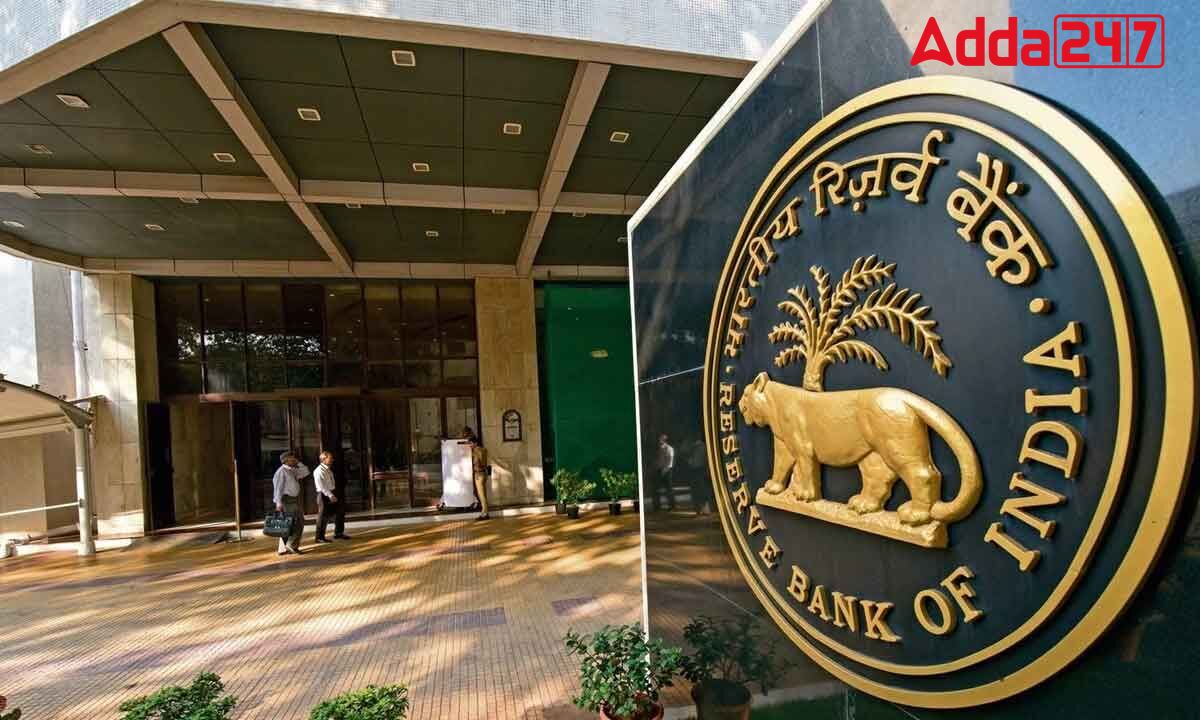

In a significant move following the Reserve Bank of India’s (RBI) issuance of fresh guidelines, State Bank of India (SBI) and Standard Chartered Bank India conducted a Credit Default Swap (CDS) trade valued at ₹25 crore. This marks a notable development in the financial landscape, particularly in credit risk management.

Transaction Overview

The trade involved a 1-year rupee CDS featuring REC, as disclosed by senior executives at Standard Chartered Bank.

Industry Insight

“This landmark transaction marks a pivotal moment in credit risk management and underscores the growing sophistication of financial instruments in the Indian market,” stated Parul Mittal Sinha, Head of Financial Markets, India, at Standard Chartered Bank.

Understanding Credit Default Swaps

- Credit default swaps are derivative instruments designed to provide a form of insurance against the risk of default of the issuer of a bond.

- This structured approach presents a clear breakdown of the news with specific sub-headers for each aspect of the transaction and its implications.

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

India Revises Base Year of Merchandise T...

India Revises Base Year of Merchandise T...