The Reserve Bank of India (RBI) has released data showing that India’s current account deficit, an important measure of the balance of payments, has decreased to $18.2 billion, which is equivalent to 2.2% of the GDP, during the December quarter of the current fiscal year. This decrease can be attributed to the reduction in the merchandise trade deficit, which stood at $30.9 billion, or 3.7% of the GDP in the second quarter of the fiscal year 2022-23.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Current Trend In the Current Account Deficit (CAD):

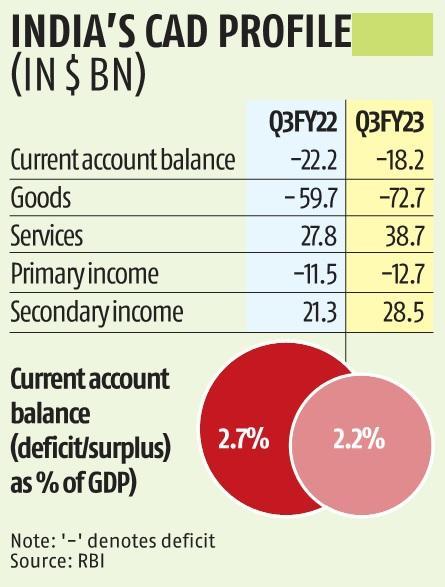

As per the RBI, during the second quarter of the previous fiscal year, the Current Account Deficit (CAD) was $30.9 billion, which is equivalent to 3.7% of the GDP. However, in the December quarter of 2021-22, it decreased to $22.2 billion or 2.7% of the GDP.

Reasons of The lower Current Account Deficit (CAD):

- The lower current account deficit in Q3:2022-23 can be attributed to the narrowing of the merchandise trade deficit, which decreased to $72.7 billion from $78.3 billion in Q2:2022-23. Furthermore, the robust services and private transfer receipts have also contributed to this reduction.

- The RBI data reveals that net services receipts showed an increase both sequentially and on a year-on-year basis. This growth can be attributed to a 24.5% increase in services exports on a year-on-year basis, driven by higher exports of software, business, and travel services.

- Private transfer receipts, which represent remittances by Indians employed overseas, amounted to $30.8 billion in the December quarter, reflecting a 31.7% increase from the previous year’s level.

- In the same quarter, net foreign direct investment decreased to $2.1 billion from $4.6 billion in the year-ago period. However, net foreign portfolio investment reported inflows of $4.6 billion in the December quarter, as opposed to an outflow of $5.8 billion in the third quarter of 2021-22. The net outgo from the primary income account, which mainly reflects investment income payments, increased to $12.7 billion from $11.5 billion in the year-ago period.

- Additionally, non-resident deposits showed net inflows of $2.6 billion in the third quarter of the current fiscal year, as compared to net inflows of $1.3 billion in the year-ago period.

- According to the RBI data, India recorded a current account deficit of 2.7% of GDP during the April-December 2022 period, as compared to a deficit of 1.1% during the same period in the previous year.

You may also read these:

- India’s overall exports cross all-time high of 750 Billion US dollars

- S&P keeps India’s economic growth forecast unchanged at 6% for FY24

Indian Olympic Medal Winners List Till N...

Indian Olympic Medal Winners List Till N...

Who is the Inventor of the Gramophone?

Who is the Inventor of the Gramophone?

HS Dhaliwal Appointed New DGP Of Andaman...

HS Dhaliwal Appointed New DGP Of Andaman...