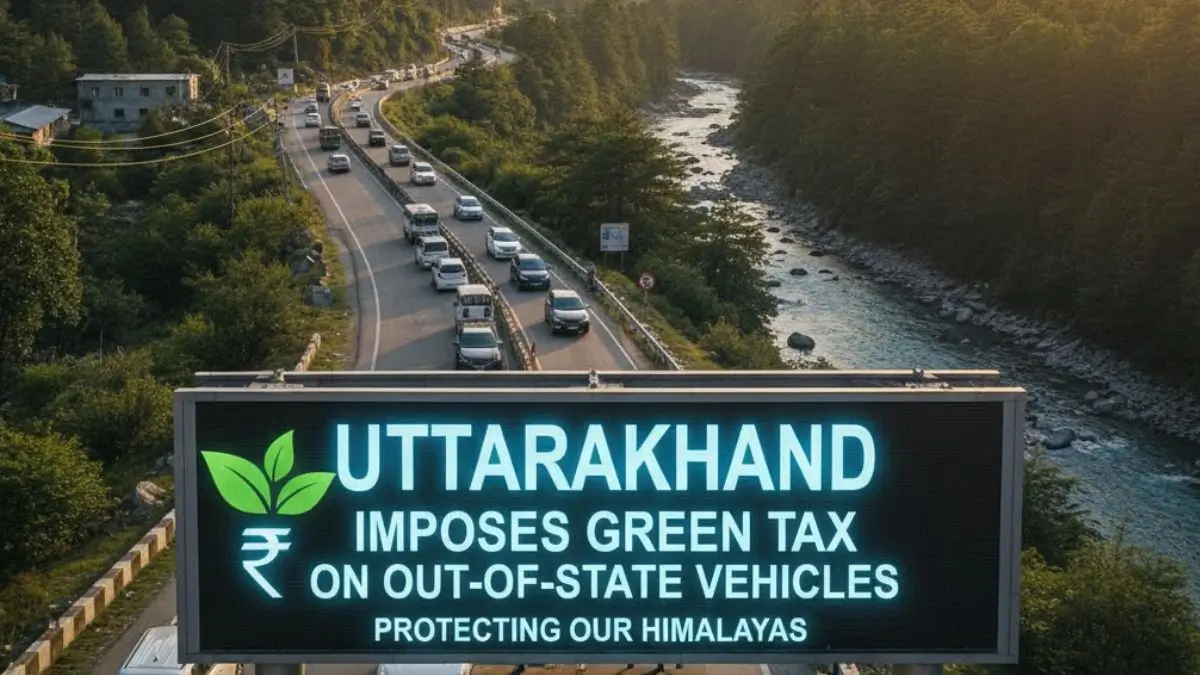

Starting December 2025, the Uttarakhand government will implement a green tax on all vehicles entering the state from outside, marking a major step towards environmental conservation and pollution control. This move aims to protect the fragile Himalayan ecosystem and reduce vehicular emissions in popular hill destinations such as Dehradun, Mussoorie, Nainital, and Rishikesh. The tax will be collected through a fully automated digital system, making Uttarakhand one of the first states to implement such a technology-driven green levy model.

Green Tax Mechanism and Rates

The green tax will vary by vehicle category, with the following rates,

- ₹80 for small private vehicles

- ₹250 for small cargo vehicles

- ₹140 for buses

- ₹120 to ₹700 for trucks (depending on their weight)

The collection process will be fully automated using Automatic Number Plate Recognition (ANPR) cameras, which are being installed at 37 state entry points. Here’s how the process will work:

- ANPR cameras capture the vehicle registration number at the border.

- This data is transmitted to a vendor system authorized by the state transport department.

- The system cross-verifies the number with the NPCI (National Payments Corporation of India) database to find the owner’s wallet.

- The green tax is auto-deducted and credited to the transport department’s account.

- This system eliminates manual toll booths, ensures real-time tax collection, and reduces the scope for leakages or evasion.

Environmental and Policy Objectives

The core objectives behind the green tax are,

- Discourage unnecessary vehicular entry into eco-sensitive zones

- Reduce emissions and improve air quality

- Generate revenue for environmental protection projects

- The initiative aligns with the Clean Uttarakhand Mission, focusing on sustainable tourism and air pollution control across Uttarakhand’s hill stations and pilgrimage centres.

The state aims to balance rising tourism with long-term ecological health, making this tax both a regulatory and environmental measure.

Green Tax Models Across India

Uttarakhand joins a list of Indian states with active green tax policies,

- Himachal Pradesh: Taxes vehicles entering from other states; exempts local vehicles in cities like Shimla.

Maharashtra, Karnataka, Telangana, AP, MP, Rajasthan, Jharkhand: Impose recurring green taxes on older vehicles — typically,

- Private vehicles over 15 years old

- Commercial vehicles over 8 years old

- These states use the revenue to fund pollution control measures, urban air quality programmes, and transport modernization.

National Significance and Future Implications

Uttarakhand’s adoption of an automated green tax system represents a national shift toward,

- Digital governance in transport regulation

- Eco-sensitive transport policy

- Sustainable tourism management

As vehicular emissions remain a leading cause of urban and hill-region pollution, this model of real-time surveillance and direct payment deduction could become a template for other hilly or ecologically sensitive states in India.

Andhra Pradesh Bags India’s Largest ₹8,1...

Andhra Pradesh Bags India’s Largest ₹8,1...

Assam Cabinet Grants 3% Job Quota to Tea...

Assam Cabinet Grants 3% Job Quota to Tea...

Gujarat Paves the Way for Women’s Workfo...

Gujarat Paves the Way for Women’s Workfo...