In the fiscal year ending March 2023, Indian banks wrote off bad loans amounting to Rs 2.09 lakh crore, bringing the total loan write-off by the banking sector to Rs 10.57 lakh crore in the past five years. The Reserve Bank of India (RBI) disclosed this information in response to a Right to Information (RTI) query.

These massive loan write-offs contributed to a significant reduction in gross non-performing assets (GNPA) for banks, which declined to a 10-year low of 3.9% of advances by March 2023. However, it is essential to note that the loans written off by banks will still be recorded as unrecovered loans on their books. The recovery rate for these write-offs during the last three years was quite low, with banks managing to recover only 18.60% of the written-off amount.

Loan Write-offs Reduce Gross Non-Performing Assets (GNPA) to a 10-year Low

-

- Banks wrote off bad loans worth Rs 2.09 lakh crore in the fiscal year ending March 2023.

- Total loan write-off by the banking sector reached Rs 10.57 lakh crore in the last five years.

- Gross non-performing assets (GNPA) decreased to 3.9% of advances in March 2023.

- GNPA had fallen from Rs 10.21 lakh crore in FY2018 to Rs 5.55 lakh crore by March 2023, largely due to loan write-offs.

Abysmal Recovery Rate Despite Loan Write-offs

-

- Banks recovered only Rs 109,186 crore from Rs 586,891 crore loans written off in the last three years (18.60% recovery rate).

- The total defaulted loans (including write-offs but excluding recovered loans) amount to Rs 10.32 lakh crore.

- If including write-offs, the total NPA ratio would have been 7.47% of advances instead of the reported 3.9%.

Trends in Loan Write-offs

-

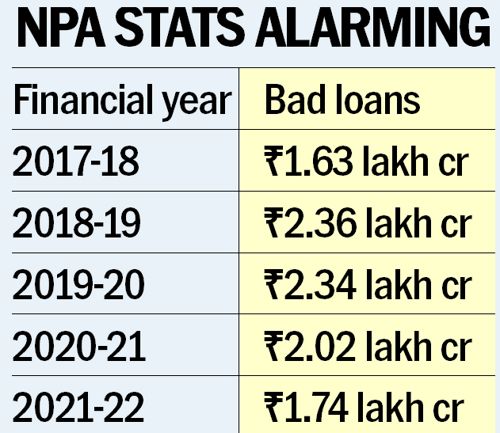

- Loan write-offs by banks increased to Rs 209,144 crore in FY2023, compared to Rs 174,966 crore in FY2022 and Rs 202,781 crore in FY2021.

- Banks write off defaulted loans to reduce non-performing assets (NPAs) in their books.

Borrower Identity Kept Confidential

-

- Banks and the RBI have never disclosed the identities of borrowers whose loans were written off.

Loan Write-offs by Individual Banks

-

- In FY2023, State Bank of India reduced NPAs due to write-offs by Rs 24,061 crore, Punjab National Bank by Rs 16,578 crore, Union Bank by Rs 19,175 crore, Central Bank of India by Rs 10,258 crore, and Bank of Baroda by Rs 17,998 crore.

RBI’s Guidance on Loan Write-offs

-

- RBI provides guidance on write-offs and advises banks to take credit-related decisions based on their commercial assessment of loan viability, adhering to board-approved policies and prudential norms.

- Policies on loan recoveries lay down the manner of recovery of dues, norms for permitted waivers, decision levels, reporting to higher authorities, and monitoring of write-off and waiver cases.

Future GNPA Scenarios

-

- According to RBI’s Financial Stability Report for June 2023, in a medium or severe stress scenario, the GNPA ratio may rise to 4.1% and 5.1%, respectively.

What is a Loan Write-Off?

A loan write-off refers to the process by which a bank removes a defaulted loan from its balance sheet, considering it as a loss. When a borrower fails to make repayments for an extended period, typically 90 days, the loan becomes a non-performing asset (NPA). To clean up their balance sheets and manage their NPAs, banks write off such loans, effectively declaring them as unrecoverable.

Purpose of Loan Write-Offs

The primary objective of loan write-offs is to address the issue of rising NPAs and improve the overall financial health of the bank. By removing defaulted loans from their assets, banks can present a more favorable financial picture to stakeholders and investors. Additionally, writing off loans helps banks reduce their tax liability, as they can claim the written-off amount as a loss during tax calculations.

Recovery Efforts After Write-Off

Even after a loan is written off, banks do not give up on recovery efforts. They continue to pursue various options to recover the defaulted amount from the borrower. While the written-off loan is no longer considered an asset, the bank aims to reclaim the money through legal actions, asset seizure, or negotiations with the borrower.

Impact on Bank’s Balance Sheet

Writing off NPAs helps banks improve their balance sheets by reducing the burden of bad loans. By removing these distressed assets, the bank’s financial position appears healthier, making it more attractive to investors and creditors. However, it is essential to note that loan write-offs do not mean the bank has abandoned the pursuit of recovering the defaulted amount.

Provisions and Write-Offs

Before writing off a loan, banks set aside provisions as a precautionary measure to cover potential losses on their balance sheets. Provisions act as a buffer against potential defaults and help banks manage risks. When a loan is eventually written off, the bank can utilize these provisions to absorb the loss.

Impact on NPAs Ratio

Loan write-offs significantly impact the calculation of gross non-performing assets (GNPA) ratio. Removing defaulted loans from the assets side of the balance sheet lowers the GNPA ratio, creating an impression of reduced NPAs. This improved ratio can boost investor confidence and enhance the bank’s reputation in the market.

Find More News Related to Banking

Which Lake is known as the Jewel of Udai...

Which Lake is known as the Jewel of Udai...

Which is the Largest Banana Producing St...

Which is the Largest Banana Producing St...

Shashi Tharoor Conferred Honorary D.Litt...

Shashi Tharoor Conferred Honorary D.Litt...