Crude oil futures faced a downward trend on Wednesday morning, with February Brent oil futures reaching $77.23, a marginal increase of 0.04 per cent. Simultaneously, January crude oil futures on WTI (West Texas Intermediate) experienced a dip, settling at $72.31, down by 0.01 per cent. This decline comes amid various global factors impacting the oil market.

US Crude Oil Inventories Surge Despite Market Expectations

- A significant contributor to the fluctuations in crude oil prices is the unexpected surge in US crude oil inventories. According to the American Petroleum Institute (API), inventories increased by 594,000 barrels for the week ending December 1.

- This stark contrast to the anticipated decline of 2.26 million barrels had the market on edge. The official data from the US Energy Information Administration (EIA) was yet to be released, potentially adding further uncertainty to the market.

Moody’s Downgrades China’s Rating, Adding to Market Concerns

- China, another major consumer of crude oil, faced economic setbacks as Moody’s downgraded its A1 debt rating from ‘stable’ to ‘negative.’

- The rating agency cited “increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector” as reasons for the downgrade.

China’s Economic Struggles and Crude Oil Inventory Build-Up

- China’s economic indicators have recently hinted at a struggle for recovery. Reports suggest that the country has been building up its crude oil inventories throughout the year.

- These factors, combined with Moody’s downgrade, pose a potential threat to the demand for crude oil in China, a crucial player in the global oil market.

Impact on Crude Oil Prices in the Indian Market

- In the Indian market, December crude oil futures on the Multi Commodity Exchange (MCX) were trading at ₹6046, down by 0.56 per cent from the previous close.

- January futures were also affected, trading at ₹6097, a 0.52 per cent decrease. These price movements reflect the interconnectedness of global events and their influence on local commodity markets.

Other Commodity Market Updates

- While crude oil took center stage, other commodities experienced fluctuations in early Wednesday trading. December natural gas futures on MCX faced a decrease, settling at ₹225.40, down by 1.14 per cent.

- On the National Commodities and Derivatives Exchange (NCDEX), December turmeric (farmer polished) contracts saw an increase, trading at ₹12862, up by 1.79 per cent. However, January jeera futures on NCDEX witnessed a dip, trading at ₹39670, down by 0.71 per cent.

Important Questions Related to Exams

Q. What was the price of February Brent oil futures on Wednesday morning?

Answer: The price of February Brent oil futures was $77.23.

Q. Which rating agency downgraded China’s A1 debt rating, and what was the reason cited for the downgrade?

Answer: Moody’s downgraded China’s A1 debt rating, citing “increased risks related to structurally and persistently lower medium-term economic growth and the ongoing downsizing of the property sector.”

Q: What commodity experienced a decrease in futures on the National Commodities and Derivatives Exchange (NCDEX), and by what percentage?

Answer: December natural gas futures on NCDEX faced a decrease, settling at ₹225.40, down by 1.14 per cent.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

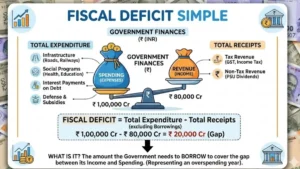

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...