What Are Tariffs?

A tariff is a tax that a government imposes on goods and services imported from other countries. When these products cross international borders, the business importing them is required to pay this tax to the government of the importing country.

Tariffs are generally applied as a percentage of the total value of the imported goods. This form of tariff is called an ad valorem tariff. Alternatively, tariffs may also be charged as a fixed amount per unit of the product.

Why Do Countries Impose Tariffs?

Governments use tariffs for several strategic and economic reasons. The main purposes include:

1. Protecting Domestic Industries

Tariffs make imported goods more expensive compared to locally produced items. This pricing difference encourages consumers to purchase domestic products, providing protection to local manufacturers from foreign competition.

2. Generating Government Revenue

In countries with limited taxation infrastructure, tariffs are an important source of government income. Every imported item contributes to the national budget through these taxes.

3. Addressing Trade Imbalances

Tariffs can help manage a trade deficit by making imports less attractive and thereby encouraging the consumption of domestically made goods. This may lead to increased local production and can promote exports.

4. Strategic or Political Goals

Sometimes, tariffs are used as tools in trade negotiations or to respond to unfair trade practices. For example, countries may impose tariffs as a form of retaliation or to pressure another country into changing a policy.

Types of Tariffs

There are three primary types of tariffs, each differing in the way the tax is calculated:

1. Ad Valorem Tariffs

These are calculated as a fixed percentage of the product’s value. For example, a 10 percent tariff on a product worth one thousand rupees means the importer must pay one hundred rupees in tax.

2. Specific Tariffs

These involve a fixed amount charged per unit of the imported good, regardless of its value. For instance, a tariff of fifty rupees per kilogram of imported rice.

3. Compound Tariffs

These combine both ad valorem and specific tariffs. For example, a product may be taxed at five percent of its value plus a fixed charge of twenty rupees per unit.

Who Ultimately Pays for Tariffs?

Although importers are responsible for paying the tariff to the government, the actual cost often trickles down to other parts of the supply chain. Here’s how the burden is typically distributed:

- Consumers: Most often, the cost of the tariff is added to the price of the product. As a result, consumers end up paying more for imported goods.

- Businesses: Some companies may absorb part of the tariff to remain competitive, which can reduce their profit margins.

- Exporters: In order to stay competitive in a foreign market, some foreign suppliers may lower their prices, indirectly bearing part of the tariff cost.

- Domestic Industry: In the long term, local producers may benefit from reduced foreign competition, potentially gaining more market share.

Additionally, businesses in the importing country may shift production locally to avoid tariffs altogether or seek exemptions if alternative suppliers are unavailable.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

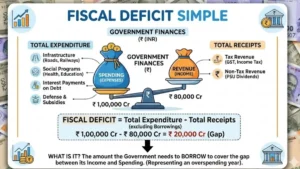

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...