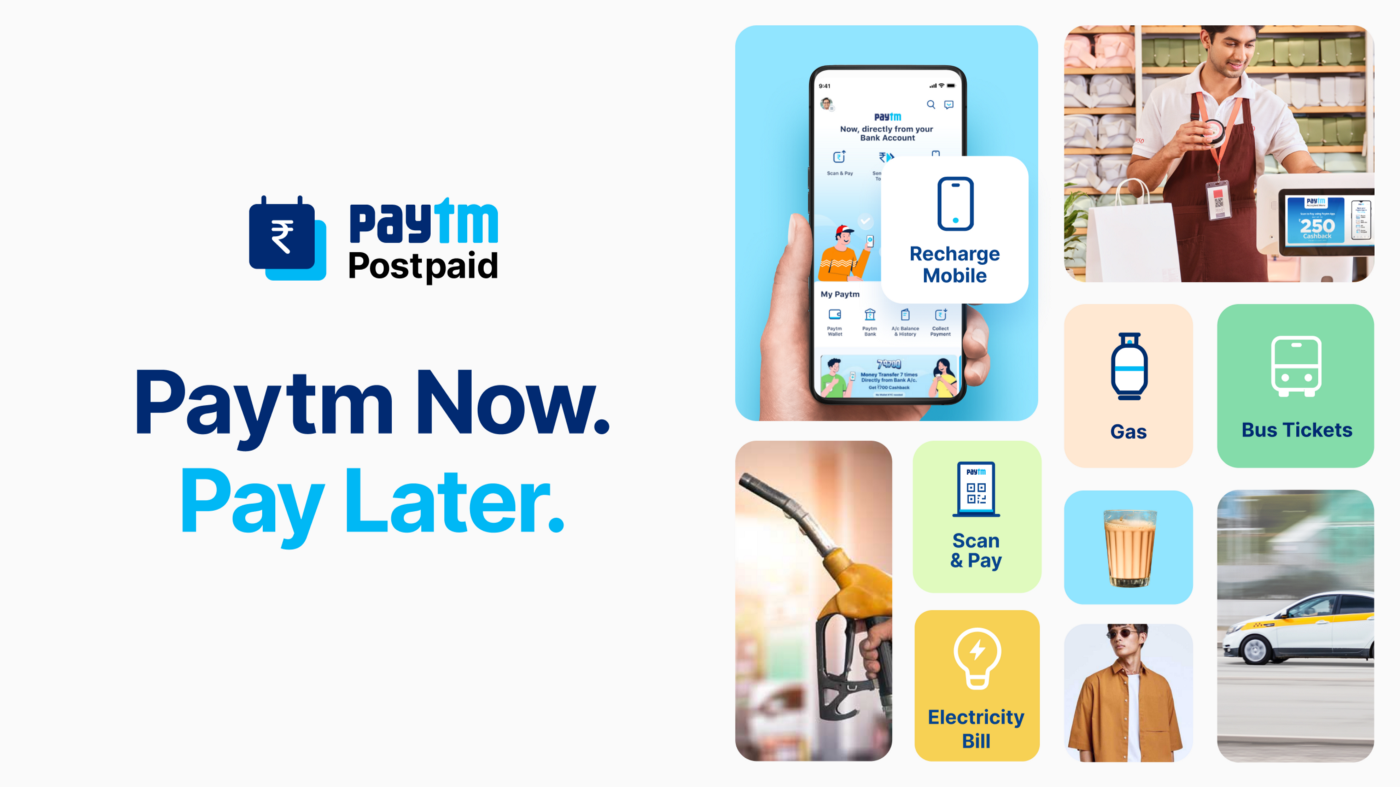

Paytm has announced the launch of Postpaid Mini, small-ticket loans that will give users the flexibility to access loans ranging from Rs 250 – Rs 1,000, in partnership with Aditya Birla Finance Ltd. The product is an extension of its Buy Now, Pay Later service, driving affordability amongst those new to credit. These small ticket instant loans will give flexibility to users and also help manage their household expenses to maintain liquidity during the ongoing Coronavirus (Covid-19) pandemic.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

With this service:

- Paytm Postpaid is offering a period of up to 30 days for repayment of loans at 0 per cent interest.

- There are no annual fees or activation charges, only a minimal convenience fee. With the launch of Postpaid Mini, the company will offer access to loans ranging from Rs 250 to Rs 1000, in addition to Paytm Postpaid’s instant credit of up to Rs 60,000.

- This could help users pay for their monthly expenses, including mobile and direct to home (DTH) recharges, gas cylinder booking, electricity and water bills, shop on Paytm Mall and more.

Important takeaways for all competitive exams:

- Paytm HQ: Noida, Uttar Pradesh;

- Paytm Founder & CEO: Vijay Shekhar Sharma;

- Paytm Founded: 2009.

7 Countries that Celebrate Holi Like Ind...

7 Countries that Celebrate Holi Like Ind...

Google Launches Nano Banana 2 Powered by...

Google Launches Nano Banana 2 Powered by...

Pakyong Airport to Be Renamed After Free...

Pakyong Airport to Be Renamed After Free...