Bank of Maharashtra (BoM) has emerged as the top performer among state-owned lenders in terms of loan growth percentage during the third quarter of 2022-23, an analysis of the latest financial results of public sector banks showed. The Pune-based lender recorded a 21.67 per cent increase in gross advances on a year-on-year basis, according to the latest quarterly numbers of the public sector bank (PSB).

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Credit Growth In PSBs:

The bank has maintained the top slot in credit growth in percentage terms consistently for the past 10 quarters despite COVID-19 pressures. BoM was followed by the Union Bank of India with 19.80 per cent growth. Country’s largest lender State Bank of India (SBI) stood at fourth spot with 16.91 per cent rise in advances growth. However, SBI’s total loans were about 17 times higher at Rs 26,47,205 crore as compared to Rs 1,56,962 crore of BoM in absolute terms.

About Retail-Agriculture-MSME (RAM) loans:

In terms of Retail-Agriculture-MSME (RAM) loans, BoM has recorded the highest growth of 19.18 per cent, followed by Punjab & Sind Bank with 19.07 per cent and Bank of Baroda with 18.85 per cent on an annual basis.

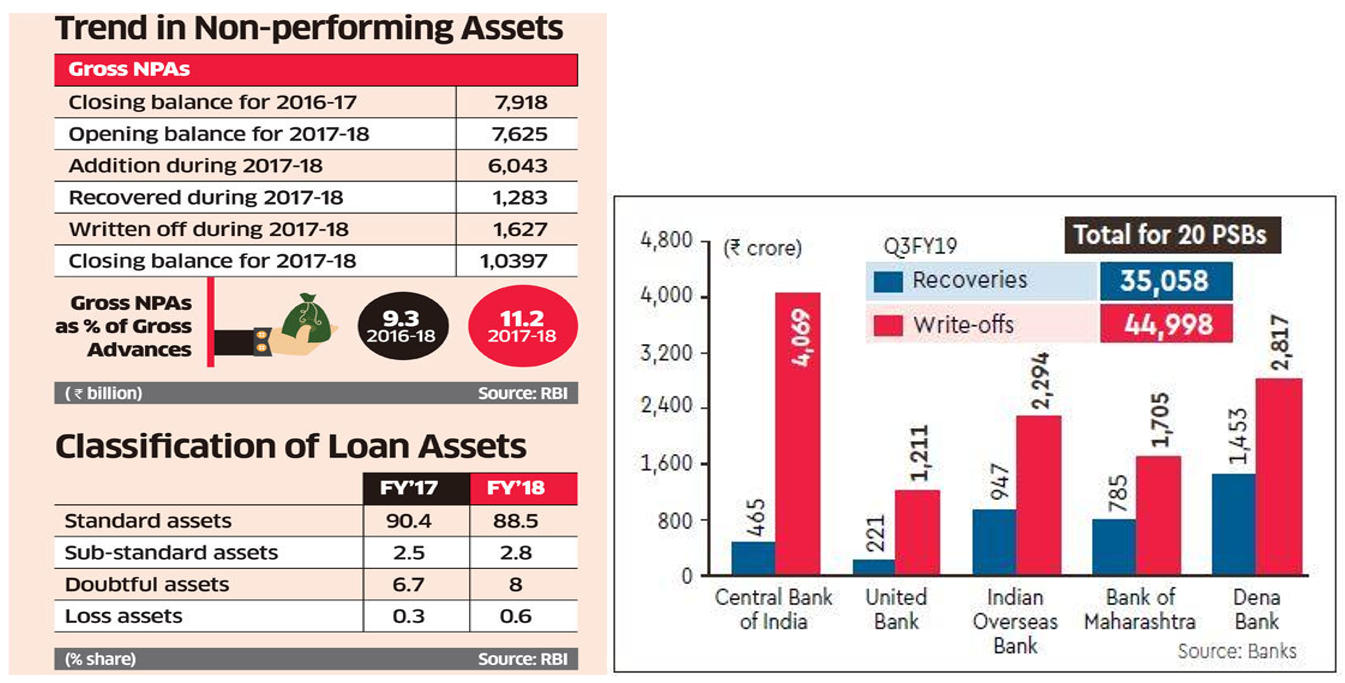

About Non-performing assets (NPAs):

BoM and SBI were in the lowest quartile as far as gross non-performing assets (NPAs) and net NPAs were concerned, according to the quarterly financial numbers published by the public sector lenders.

Gross NPAs reported by BoM and SBI were 2.94 per cent and 3.14 per cent of their total advances, respectively, as on December 31, 2022. Net NPAs for these two banks came down to 0.47 per cent and 0.77 per cent, respectively.

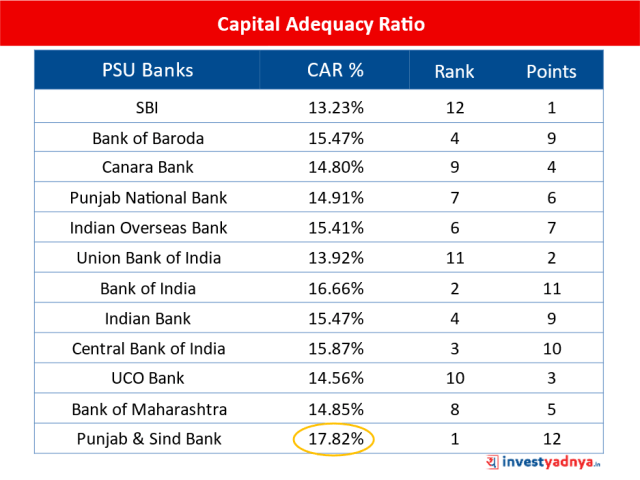

About Capital Adequacy Ratio:

With regard to Capital Adequacy Ratio, BoM recorded 17.53 per cent, the highest among PSBs, followed by Canara Bank at 16.72 per cent and Indian Bank at 15.74 per cent as on December 31, 2022.

About Deposit Growth:

As far as deposit growth was concerned, Bank of Baroda earned the top slot with 14.50 per cent growth followed by Union Bank of India with 13.48 per cent rise on annual basis. BoM stood third in terms of total deposit growth among the PSBs during the third quarter, according to the data.

In terms of total business growth, Union Bank of India recorded the highest growth of 16.07 per cent during the third quarter. It was followed by BoM with 15.77 per cent rise on an annual basis and Bank of Baroda clinched third position with 15.23 per cent.

Profits of Public Sector Banks(PSBs):

PSBs have logged a robust profit growth of 65 per cent at Rs 29,175 crore during the third quarter ended December 2022, with Bank of Maharashtra (BoM) emerging as the top performer in terms of percentage growth in profit.

It recorded a 139 per cent jump in profit at Rs 775 crore at the end of December 2022, according to quarterly results declared by the lender.

BoM was followed by Kolkata-based UCO Bank which posted a profit of Rs 653 crore, 110 per cent higher than its earnings in the third quarter of the previous fiscal.

You may also read: RBI Cancels Registration of Two Entities for Regulatory Lapses

Indian Olympic Medal Winners List Till N...

Indian Olympic Medal Winners List Till N...

Who is the Inventor of the Gramophone?

Who is the Inventor of the Gramophone?

HS Dhaliwal Appointed New DGP Of Andaman...

HS Dhaliwal Appointed New DGP Of Andaman...