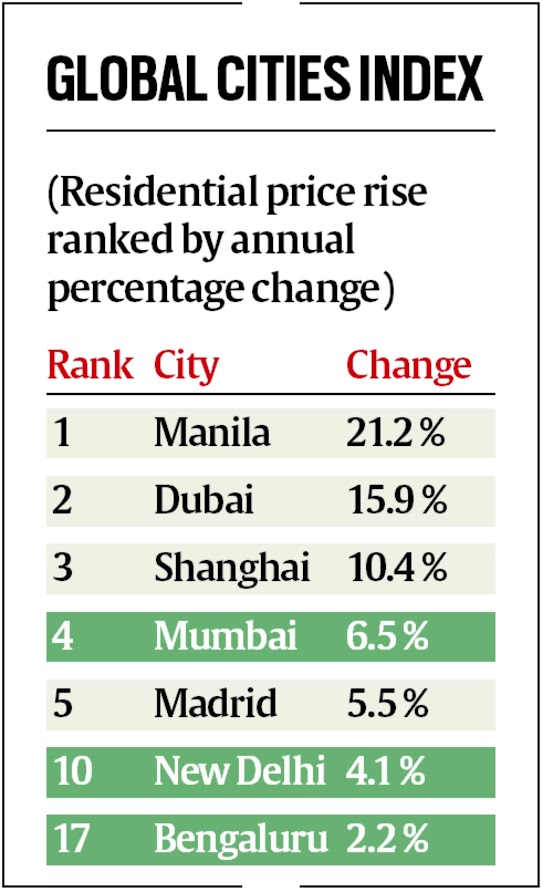

Knight Frank’s Prime Global Cities Index, in its latest report, reveals that for the quarter ending in September 2023, Mumbai has achieved the fourth-highest year-on-year growth in prime residential prices among global cities. This significant surge has reshaped the city’s real estate dynamics, catapulting it 18 places above its September 2022 ranking.

Mumbai’s 6.5% Surge in Prime Residential Prices

Mumbai’s real estate market recorded a substantial 6.5% increase in prime residential prices. This surge is a testament to the city’s enduring appeal to homebuyers and investors alike. With this impressive growth rate, Mumbai is now positioned as a prime destination for real estate investment, attracting global attention and capital.

New Delhi and Bengaluru Follow Suit

New Delhi‘s National Capital Region (NCR) has made a significant leap, climbing from the 36th rank a year ago to secure the 10th spot in the September 2023 rankings. This growth is underpinned by a substantial 4.1% year-on-year increase in prime residential prices.

Bengaluru Ascends Global Rankings with 2.2% Prime Residential Price Growth

Bengaluru, often referred to as the “Silicon Valley of India,” has experienced a commendable rise in its global ranking. In 2022, the city held the 27th position, but in 2023, it soared to the 17th spot, backed by a 2.2% growth in prime residential prices. This growth signifies the robust potential of Bengaluru’s real estate market.

Prime Global Cities Index Overview

The Prime Global Cities Index, compiled by Knight Frank, is a valuation-based index that tracks the movement of prime residential prices across 46 cities worldwide. It provides a comprehensive perspective on the health and performance of real estate markets in these global hubs. Importantly, the index tracks nominal prices in local currency, offering a detailed understanding of local market dynamics.

Global Trends in Prime Residential Prices

The Prime Global Cities Index reveals that the average rise in annual prime residential prices across the 46 markets for the 12-month period ending in September 2023 was 2.1%. This growth rate is notably the strongest recorded since the third quarter of 2022. Moreover, it reflects the fact that 67% of the cities included in the index are experiencing growth on an annual basis, signifying a global trend of increasing prime residential prices.

Manila Takes the Top Spot

Manila claims the top position in the Prime Global Cities Index. Manila has experienced an impressive 21.2% rise in residential property prices, a growth attributed to strong domestic and foreign investments in the city’s real estate sector.

Dubai’s Slide from the Top

Dubai has been displaced from the top spot for the first time in eight quarters. This displacement is primarily due to a sharp decline in quarterly growth, dropping from 11.6% in the June quarter to a mere 0.7% in the September quarter.

San Francisco: The Weakest Market

San Francisco emerges as the weakest market in the Prime Global Cities Index, with a notable decline of 9.7% on a year-on-year basis. This decline highlights the market dynamics in the city and underscores the varied performance of global real estate markets.

India's Progress in Human Development In...

India's Progress in Human Development In...

CareEdge State Rankings 2025: Maharashtr...

CareEdge State Rankings 2025: Maharashtr...

Top 10 Most Expensive Cities To Live Aro...

Top 10 Most Expensive Cities To Live Aro...