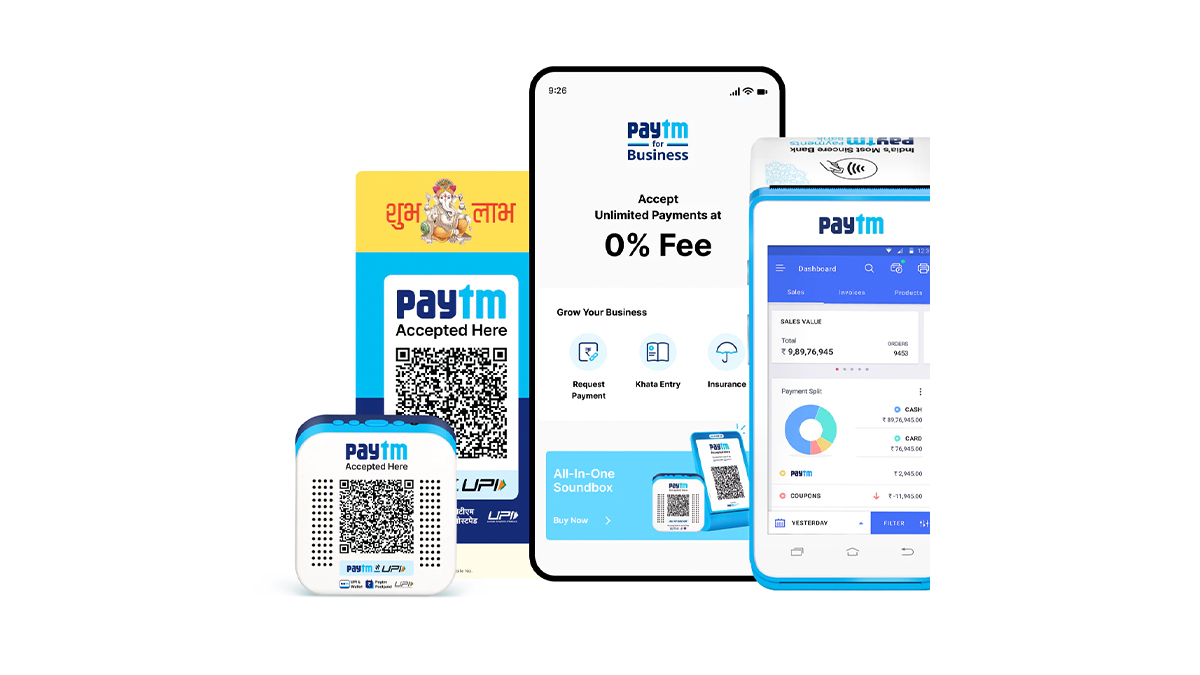

Paytm brand has partnered with Jana Small Finance Bank to deploy card machines to further drive digitisation among merchants across the country. This partnership will enable Jana Small Finance Bank to extend Paytm’s All-in-one EDC machines to its existing and potential customers, providing a one-stop solution for all their digital payment needs. With over 4.5 million devices deployed, Paytm remains the market leader in offline payments. Paytm’s EDC devices and All-in-One POS devices have revolutionised digital payments in India with their flexibility of accepting multiple payment methods.

Bank Maha Pack includes Live Batches, Test Series, Video Lectures & eBooks

Features of card machines:

- Paytm’s card machines provide a feature-rich payments solution that has enabled a robust growth of businesses for our merchant partners. This partnership will help expand our reach and deploy card machines across India’s small cities and towns.

- This partnership is in line with our vision to become the leading digitised bank of aspirational India to further financial inclusion in the country.

- MSME is a key priority for our Bank and we serve their needs in 150 cities. Our offerings are digital and this relationship with Paytm will further enhance our services to our customers.

- Paytm’s card machines provide multilingual support to its merchant partners to accept payments through UPI, credit/debit cards, net banking, international cards, Paytm Postpaid, PaytmWallet and EMI. The devices also offer instant voice alerts and instant settlement, which makes merchant partners convenient.

Important takeaways for all competitive exams:

- MD and CEO of Paytm: Vijay Shekhar Sharma;

- Paytm Founded: August 2010;

- Paytm Headquarters: Noida, Uttar Pradesh, India.

Which District is known as the Medical C...

Which District is known as the Medical C...

Which was the First Women's University i...

Which was the First Women's University i...

L&T Vyoma to Study 250 MW Green AI D...

L&T Vyoma to Study 250 MW Green AI D...