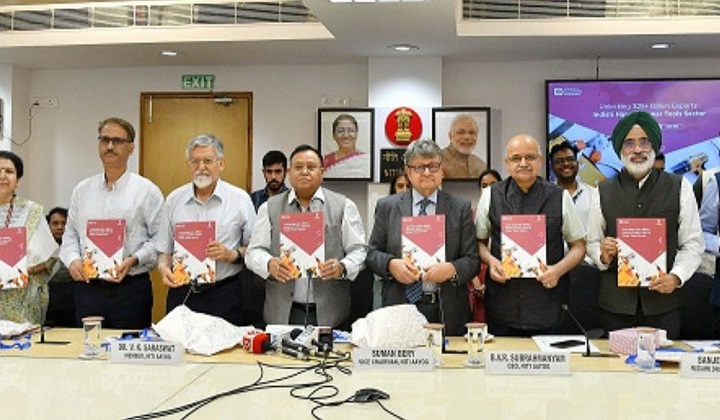

NITI Aayog launched a report titled ‘Unlocking $25+ Billion Export Potential – India’s Hand & Power Tools Sector’, aiming to explore the potential of India’s hand and power tools industry in the global trade landscape. The report identifies the transformative role that this sector could play in boosting India’s economic growth, creating jobs, and enhancing its position as a global manufacturing hub. With the global market for these tools expected to grow significantly by 2035, India’s focus on strengthening this sector could lead to $25 billion in exports over the next decade and the creation of 35 lakh jobs.

This article provides a detailed breakdown of the report’s key insights, challenges, and interventions suggested to achieve India’s growth targets in the hand and power tools market, highlighting the opportunities and strategies for success from both an economic and exam preparation perspective.

Key Insights from the Report

Global Market Growth and India’s Position

- Global Market Size: The global market for hand and power tools is currently valued at around $100 billion, with projections indicating it will grow to $190 billion by 2035.

- Indian Market Share: India currently exports $600 million in hand tools (1.8% of the market) and $470 million in power tools (0.7% of the market).

- China’s Dominance: China is the dominant player in this sector, accounting for 50% of hand tools exports and 40% of power tools exports globally, with $13 billion and $22 billion in exports respectively.

India’s Export Potential

- Export Target: India has the potential to increase its exports to $25 billion over the next decade, which represents a 10% market share in power tools and 25% market share in hand tools.

- Job Creation: Achieving this export goal could lead to the generation of approximately 35 lakh jobs, primarily in the manufacturing and export sectors.

Challenges Facing India’s Hand & Power Tools Sector

- Cost Disadvantages: India faces a 14-17% cost disadvantage compared to China, driven by:

- Higher raw material costs (steel, plastic, motors).

- Lower labour productivity due to overtime restrictions and higher wages.

- High logistics and transport costs from inland states to ports.

- Interest Rates and Overheads: Higher interest rates and logistics costs further impact the cost-effectiveness of India’s export potential.

Strategic Interventions for Growth

- The report proposes several key interventions to strengthen India’s hand and power tools industry.

- Developing World-Class Hand Tool Clusters.

- Public-Private Partnership (PPP) Model.

Addressing Structural Cost Disadvantages

- Reform Market Policies: Rationalize Quality Control Order (QCO) restrictions, reduce import duties on raw materials like steel, and simplify Export Promotion Capital Goods (EPCG) schemes.

- Ease Labour and Building Regulations: Reforming labour laws and building regulations to enhance competitiveness and operational efficiency.

Providing Bridge Cost Support

- Offset Cost Disadvantages: The report suggests providing bridge cost support to counteract disadvantages, although no additional funding is needed if structural reforms are effectively implemented. If reforms are delayed, approximately ₹8,000 crores in support may be necessary.

- Long-Term Investment: The investment in these reforms is expected to generate 2-3 times its value in tax revenue over the next five years.

| Summary/Static | Details |

| Why in the news? | NITI AAYOG Launched Unlocking $25+ Billion Export Potential Report |

| Global Market for Tools | Valued at $100 billion, projected to grow to $190 billion by 2035. |

| India’s Export Share | $600 million in hand tools (1.8% market share) and $470 million in power tools (0.7% market share). |

| Export Potential Target | $25 billion in exports over the next decade, creating 35 lakh jobs. |

| Cost Disadvantages | India faces a 14-17% cost disadvantage due to higher raw material costs and logistics. |

| Key Interventions | 1. Develop world-class hand tool clusters. 2. Address cost disadvantages through market reforms. 3. Provide bridge cost support for competitiveness. |

| Government Focus | Hand and power tools sector vital for India’s manufacturing and economic growth. |

Global AI Brain Race 2026: US Takes Crow...

Global AI Brain Race 2026: US Takes Crow...

Top 10 Under 40 Billionaires: This Fello...

Top 10 Under 40 Billionaires: This Fello...

US vs Russia vs Asia: The Nuclear Stockp...

US vs Russia vs Asia: The Nuclear Stockp...