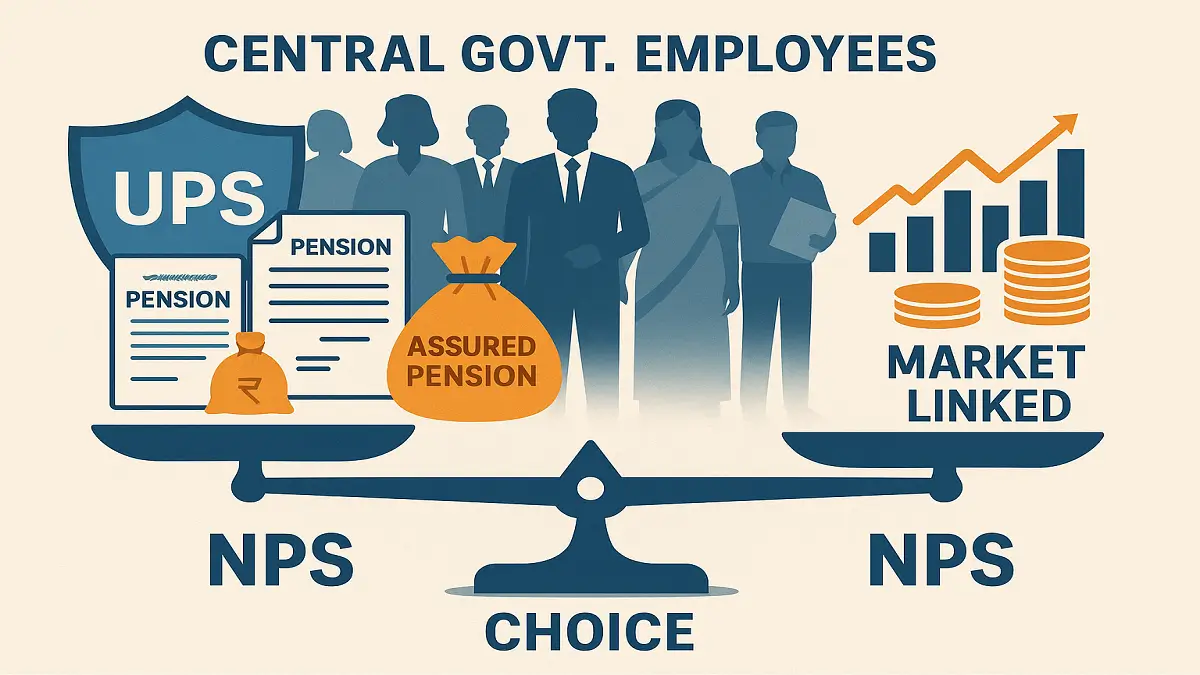

The Government of India has introduced the Unified Pension Scheme (UPS), effective from April 1, 2025, as an alternative to the National Pension System (NPS) for central government employees. With the deadline of September 30, 2025, employees must decide whether to remain under the market-linked NPS or opt for the new UPS. Those who do not switch before the deadline will remain in NPS by default and will lose the chance to opt for UPS later.

Key Deadlines and Eligibility

- Last Date to Switch: September 30, 2025 (extended from June 30).

- Who Can Switch? Central government employees appointed on or after January 1, 2004 (under NPS).

- Not Eligible: Employees already under CCS (Pension) Rules, 2021, railway staff, casual/daily-rated employees, contingency staff, All India Services, contract workers, etc.

- New Joinees: Employees joining on or after April 1, 2025, can opt for UPS within 30 days of joining.

What Is UPS?

The Unified Pension Scheme (UPS) is designed to offer assured pension benefits with greater financial security compared to NPS.

Key Features of UPS:

- Guaranteed Minimum Payout: Unlike NPS, returns are not fully market-linked.

- Gratuity Benefits: Provides gratuity in addition to pension.

- Low Risk: Offers more stability and protection against market volatility.

- Employee + Employer Contributions: Fund-based contributions similar to NPS, but with assured benefits.

What Is NPS?

The National Pension System (NPS), introduced in 2004, is a market-linked retirement plan. Returns depend on market performance, which means potential for higher gains but also exposure to risks.

Key Features of NPS:

- Market-Linked Growth: Pension corpus grows based on investment returns.

- Partial Withdrawal Facility: For specific purposes like education or medical needs.

- No Guaranteed Pension: Final pension depends on accumulated corpus and annuity rates.

Guidelines for Switching from UPS to NPS

According to the Finance Ministry:

- UPS employees can switch to NPS only once and cannot revert back.

- The switch must happen at least 1 year before retirement or 3 months before voluntary retirement.

- Employees facing dismissal, disciplinary action, or involuntary retirement cannot switch.

- If no decision is taken in time, employees will continue in UPS by default.

UPS Vs NPS: Key Differences

| Feature | UPS (Unified Pension Scheme) | NPS (National Pension System) |

|---|---|---|

| Nature | Assured pension with guaranteed minimum payout | Market-linked, no guaranteed pension |

| Risk | Low risk, stable returns | Higher risk, market-dependent |

| Gratuity | Available | Not available |

| Flexibility | Limited switching (only once to NPS) | No option to move to UPS after deadline |

| Security | Greater financial security | Higher growth potential but uncertain |

V.O. Chidambaranar Port Authority Secure...

V.O. Chidambaranar Port Authority Secure...

Reliance Industries Limited Secures U.S....

Reliance Industries Limited Secures U.S....

Adani Power Forms Nuclear-Focused Subsid...

Adani Power Forms Nuclear-Focused Subsid...