As the winter smog season gripped northern India, Ghaziabad — a key city in the National Capital Region (NCR) — recorded the worst air pollution levels in the country for the month of November 2025. A recent report by the Centre for Research on Energy and Clean Air (CREA) found that PM2.5 levels in Ghaziabad reached 224 µg/m³, far exceeding safe limits. This new data highlights the continuing public health challenge posed by winter air pollution in the NCR, even as stubble burning events reportedly declined compared to previous years.

Top 10 Most Polluted Cities in India – November 2025

- Ghaziabad (UP) – PM2.5: 224 µg/m³

- Noida (UP)

- Bahadurgarh (Haryana)

- Delhi – PM2.5: 215 µg/m³

- Hapur (UP)

- Greater Noida (UP)

- Baghpat (UP)

- Sonipat (Haryana)

- Meerut (UP)

- Rohtak (Haryana)

These cities consistently breached the National Ambient Air Quality Standards (NAAQS), with most logging hazardous air quality levels on all 30 days in November.

Key Findings of the CREA Report

- 20 of the 29 cities in NCR recorded higher PM2.5 levels in November 2025 than in the same month in 2024.

- Ghaziabad topped the list with an average PM2.5 concentration of 224 µg/m³, making it the most polluted city in India that month.

- Other NCR cities like Faridabad, Noida, and Bhiwadi also reported extremely poor air quality levels.

This rise in pollution came despite a dip in farm fire contributions, indicating that urban emissions, traffic, construction dust, and weather conditions remain major culprits.

Nationwide Pollution Trends

CREA’s analysis of 29 NCR cities showed that,

- 20 cities recorded higher pollution than 2024

- Most had no single day within safe limits

Across India,

- Rajasthan: 23 of 34 cities breached PM2.5 limits

- Haryana: 22 of 25 cities

- Uttar Pradesh: 14 of 20 cities

- Madhya Pradesh: 9 of 12 cities

- Odisha: 9 of 14 cities

- Punjab: 7 of 8 cities

This highlights a widespread, chronic air pollution crisis across central and northern India.

Cleanest Cities in India – November 2025

At the other end of the spectrum, Shillong in Meghalaya was India’s cleanest city, with a PM2.5 level of just 7 µg/m³.

Other top clean cities include,

- 6 cities in Karnataka

- 1 each in Sikkim, Tamil Nadu, and Kerala

These regions benefit from favorable geography, dense vegetation, and relatively low industrial activity.

Understanding PM2.5

PM2.5 (particulate matter less than 2.5 micrometers in diameter) is among the most harmful pollutants, as it can penetrate deep into the lungs and even enter the bloodstream. Prolonged exposure can lead to,

- Respiratory diseases (asthma, bronchitis)

- Cardiovascular issues

- Premature death, especially among the elderly and children

The WHO safe limit for PM2.5 is 15 µg/m³ (annual) and 25 µg/m³ (24-hour average). Ghaziabad’s 224 µg/m³ is almost 9 times the 24-hour safe limit.

Why Pollution Worsens in November

Every year, air quality in North India deteriorates during the onset of winter due to,

- Temperature inversion (cooler air traps pollutants near the surface)

- Low wind speed and poor ventilation

- Increased vehicular and industrial emissions

- Open burning of biomass and waste

- Residual effects of stubble burning in Punjab and Haryana

Though farm fire incidents reportedly declined this year, the lack of strong policy enforcement on urban sources has kept pollution levels dangerously high.

Implications for Public Health and Policy

With many NCR cities continuing to breach hazardous air quality levels, there’s an urgent need for,

- Strict enforcement of construction and dust control norms

- Improved public transport and reduction in vehicle emissions

- Stronger waste management systems

- Air quality forecasting and early warning systems

- Long-term transition to clean energy solutions

The data also signals the importance of strengthening the National Clean Air Programme (NCAP) and ensuring coordination between Centre, States, and local urban bodies.

Key Takeaways

- Most Polluted City (Nov 2025): Ghaziabad

- PM2.5 Level: 224 µg/m³

- NCR Cities Affected: 20 out of 29 saw worse air quality than Nov 2024

- Stubble Burning Impact: Lower than 2024, but urban sources still dominant

- Health Risk: PM2.5 levels nearly 9x higher than WHO’s 24-hour safe limit

- Action Needed: Policy enforcement on emissions, better monitoring, clean tech adoption.

Government Expands Carbon Credit Trading...

Government Expands Carbon Credit Trading...

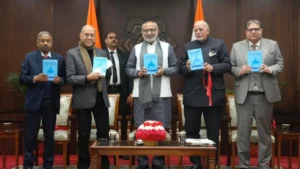

Vice President C. P. Radhakrishnan Launc...

Vice President C. P. Radhakrishnan Launc...

SAMPANN Pension Portal Integrated with U...

SAMPANN Pension Portal Integrated with U...