The Reserve Bank of India (RBI) has taken action against several banks and a housing finance company in Gujarat due to their failure to follow certain banking regulations.

Here’s a breakdown of the penalties imposed:

Gujarat Mercantile Co-operative Bank Ltd.

- Penalty Amount: ₹4.50 lakh

Reasons for Penalty:

-

- Violation of RBI directions on deposit placement and Cash Reserve Ratio (CRR).

- Exceeded inter-bank exposure limits.

- Failed to maintain the minimum CRR on certain days.

Nagarik Sahakari Bank Ltd.

- Penalty Amount: ₹2.00 lakh

Reasons for Penalty:

-

- Breached sections of the Banking Regulation Act, 1949.

- Non-transfer of eligible funds to Depositor Education and Awareness Fund.

- Granted a credit facility to an individual with a bank director’s relative as a guarantor.

- Exceeded inter-bank exposure and counterparty exposure limits.

- Failed to pay interest on unclaimed matured term deposits.

Makarpura Industrial Estate Co-operative Bank Ltd.

- Penalty Amount: ₹2.00 lakh

Reasons for Penalty:

-

- Violation of Section 26A (2) of the Banking Regulation Act, 1949.

- Failure to transfer eligible funds to the Depositor Education and Awareness Fund.

- Sanctioned a loan with a bank director’s relative as a guarantor.

The Sevalia Urban Co-operative Bank Ltd.

- Penalty Amount: ₹50,000

Reason for Penalty:

-

- Non-compliance with RBI directions regarding loans and advances involving bank directors and their relatives.

- Sanctioned a loan with a director’s relative as a surety or guarantor.

West End Housing Finance Limited

- Penalty Amount: ₹1.70 lakh

Reason for Penalty:

-

- Failure to follow National Housing Bank (NHB) directions on shareholding changes.

- The company changed its shareholding without prior written permission from NHB or RBI, exceeding permitted limits.

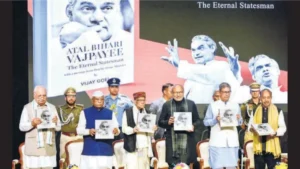

VP C. P. Radhakrishnan Unveils 'Atal Bih...

VP C. P. Radhakrishnan Unveils 'Atal Bih...

Who Was Mukul Roy? ‘Chanakya of Bengal P...

Who Was Mukul Roy? ‘Chanakya of Bengal P...

Which Vitamin is Found in Bananas? Check...

Which Vitamin is Found in Bananas? Check...