Staying updated with the latest current affairs 2026- daily, weekly, and monthly is essential for every competitive exam aspirant. Adda247 offers reliable and easy-to-read current affairs coverage, including Today’s Current Affairs and a comprehensive 2026 compilation.

Whether you’re preparing for Bank, SSC, Railway, or Insurance exams, Adda247 keeps you ahead with the latest national and international updates. Access Daily current affairs weekly highlights, and monthly PDF capsules to strengthen your general awareness and improve your exam scores.

By consistently following Current Affairs 2026, aspirants can strengthen their exam preparedness, enhance accuracy in the general knowledge section, and stay ahead with reliable, exam-oriented updates tailored for government exam preparation.

Today’s Latest Current Affairs

- Weekly One Liners 19th to 25th of January 2026January 25, 2026Weekly Current Affairs One-Liners Current Affairs 2026 plays a very important role in competitive examinations and hence, aspirants ...

- Indian Constitution: Borrowed Features from Constitutions Around the WorldJanuary 24, 2026The Constitution of India is one of the most detailed and thoughtfully written constitutions in the world. ...

- Where the First Republic Day Parade Was Actually Held?January 24, 2026Every year on 26 January, India celebrates Republic Day with a grand parade in New Delhi. Today, ...

- The Indian Constitution: 5 Terms in the Preamble You Should KnowJanuary 24, 2026The Preamble of the Indian Constitution is like the heart of the Constitution. It explains the basic ...

- The 21-Gun Salute: Why It Does Not Use 21 Guns?January 24, 2026The 21-gun salute is one of the highest military honors in the world. It is performed to ...

- AIFF Expresses Condolences on the Death of Former Indian Defender Ilyas PashaJanuary 24, 2026Former India and East Bengal football star Ilyas Pasha passed away on January 22, 2026, after a ...

- RXIL Makes History By Becoming India’s First TReDS Platform to Announce Interim DividendJanuary 24, 2026Receivables Exchange of India Ltd (RXIL), India’s first Trade Receivables Discounting System (TReDS) platform, has announced an ...

- Republic Day 2026: Check Date, Theme, Chief Guests and SignificanceJanuary 24, 2026India celebrates Republic Day every year on 26 January. This day is special because it marks when ...

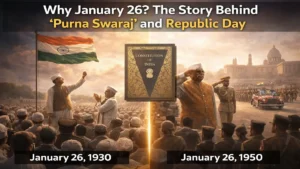

- Why January 26? The Story Behind “Purna Swaraj” and Republic DayJanuary 24, 2026India celebrates Republic Day on January 26 every year to mark the day the Constitution of India ...

- 77th Republic Day Parade 2026: Key Firsts, Military Power and Cultural HighlightsJanuary 24, 2026The 77th Republic Day Parade on January 26, 2026, stood out as one of the most dynamic ...

General Studies

- Indian Constitution: Borrowed Features from Constitutions Around the World January 24, 2026

- Where the First Republic Day Parade Was Actually Held? January 24, 2026

- The Indian Constitution: 5 Terms in the Preamble You Should Know January 24, 2026

- The 21-Gun Salute: Why It Does Not Use 21 Guns? January 24, 2026

- Which City is known as the Gold Capital of India? January 22, 2026

- Which is the Safest City in the World in 2026? Check the List of Top-10 January 22, 2026

Important Days 2026

- Republic Day 2026: Check Date, Theme, Chief Guests and Significance January 24, 2026

- National Tourism Day 2026 – Date, History, Significance and Celebration January 24, 2026

- National Voters Day 2026: Meaning, Date, History and Significance January 24, 2026

- International Day of Education:- Know Date, History and Significance January 24, 2026

- National Girl Child Day 2026: Theme, History, Significance & Inspirational Quotes January 24, 2026

- Bharat Rang Mahotsav 2026: India’s Largest International Theatre Festival Across 40 Locations January 23, 2026

Latest Current Affairs 2026

Staying updated with the Latest Current Affairs 2026 from adda247 current affairs can significantly enhance your general awareness and give you a competitive edge in exams like IBPS PO, SBI PO & Clerk, UPSC IAS, SSC CGL & CHSL, RRB NTPC, Group D, and many others. Since Current Affairs 2026 form a crucial part of the General Awareness syllabus, thorough preparation is essential for success. With Adda247’s structured resources, your exam journey becomes more efficient, result-oriented, and confidence-driven.

For government exam aspirants, keeping up with Daily News Current Affairs Today is vital, as it directly impacts performance in highly competitive tests. The Current Affairs section evaluates candidates’ awareness of ongoing developments, making it a key element of the preparation strategy. Staying informed not only boosts your chances of securing a government job but also builds a strong foundation for long-term career growth.

Access Daily Current Affairs Updates for Exam Success

To access Daily Current Affairs Updates, candidates can visit the Current Affairs Adda website and explore dedicated sections for Daily, Weekly, and Monthly Current Affairs 2026. This ensures effective preparation strategies that help aspirants excel in Banking, SSC, Railways, UPSC, and Insurance exams.

With exams witnessing intense competition every year, the General Awareness (GA) section becomes decisive, especially in assessing knowledge of the Latest Current Affairs 2026. Regular updates, consistent revision, and focused practice on recent events can greatly improve your performance, ensuring better exam readiness and overall success.