Reserve Bank of India has issued a framework for facilitating small-value digital payments in offline mode using cards, wallets, mobile devices, etc, to push digital transactions in rural and semi-urban areas. The upper limit of an offline payment transaction was fixed at Rs 200, with a total limit of Rs 2,000 at any point in time. The framework will enable the Authorised Payment System Operators (PSOs) and Payment System Participants (PSPs), Acquirers and Issuers (banks and non-banks) to conduct small value offline digital payments.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Under the offline mode, payments can be carried out face-to-face (proximity mode) using any channel or instrument like cards, wallets, and mobile devices. These transactions will not require an additional factor of authentication (AFA), the Reserve Bank of India said, adding that since the transactions are offline, alerts (by way of SMS and/or e-mail) will be received by the customer after a time lag.

Iran Names Ayatollah Alireza Arafi as Te...

Iran Names Ayatollah Alireza Arafi as Te...

Iran’s Supreme Leader Ayatollah Ali Kham...

Iran’s Supreme Leader Ayatollah Ali Kham...

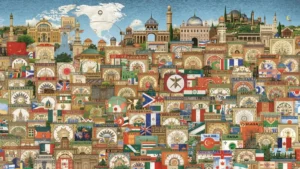

Which Country Officially Uses Two Differ...

Which Country Officially Uses Two Differ...