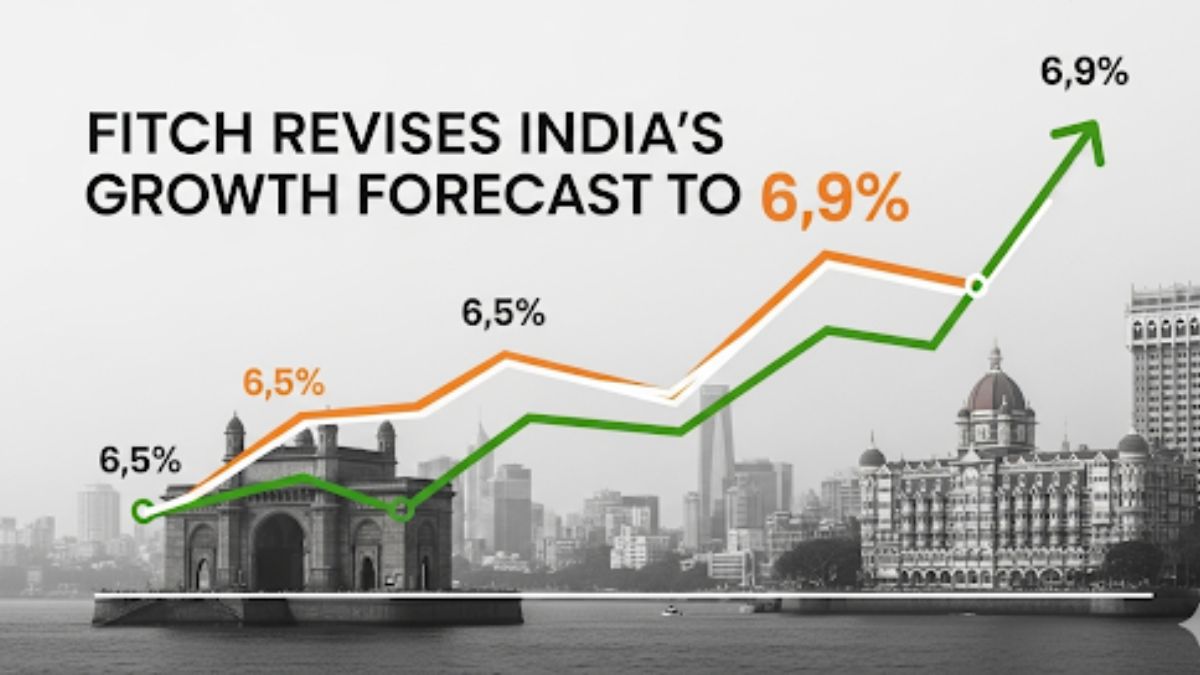

In a fresh update that underscores confidence in India’s economic trajectory, Fitch Ratings has upgraded India’s GDP growth forecast for FY2025 from 6.5% to 6.9%. The upward revision, announced in September 2025, is driven by robust domestic demand, rising consumer spending, and favourable financial conditions. Even as global trade faces headwinds, India’s economy continues to demonstrate resilience, supported by structural reforms and macroeconomic stability.

Drivers Behind the Growth Upgrade

Fitch highlighted several key factors contributing to the improved growth outlook,

- Strong Domestic Demand: Consumer confidence remains high, with rising household consumption across sectors.

- Supportive Financial Conditions: Stable interest rates and improved liquidity are encouraging borrowing and investment.

- Resilient Private Sector Activity: Corporate earnings and capital expenditure are recovering steadily post-pandemic.

- These trends collectively suggest that the Indian economy is well-positioned to maintain momentum even in a globally uncertain environment.

GST Reforms: A Key Growth Enabler

Fitch emphasized the positive impact of ongoing Goods and Services Tax (GST) reforms, describing them as “credit positive” for rated Indian firms. The reforms are expected to,

- Enhance compliance and revenue collection

- Lower costs of doing business

- Stimulate consumer spending

- Increase market efficiency across sectors

These outcomes are particularly important in insulating India’s economy from external shocks, including global tariff hikes like those recently imposed by the United States.

Looking Ahead: Growth Beyond FY25

Fitch projects that India’s growth will average 6.3% by FY2027, with the economy operating slightly above its potential output. This projection suggests that India is not just recovering but expanding on a structurally stronger base, driven by domestic engines of growth rather than global demand alone.

RBI Policy Outlook and Global Trends

As part of its broader analysis, Fitch also predicts that the Reserve Bank of India (RBI) may cut interest rates by 25 basis points towards the end of 2025. This anticipated rate cut is aimed at further supporting demand while keeping inflation in check.

In contrast, global economic growth is expected to rise only modestly, with Fitch forecasting a 2.3% global growth rate in 2026, led by recovery in China and the Eurozone. India’s projected growth stands out significantly in this global context.

Static Facts and Takeaways

- Fitch Ratings upgraded India’s FY25 GDP forecast from 6.5% to 6.9% in September 2025.

- Growth is supported by domestic demand, financial stability, and GST reforms.

- GST reforms are expected to be credit positive and boost consumption and economic efficiency.

- FY27 forecast: India’s GDP likely to grow at 6.3%, slightly above its potential.

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...