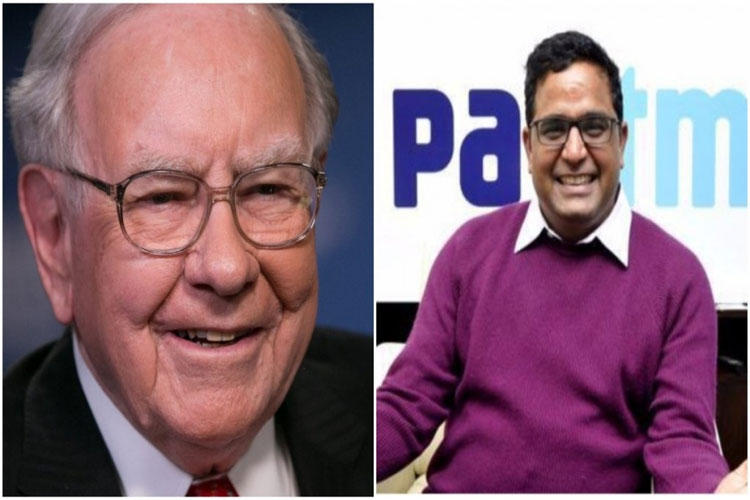

Warren Buffett-led Berkshire Hathaway has made headlines by completely divesting its 2.46% stake in One 97 Communications, the parent company of Paytm. The move resulted in a significant loss of about Rs 507 crore for the legendary investor.

Transaction Details:

- Berkshire Hathaway’s entire stake was sold at an average price of Rs 877.2 per share.

- The shares were acquired by Ghisallo Master Fund and Copthall Mauritius Investment, with the former purchasing 42,75,000 shares and the latter acquiring 75,75,529 shares.

- Berkshire Hathaway garnered nearly Rs 1,371 crore from the transaction.

Market Impact:

- Prior to the sale, shares of Paytm experienced a decline of 3.23 percent, reaching Rs 893.

Background and Loss Analysis:

- As of September-end, Berkshire held 1,56,23,529 shares in Paytm through BH International, representing a 2.46 percent stake. The average cost of acquisition for BH International, as per the IPO prospectus, was Rs 1,279.7 per share.

- BH International had initially invested Rs 2,179 crore in Paytm in September 2018.

- The IPO saw BH International selling shares worth Rs 301.70 crore at Rs 2,150 per share.

- Including the recent transaction where shares worth Rs 1,371 crore were sold, Berkshire’s total earnings from its Paytm investment amounted to Rs 1,672.7 crore, resulting in a loss of approximately Rs 507 crore.

Market Trends:

- Key pre-IPO investors, including SoftBank, have been gradually offloading their Paytm investments as the stock shows signs of recovery.

Important Questions Related to Exams

Q: Why did Warren Buffett’s Berkshire Hathaway exit Paytm, and what was the financial outcome?

A: Berkshire Hathaway exited Paytm by selling its entire 2.46% stake at an average price of Rs 877.2 per share. The transaction, resulting in a Rs 507 crore loss, saw Ghisallo Master Fund and Copthall Mauritius Investment acquiring the shares.

Q: What prompted the exit, and how does it align with broader market trends?

A: Berkshire Hathaway’s exit follows a trend of key pre-IPO investors, including SoftBank, adjusting their positions as Paytm’s stock shows signs of recovery. The move reflects evolving investor sentiments and ongoing portfolio recalibrations in the financial market.

Q: What was the initial investment and the overall financial impact on Berkshire Hathaway?

A: BH International’s (Berkshire Hathaway) average cost of acquiring Paytm shares was Rs 1,279.7 per share. Despite initially selling shares during the IPO and the recent transaction earning nearly Rs 1,371 crore, Berkshire incurred a total loss of about Rs 507 crore from its Paytm investment.

Q: How did the market respond to the exit, and what does it indicate for Paytm’s future?

A: Prior to the exit, Paytm’s shares experienced a 3.23% decline, reaching Rs 893. The market response underscores the dynamic nature of investor sentiments, reflecting both challenges and opportunities for Paytm as it navigates its path to recovery.

Airbus and Tata to Debut India’s First...

Airbus and Tata to Debut India’s First...

RBI Forms Panel to Review Fee Structure ...

RBI Forms Panel to Review Fee Structure ...

NFDC and Netflix India Collaborate to Tr...

NFDC and Netflix India Collaborate to Tr...