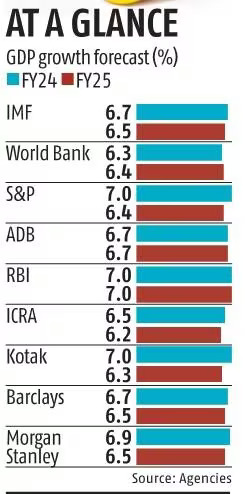

In its latest analysis, Morgan Stanley Research projects India’s GDP growth for FY25 to moderate to 6.5%, down from the 6.9% projected for FY24. Despite this moderation, the report maintains a constructive outlook on the Indian economy, citing improvements in domestic demand and macro stability.

Key Points from Morgan Stanley Research

- Growth Projection: GDP growth for Q3 FY24 is expected at 6.5%, a slight slowdown from the first half of the financial year.

- Macroeconomic Stability: Strength in fundamentals and improved domestic demand contribute to macro stability.

- Current Account Deficit: Supported by robust services exports and declining global commodity prices, especially oil, the current account deficit is expected to remain benign.

ICRA Highlights Sequential Moderation in GDP Growth

Meanwhile, ICRA forecasts a sequential moderation in year-on-year GDP growth to 6% in Q3 FY24 from 7.6%, primarily influenced by the agriculture and industry sectors. The report also notes a slowdown in investment activity, with government capital expenditure witnessing a slight dip in the last quarter.

Key Points from ICRA Report

- GDP Growth Projection: Sequential moderation in GDP growth to 6% in Q3 FY24 from 7.6%.

- Investment Activity: Government capital expenditure declined slightly in October-December 2023, indicating a slowdown in investment activity.

- State Government Expenditure: Capital outlay and net lending of state governments shrank by 3.9% year-on-year, after a significant surge in the previous quarter.

India Forex Reserves Reach Record $728.5...

India Forex Reserves Reach Record $728.5...

Maharashtra Records Slowest GSDP Growth ...

Maharashtra Records Slowest GSDP Growth ...

RBI Reports Sharp Fall in India’s Curren...

RBI Reports Sharp Fall in India’s Curren...