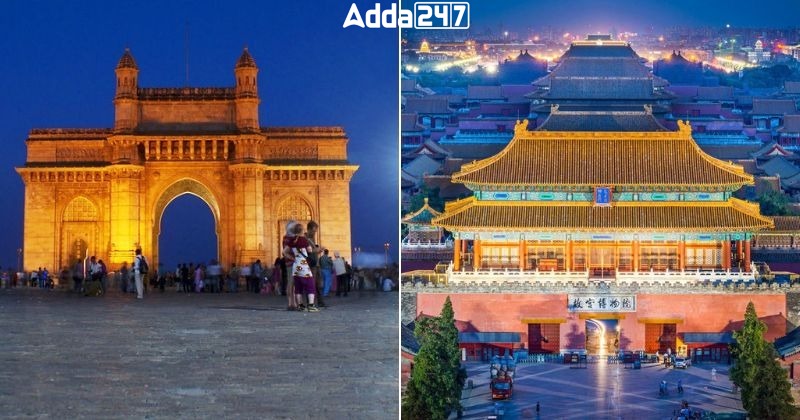

In a landmark shift, Mumbai has overtaken Beijing as Asia’s billionaire capital, according to the latest report from the Shanghai-based Hurun Research Institute. This monumental achievement reflects Mumbai’s burgeoning economic landscape and underscores India’s rising prominence in global wealth distribution.

Hurun Research Institute Report: Key Findings

1. Mumbai’s Ascendancy:

- Mumbai boasts 92 billionaires, securing its position as Asia’s third billionaire capital, trailing behind New York (119) and London (97).

- Notable figures driving Mumbai’s billionaire status include Mukesh Ambani of Reliance Industries and Gautam Adani of Adani Group.

- India’s robust economy, growing at 7.5% in 2023, facilitated the addition of 94 billionaires, marking the country’s highest count since 2013.

2. China’s Challenges:

- Despite maintaining the top spot with 814 billionaires, China experienced a decline in ultra-rich individuals, with 155 fewer billionaires compared to 2022.

- Struggles in China’s real estate and renewable energy sectors, coupled with weak stock markets, contributed to the decrease in billionaire numbers.

3. Wealth Dynamics in China:

- Wealth controlled by China’s billionaires fell by 15%, with 40% of individuals from the previous Hurun list losing their positions.

- Industries such as real estate and renewables saw notable declines in wealth, impacting figures like Wang Jianlin of Dalian Wanda Group.

4. U.S. Technological Advancements:

- The U.S. witnessed significant wealth growth driven by advancements in artificial intelligence, propelling figures like Jensen Huang of Nvidia into the top 30 billionaires with $48 billion in assets.

- Tech giants behind companies like Google, Meta, and Microsoft experienced surges in wealth following a stock rally.

5. Global Representation:

- The Hurun rich list encompasses 3,279 individuals from 73 countries, highlighting the global distribution of wealth.

- U.S. billionaires accounted for 37% of the list, with a 5% increase in billionaire numbers and a 9% rise in total wealth.

6. Methodology:

- The report’s rankings are based on individuals’ shareholdings in listed entities as of January 15. For non-listed companies, wealth valuation is derived from comparisons with listed equivalents.

India's Progress in Human Development In...

India's Progress in Human Development In...

CareEdge State Rankings 2025: Maharashtr...

CareEdge State Rankings 2025: Maharashtr...

Top 10 Most Expensive Cities To Live Aro...

Top 10 Most Expensive Cities To Live Aro...