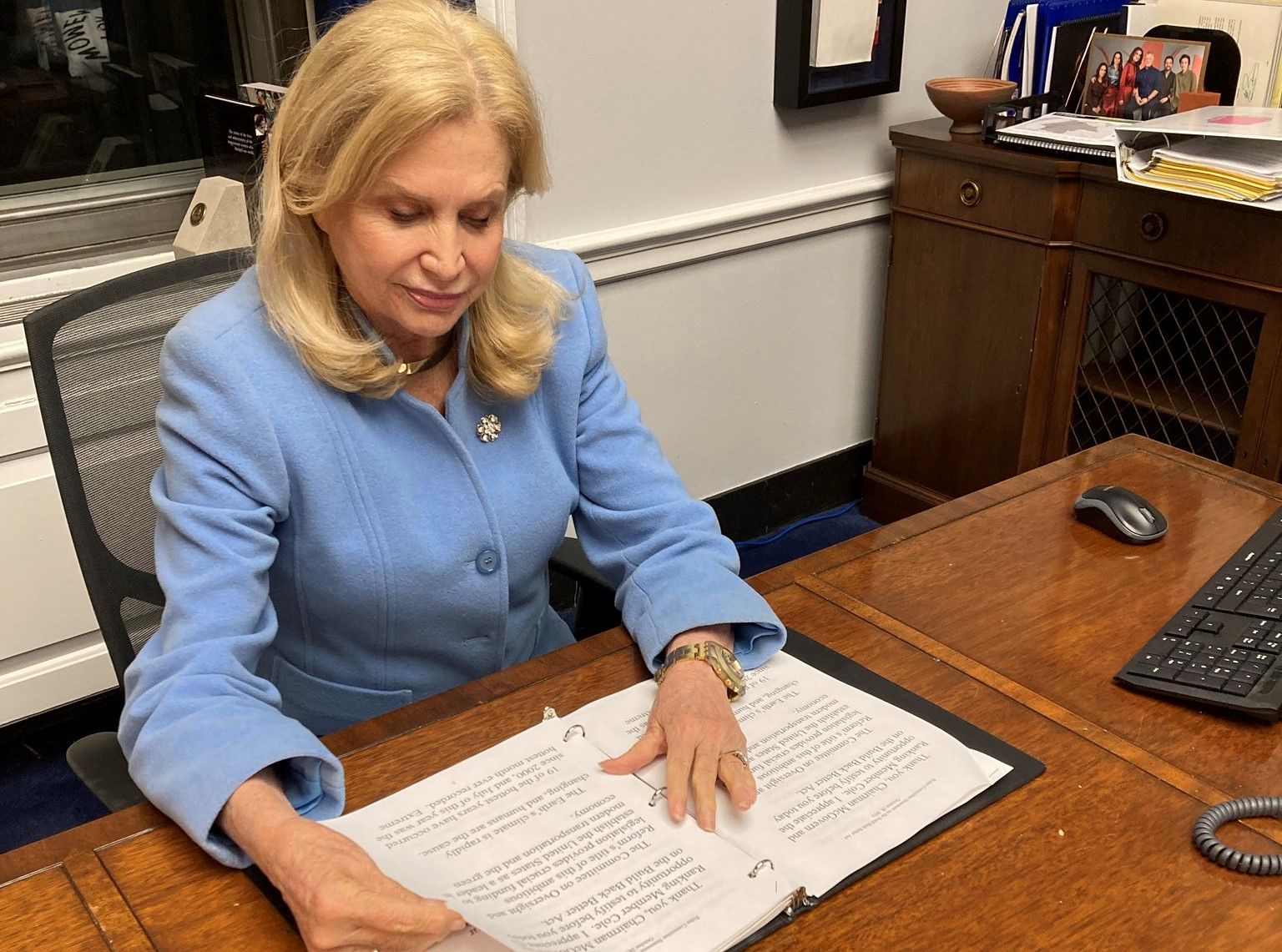

United States lawmakers led by Congresswoman Carolyn B Maloney from New York, introduced a bill to declare Diwali a national holiday in the country. The lawmaker announced the Deepavali Day Act in the House of Representatives. The historic legislation is being supported by a number of lawmakers including Indian-American Representative Raja Krishnamoorthi. Meanwhile, Krishnamoorthi also introduced a resolution in the US Congress to recognise the religious and historical significance of the festival of lights.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Important takeaways for all competitive exams:

- United States Capital: Washington, DC;

- United States President: Joe Biden;

- United States Currency: United States Dollar.

Must Read: Happy Diwali 2022: Wishes, Quotes and Greetings in English

Which is the Largest House in the World?...

Which is the Largest House in the World?...

Who is the Richest Man in Asia in 2026? ...

Who is the Richest Man in Asia in 2026? ...

Third Edition of Future Warfare Course L...

Third Edition of Future Warfare Course L...