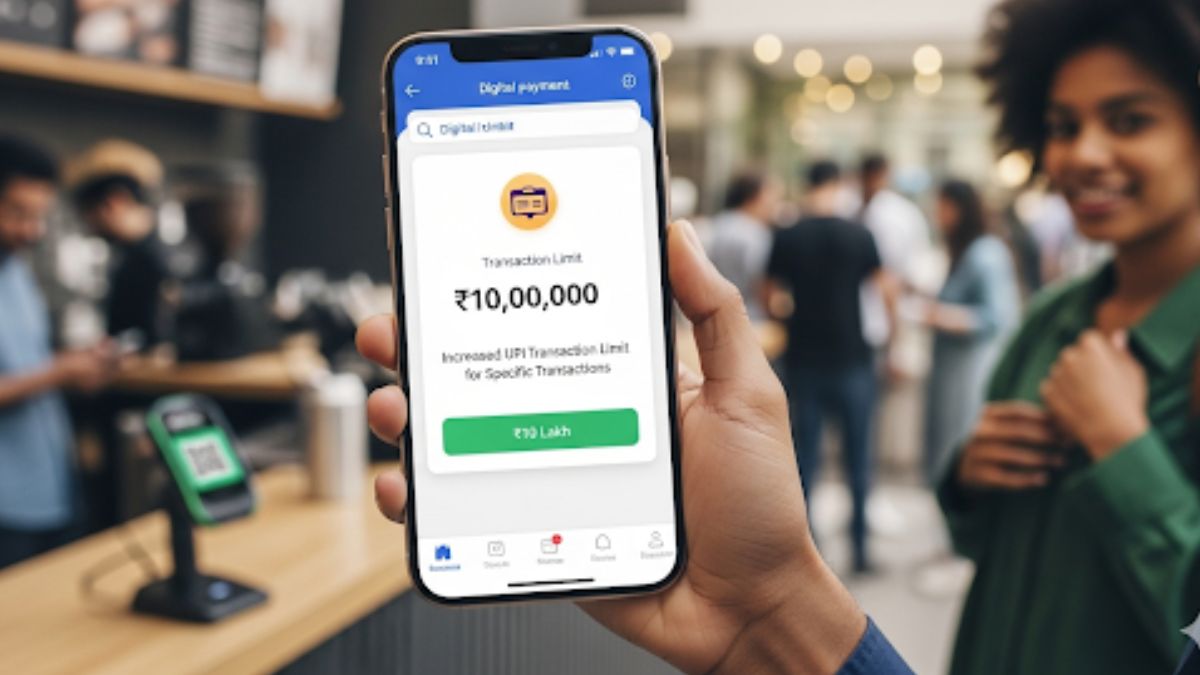

Starting September 15, 2025, the National Payments Corporation of India (NPCI) will implement revised UPI transaction limits for specific high-value payment categories. The per-transaction limit has been increased to ₹5 lakh, and the 24-hour aggregate limit raised to ₹10 lakh for several services, including insurance, capital markets, government tax payments, and credit card payments—a significant step in expanding UPI’s role in India’s digital financial ecosystem.

Key Highlights of the New UPI Transaction Limits

NPCI’s new directive mandates increased UPI limits for Person to Merchant (P2M) transactions made to verified merchants. The limits are effective from September 15, 2025, and aim to facilitate seamless high-value digital transactions.

Revised UPI Limits (Effective Sept 15, 2025)

| Category | Old Per-Transaction Limit | New Per-Transaction Limit | 24-Hour Cumulative Limit |

| Capital Markets (Investments) | ₹2 lakh | ₹5 lakh | ₹10 lakh |

| Insurance Payments | ₹2 lakh | ₹5 lakh | ₹10 lakh |

| Govt. e-Marketplace (EMD/Tax) | ₹1 lakh | ₹5 lakh | ₹10 lakh |

| Credit Card Payments | ₹2 lakh | ₹5 lakh | ₹6 lakh |

| Loan/EMI Collections | ₹2 lakh | ₹5 lakh | ₹10 lakh |

| Travel Bookings | ₹1 lakh | ₹5 lakh | ₹10 lakh |

| Jewellery Purchases | ₹1 lakh | ₹2 lakh | ₹6 lakh |

| FX Retail via BBPS | ₹2 lakh | ₹5 lakh | ₹5 lakh |

| Term Deposits via Digital Accounts | ₹2 lakh | ₹5 lakh | ₹5 lakh |

| Digital Account Opening (Funding) | ₹1 lakh | ₹2 lakh | ₹2 lakh |

Who Will Benefit?

This expansion in UPI limits primarily benefits,

- Investors transacting in mutual funds, stocks, and AMCs

- Policyholders making high-value insurance premium payments

- Taxpayers making EMD or GST payments on Govt. e-Marketplace (MCC 9311)

- Cardholders settling large credit card bills

- Loan borrowers and businesses handling bulk EMI or collection payments

- Frequent travelers booking high-value trips

- Jewellery buyers seeking cashless transactions

- Forex users and digital account openers needing smooth onboarding and funding

Scope and Limitations

- Applies only to P2M (Person to Merchant) transactions via verified merchants

- P2P (Person to Person) UPI limit remains unchanged at ₹1 lakh/day

- Banks and PSPs must implement the new limits by Sept 15, 2025

- Member banks may set internal limits lower than NPCI’s maximum, depending on their risk policies

Key Takeaways for Exam

Unified Payments Interface (UPI).

- Developed by: National Payments Corporation of India (NPCI).

- Launched: 2016.

- Purpose: Enables instant money transfers between two bank accounts via mobile.

- Key feature: Uses Virtual Payment Address (VPA) for transfers, avoiding sharing sensitive bank details.

PhonePe Launches AI-Powered Natural Lang...

PhonePe Launches AI-Powered Natural Lang...

ICICI’s New Swasthya Pension Scheme: A S...

ICICI’s New Swasthya Pension Scheme: A S...

RBI’s New Rulebook: UTI Required for All...

RBI’s New Rulebook: UTI Required for All...