since the 4th Pay Commission. This revision aims to counter inflation, address growing economic demands, and enhance the overall standard of living for government employees across India.

Highlights of the 8th Pay Commission

- The 8th Pay Commission is expected to benefit over 48.62 lakh active employees and 67.85 lakh pensioners. It introduces a fitment factor of 2.28, resulting in a 34.1% increase in minimum salary.

- The Dearness Allowance (DA), projected to touch 70% by early 2026, will be merged with the basic pay to revise salary structures comprehensively.

Key expected changes

- Minimum Basic Salary hike from ₹18,000 to ₹41,000

- DA Merger with base salary

- Enhanced pension and timely disbursement

Salary Structure Under the 8th Pay Commission

The salary under the 8th Pay Commission will include,

Basic Pay

- Determined by applying the fitment factor to the existing basic pay under the 7th CPC. This is the core of the new pay structure.

Allowances

Recalculated allowances will include,

- Dearness Allowance (DA) – a cost-of-living adjustment

- House Rent Allowance (HRA) – based on city category (metro, tier-2, tier-3)

- Travel Allowance (TA) – varying by grade and location

Gross Salary

- The gross salary is the sum of the revised basic pay and all allowances, minus applicable deductions.

Pension Revisions for Retirees

- Retired employees are also major beneficiaries.

- With a proposed fitment factor of 2.28, the minimum pension, currently at ₹9,000, could increase to around ₹20,500. This is a substantial enhancement aimed at improving the financial stability of senior citizens.

Fitment Factor: What It Means

The fitment factor is a multiplier used to calculate the new basic pay by converting the existing salary. Historically, each Pay Commission introduces a new fitment factor,

- 6th CPC: 1.86

- 7th CPC: 2.57

- 8th CPC (expected): 3.00

If approved, this will bring an average 20% hike in salaries.

Salary Calculator Guide

A simplified calculation using the expected fitment factor of 3.00 is as follows.

- Revised Basic Pay = Existing Basic Pay × 3.00

- DA = Revised Basic Pay × 0.50 (assuming 50% DA)

- HRA = Revised Basic Pay × City Category % (27% for metro, 20% for tier-2, 10% for tier-3)

- TA is added based on grade/city

- Gross Salary = Revised Basic + DA + HRA + TA – Deductions

This tool is particularly useful for employees to estimate their take-home salary in 2026.

Pay Matrix Table Comparison

Here’s a glimpse into the revised Pay Matrix under the 8th CPC compared to the 7th CPC.

- Level 1: ₹18,000 ➔ ₹21,600

- Level 6: ₹35,400 ➔ ₹42,480

- Level 10: ₹56,100 ➔ ₹67,320

- Level 13A: ₹1,31,100 ➔ ₹1,57,320

- Level 18: ₹2.5 lakh ➔ ₹3 lakh

This structured salary progression ensures transparency and parity across various services.

Implementation Timeline

- The Commission was formally approved on January 16, 2025, giving over 12 months for thorough recommendations and reviews. The rollout is scheduled for January 1, 2026.

WHO Foundation and Novo Nordisk Launch I...

WHO Foundation and Novo Nordisk Launch I...

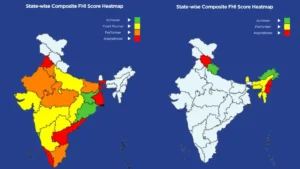

NITI Aayog Releases Fiscal Health Index ...

NITI Aayog Releases Fiscal Health Index ...

UIDAI Launches Bug Bounty Program to Str...

UIDAI Launches Bug Bounty Program to Str...