In a significant ruling, the Bombay High Court declared that public sector banks lack the legal authority to issue Look Out Circulars (LOCs) against defaulting borrowers. This verdict, based on a challenge to a clause in a government memorandum, invalidates all LOCs issued by such banks.

The Verdict

A division bench comprising Justices Gautam Patel and Madhav Jamdar deemed the clause empowering public sector bank chairpersons to issue LOCs unconstitutional. Despite the government’s attempt to seek a stay on the ruling, the bench refused. The judgment is based on petitions contesting the validity of the clause.

Implications and Restrictions

The court’s decision prohibits the Bureau of Immigration from acting on LOCs issued by banks against defaulters. However, it clarifies that orders from tribunals or criminal courts restraining defaulters from traveling abroad remain unaffected.

Legality of the Memorandum

While the court found the government’s office memorandum not violating the Constitution, it deemed the clause allowing bank chairpersons to issue LOCs as “arbitrary and without power in law.” The memorandum, amended in 2018, granted public sector banks authority to issue LOCs in the “economic interest of India,” aiming to prevent individuals from traveling abroad if their departure could harm the country’s economic interests.

Contesting Interpretation

Petitioners argued that the phrase “economic interest of India” cannot be equated with the “financial interests” of any bank, highlighting a nuanced distinction between national economic concerns and individual bank finances.

DBT Marks 40 Years; Dr Jitendra Singh La...

DBT Marks 40 Years; Dr Jitendra Singh La...

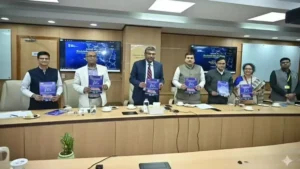

MeitY Launches ‘Blockchain India Challen...

MeitY Launches ‘Blockchain India Challen...

Cabinet Approves MSP for Raw Jute for 20...

Cabinet Approves MSP for Raw Jute for 20...