India’s eight core industries registered a 2% year-on-year growth in July 2025, according to the latest data released by the Ministry of Commerce and Industry. This modest rise in industrial output reflects a mixed performance, with robust expansion in steel, cement, fertilisers, and electricity, partially offset by a significant decline in coal production and a dip in petroleum-related outputs.

Understanding the Core Sector

What Are the Eight Core Industries?

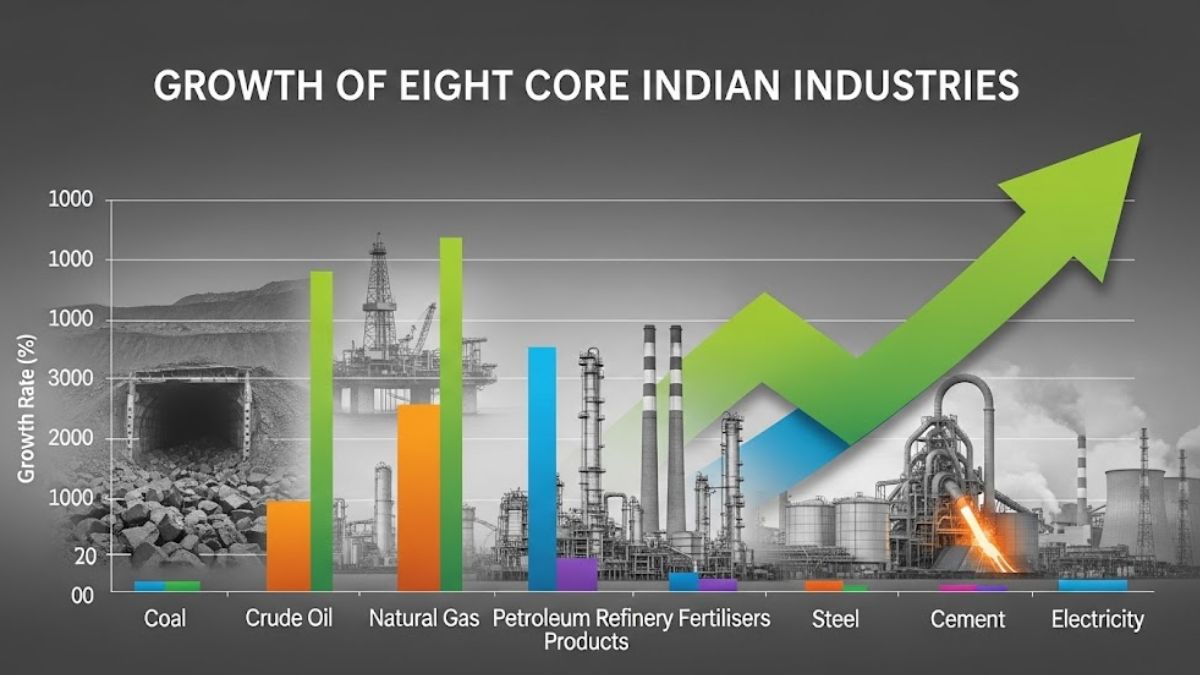

The core sector comprises the following industries,

- Coal

- Crude Oil

- Natural Gas

- Petroleum Refinery Products

- Fertilisers

- Steel

- Cement

- Electricity

These industries together contribute 40.27% of the weight in the Index of Industrial Production (IIP), making them crucial indicators of India’s industrial health.

July 2025 Performance Highlights

Top Performing Sectors

- Steel: Registered a sharp 12.8% growth, the highest among all core sectors. This was driven by strong demand from ongoing government infrastructure projects.

- Cement: Rose by 11.7%, reflecting robust activity in the construction and real estate sectors, further bolstered by infrastructure spending.

- Fertilisers: Grew by 2%, supported by a favorable kharif sowing season following good monsoon rainfall.

- Electricity: Increased marginally by 0.5%, indicating stable power generation, although hindered by weather-related factors.

Sectors in Decline

- Coal: Plunged by 12.3% due to heavy monsoon rains disrupting mining operations.

- Crude Oil: Fell by 1.3%, continuing a long-standing trend of stagnation in domestic production.

- Natural Gas: Declined by 3.2%, impacted by reduced upstream activity.

- Petroleum Refinery Products: Dropped by 1%, indicating slower downstream refining activity.

Cumulative Performance (April–July 2025-26)

Overall Growth

- The core sector posted a 1.6% cumulative growth for the first four months of the financial year 2025–26, compared to the same period last year.

Strong Performers

- Cement: Up 8.9%

- Steel: Up 8.5%

These numbers reflect continued support from infrastructure expansion, including the PM Gati Shakti initiative and increased capital expenditure by the government.

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...

India’s Core Sector Growth Slows to 4% i...

India’s Core Sector Growth Slows to 4% i...

Unemployment Rises to 5%! Why India’s Jo...

Unemployment Rises to 5%! Why India’s Jo...