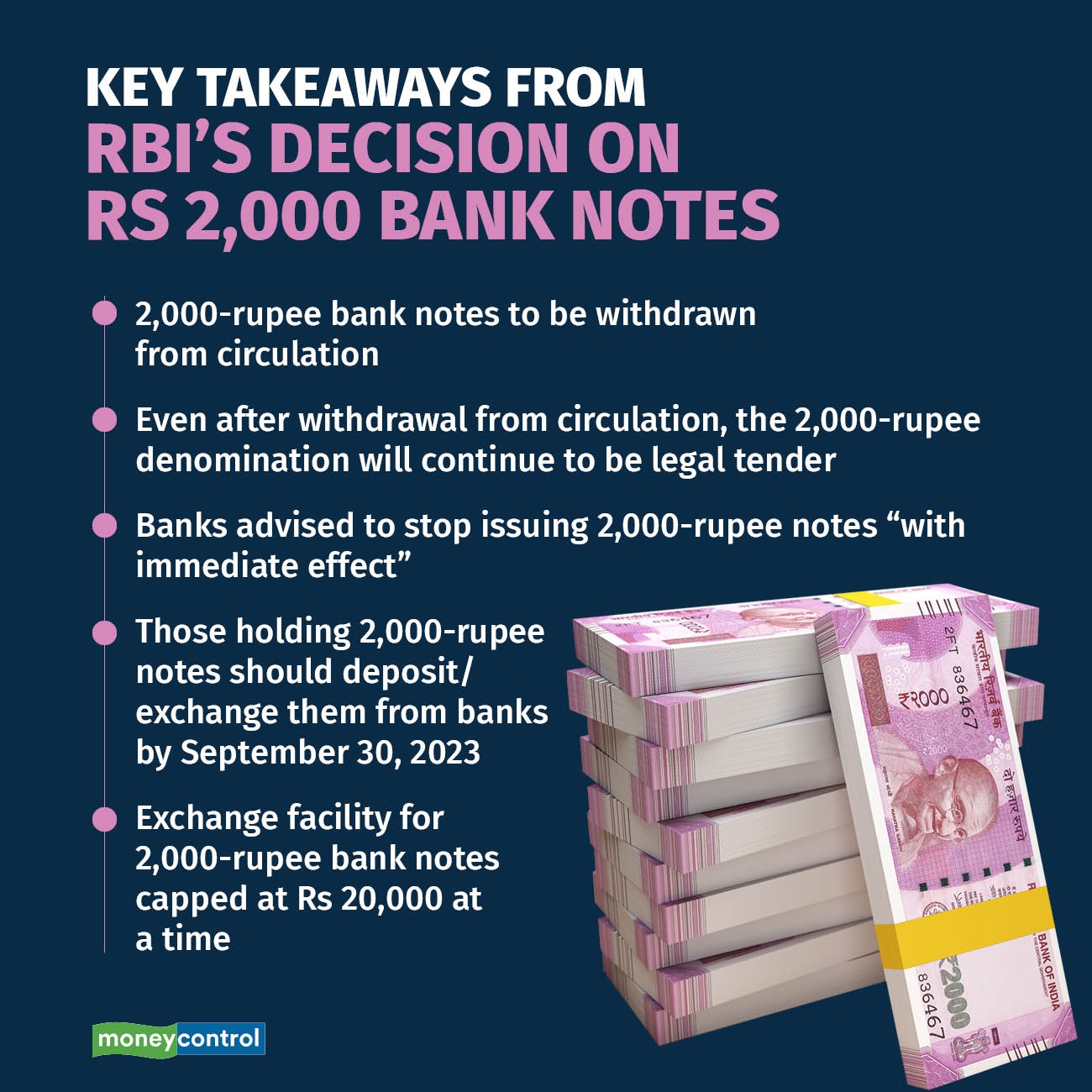

On May 19, 2023, the Reserve Bank of India (RBI) announced the withdrawal of ₹2000 currency notes from circulation as part of its Clean Note Policy. Unlike the previous note ban, the government has allowed ample time for the public to deposit these notes with banks. This article highlights the reasons for the withdrawal, the process of exchanging or depositing ₹2000 notes, the exchange limit, the impact on the economy, and provides an overview of demonetization and legal tender in India.

