The Government of India has announced a series of major reforms to modernize the Employees Provident Fund Organisation (EPFO) and expand social security coverage across the country. Union Minister for Labour & Employment, Dr. Mansukh Mandaviya, shared these initiatives while inaugurating the newly constructed Bhavishya Nidhi Bhawan of EPFO at Vatva in Gujarat. The reforms aim to make EPFO services more accessible, technology-driven, and citizen-friendly while ensuring financial security for workers.

Key EPFO Reforms Announced

The following major reforms were announced to improve EPFO services nationwide,

- Modern, technology enabled EPFO offices with single window service

- Facility to resolve EPF issues at any EPFO regional office

- Introduction of EPF Suvidha Providers to assist members

- Mission-mode KYC drive to activate inoperative EPF accounts

- Simplified digital platform for faster claim settlement

- Social security protection for Indian workers abroad through FTAs

- Expansion of social security coverage to 100 crore citizens by March 2026

Detailed Overview of the Reforms

1. Modern Technology Enabled EPFO Offices

- EPFO offices across India are being redeveloped into modern, citizen-centric service centres similar to Passport Seva Kendras.

- These offices will operate as single window service hubs, allowing members to resolve all EPF related issues efficiently.

- A pilot project is already underway in Delhi.

2. Any-Office Service Facility

- Under the new system EPF members will no longer be required to visit their original or linked EPFO office.

- They can approach any regional EPFO office anywhere in the country to get their grievances addressed, making services more flexible and convenient.

3. Introduction of EPF Suvidha Providers

- To support workers who are unfamiliar with digital systems, the government will introduce EPF Suvidha Providers.

- These authorised facilitators will help members understand procedures, file claims and access EPFO benefits, especially assisting first-time users.

4. Mission-Mode KYC Drive for Inoperative Accounts

- A large amount of workers money is currently locked in inoperative EPF accounts due to incomplete KYC or accessibility issues.

- EPFO will launch a mission mode KYC verification drive to ensure that such funds are returned to their rightful owners.

5. Simplified Digital Claim Settlement

- A dedicated digital platform will be introduced to allow easy claim filing and faster settlements.

- Automatic processing of claims up to ₹5 lakh has already been implemented, reducing delays and paperwork.

6. Social Security for Indian Workers Abroad

- India’s Free Trade Agreements (FTAs) will now include social security protection provisions.

- This will allow Indian workers employed abroad to retain their provident fund contributions and access benefits even after returning to India similar to provisions in the India UK FTA.

7. Expansion of Social Security Coverage

- India’s social security coverage has increased from 19% before 2014 to 64% today.

- Currently, around 94 crore people are covered under social security schemes.

- The government aims to bring 100 crore citizens under the social security net by March 2026, making India one of the largest social security providers globally.

Employees Provident Fund Organisation (EPFO)

- Statutory body established under the Employees Provident Funds and Miscellaneous Act, 1952

- Functions under the Ministry of Labor and Employment

- Administered by the Central Board of Trustees, a tripartite body of government, employers, and employees

- Manages three schemes: EPF (1952), EPS (1995), and EDLI (1976)

- EPS provides pension after retirement at 58 years with a minimum of 10 years of service

- Supreme Court recently allowed employees extra time to opt for higher pension contributions under EPS with employer consent

Key Takeaways

- EPFO offices to become single-window, technology-enabled service centres

- Introduction of EPF Suvidha Providers for citizen assistance

- Mission-mode KYC drive to unlock inoperative EPF accounts

- Social security clauses to be included in India’s FTAs

- Target of 100 crore citizens under social security by March 2026

- EPFO corpus: ₹28 lakh crore, interest rate: 8.25%

Question

Q. Under the “Any-Office Service Facility”, EPF members can:

A. Access services only online

B. Visit only their original EPFO office

C. Get grievances addressed at any EPFO office nationwide

D. File claims only through employers

India’s Agri Exports to US Set to Rise a...

India’s Agri Exports to US Set to Rise a...

World’s Largest Grain Storage Plan in Co...

World’s Largest Grain Storage Plan in Co...

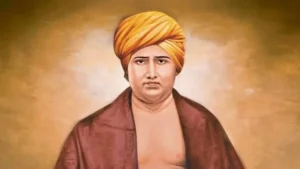

Swami Dayanand Saraswati Remembered on H...

Swami Dayanand Saraswati Remembered on H...