In the first four months of the 2023-24 financial year, India’s fiscal deficit has surged, surpassing a third of the full-year target. This financial imbalance, measured as the difference between government expenditure and revenue, is a critical indicator of the government’s borrowing needs.

Fiscal Deficit Overview:

- As of the end of July, the fiscal deficit in absolute terms stood at Rs 6.06 lakh crore, according to data from the Controller General of Accounts (CGA).

- This represents a significant increase compared to the same period in the previous financial year, where the deficit was at 20.5% of the Budget Estimates (BE).

Government’s Fiscal Target:

- In the Union Budget for 2023-24, the government aimed to reduce the fiscal deficit to 5.9% of the gross domestic product (GDP).

- In the prior financial year (2022-23), the deficit had reached 6.4% of the GDP, slightly lower than the initial estimate of 6.71%.

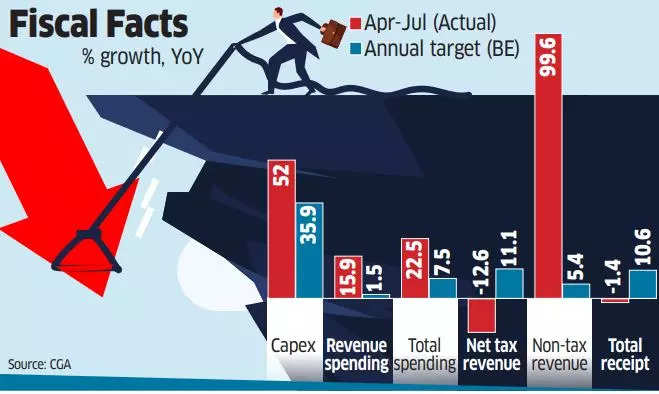

Revenue Collection:

- During the April-July period of the current fiscal year, the net tax revenue amounted to Rs 5.83 lakh crore, constituting 25% of the BE.

- This reflects a decrease compared to the same period in the previous year when the net tax revenue collection was 34.4% at the end of July 2022.

Government Expenditure:

- The central government’s total expenditure in the first four months of the financial year reached Rs 13.81 lakh crore, equivalent to 30.7% of the BE.

- In comparison, in the previous year, expenditure had reached 28.6% of the BE during the same period.

- Of the total expenditure, Rs 10.64 lakh crore was allocated to the revenue account, while Rs 3.17 lakh crore was earmarked for the capital account.

Find More News on Economy Here

Which Country Officially Uses Two Differ...

Which Country Officially Uses Two Differ...

Historic Glory! Jammu & Kashmir Win ...

Historic Glory! Jammu & Kashmir Win ...

Three Major Inland Waterways Projects Op...

Three Major Inland Waterways Projects Op...