Reasons for the Withdrawal of ₹2000 Notes:

- Introduction during demonetization: The ₹2000 note was introduced in November 2016 as part of demonetization to replace the withdrawn ₹500 and ₹1000 notes. Demonetization aimed to tackle issues such as black money, corruption, tax evasion, and promote digital transactions.

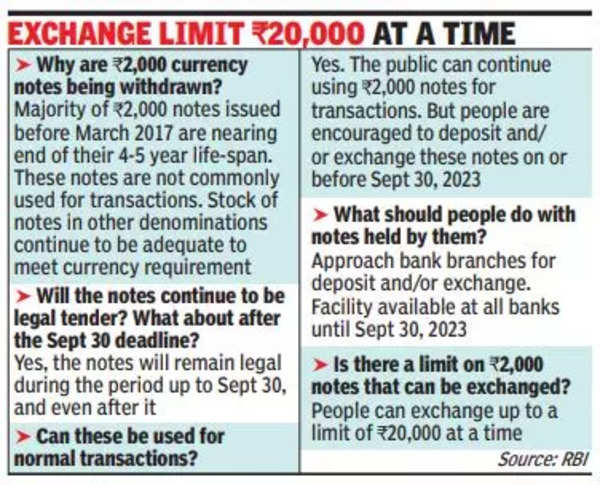

- Achieving sufficient money circulation: Once the objective of ensuring adequate money circulation in the economy was achieved, the printing of ₹2000 notes was stopped in 2018-19.

- Decreased transactions and digitization: The recent surge in digitization and reduced usage of high-value currency notes contributed to the decision to withdraw ₹2000 notes.

- Lifespan of notes: The majority of ₹2000 notes in circulation were issued prior to March 2017 and have reached their estimated lifespan of 4-5 years. As per the Clean Note Policy, the RBI aims to maintain good quality currency notes.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

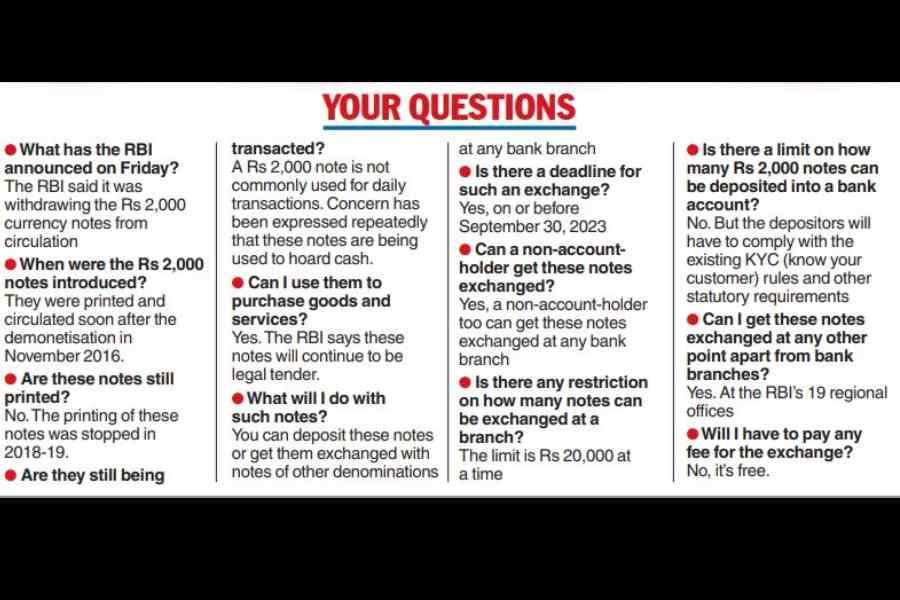

Process of Exchanging ₹2000 Notes:

- Deadline and legal tender status: The deadline to deposit ₹2000 notes in banks is September 30, 2023. However, even after the deadline, these notes will remain legal tender.

- Depositing and exchanging: Individuals can approach any bank, regardless of whether they hold an account there, to deposit or exchange ₹2000 notes.

- Compliance and encashment: Deposits can be made in the usual manner, subject to compliance with Know Your Customer (KYC) norms and other statutory requirements. The encashment of deposited ₹2000 notes can be done later.

- RBI Regional Offices: Currency exchange facilities are available at the 19 RBI Regional Offices with Issue Departments.

₹2000 Note Exchange Limit:

- Exchange limit: The exchange of ₹2000 notes into other denomination banknotes can be made up to a limit of ₹20,000/- at a time at any bank. This service is free of cost.

- No limit for deposits: There is no limit for depositing ₹2000 notes into bank accounts, subject to compliance with KYC and other regulatory requirements.

Impact and Rationale:

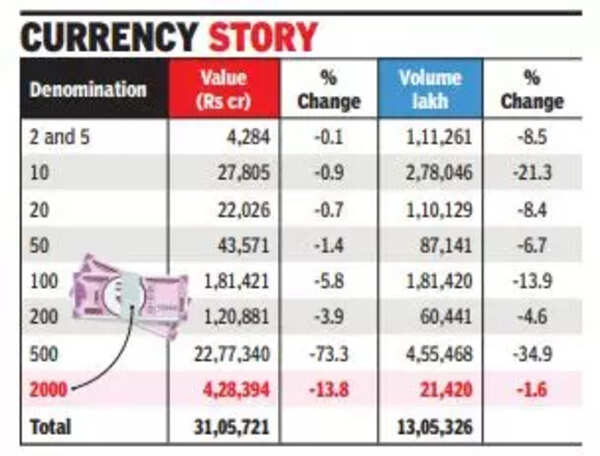

- Marginal impact on the economy: The withdrawal of ₹2000 notes will have a minimal impact as they constitute only 10.8% of the total currency in circulation.

- Adequate availability of other denominations: The economy has a sufficient supply of banknotes in other denominations, ensuring no disruption in normal life or the economy.

- Boosting bank deposits: The withdrawal may lead to increased bank deposits, positively affecting credit growth and potentially moderating short-term interest rates.

- Curbing black money and corruption: The withdrawal aligns with efforts to curb black money and corruption by promoting transparency and formalizing the economy.

RBI’s Clean Note Policy:

The Clean Note Policy focuses on providing the public with currency notes and coins that have enhanced security features while gradually phasing out old or soiled notes. It ensures that older banknotes, issued before 2005, are withdrawn from circulation to align with international practices.

Demonetization in India:

- Definition and legal basis: Demonetization refers to the act of stripping a currency unit of its status as legal tender. In India, demonetization is governed by Section 26(2) of the RBI Act, 1934, empowering the government to declare banknotes as ceasing to be legal tender.

- Advantages: Demonetization aims to stabilize currency, fight inflation, curb counterfeiting, promote digitization, formalize the economy, increase tax revenues, and reduce corruption and crime.

- Disadvantages: The process can temporarily slow down economic activity, involve administrative costs, and impact cash-driven sectors.

Legal Tender in India:

- Definition and types: Legal tender refers to currency recognized by law as an acceptable means of settling debts or obligations. Coins with denominations equal to or higher than one rupee and banknotes are considered legal tender in India.

- Limits and regulations: Certain limits, such as the amount of cash transactions, may be imposed to curb black money. The government issues coins, including the ₹1 coin, while the RBI issues all other currency notes.

Find More News on Economy Here

What is the Strait of Hormuz? Know About...

What is the Strait of Hormuz? Know About...

Which Country is the Largest Consumer of...

Which Country is the Largest Consumer of...

Amol Palekar to Receive META Lifetime Ac...

Amol Palekar to Receive META Lifetime Ac...