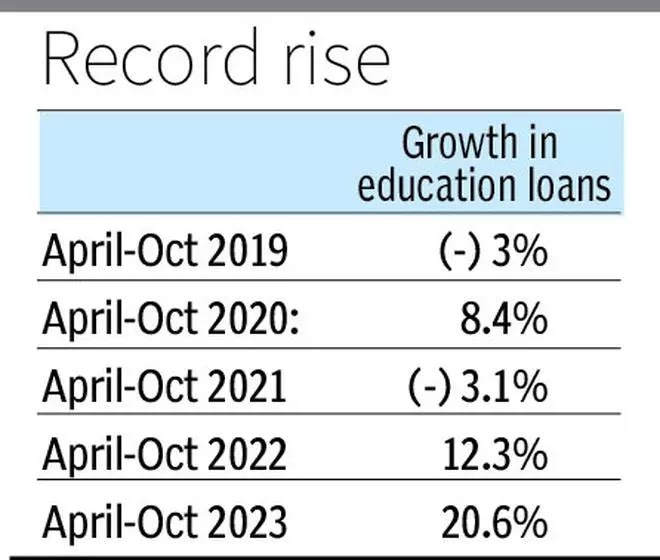

Education loans in India have witnessed a remarkable year-on-year growth of 20.6%, reaching ₹1,10,715 crore in the current financial year till October. This substantial increase, as reported by the Reserve Bank of India (RBI), marks the highest growth in the last five years. In comparison, the growth registered in the corresponding period was 12.3% in FY23 and a negative 3.1% in FY22, reflecting a significant positive shift.

Factors Driving the Surge

1. Low Base and Revival of Offline Campus Courses

One major driving force behind the surge in demand is the combination of a low base and the revival of offline campus courses, both in India and abroad. Bibekananda Panda, Senior Economist at the State Bank of India, notes that the fresh and pent-up demand for education loans is fueled by these factors.

2. Foreign Education Loans Dominating

Over the past year, foreign education loans have played a pivotal role, constituting nearly 65% of the loans disbursed. The average ticket size for these loans ranges from ₹40 lakh to ₹60 lakh. This increase aligns with the resurgence of offline campus courses and a growing interest in international education.

3. RBI’s Supportive Measures

The Reserve Bank of India’s recent actions, tightening credit to certain retail segments by increasing risk weights for banks and NBFCs, have spared education loans. According to Panda, this regulatory stance is expected to support the flow of credit to the education sector in the coming months.

Impact of US Admissions

Loans for education in the United States, in particular, have seen a notable uptick. The US Embassy and its consulates in India issued a record 1.40 lakh student visas between October 2022 and September 2023. A significant portion of these admissions is supported by education loans, contributing to the overall growth in the loan portfolio for banks.

Hassle-Free Application and Disbursal Process

The ease of obtaining education loans is another pivotal factor contributing to the growth. Banks have streamlined the application and disbursal process, making it more accessible and convenient for applicants. This customer-friendly approach has facilitated a smoother experience for students seeking financial assistance for their education.

Role of NBFCs in the Education Loan Segment

Non-Banking Financial Companies (NBFCs) are actively participating in the education loan segment. Notably, some NBFCs, including HDFC Credila, offer education loans up to ₹50 lakh without requiring collateral. The entire process is digitized, incorporating Video Know Your Customer (KYC), and promises speedy disbursal within a week from the date of application.

According to data from rating agencies, education loans of NBFCs experienced a phenomenal 100% growth in Assets Under Management (AUM) in FY23 compared to the previous year, showcasing the sector’s robust expansion.

Summary

- Education Loan Surge: Education loans in India have recorded an impressive 20.6% Year-Over-Year growth.

- Financial Volume: The loans reached ₹1,10,715 crore by October in the current fiscal year.

- Five-Year High: This growth is the highest observed in the last five years, based on data from the Reserve Bank of India (RBI).

- Diverse Factors: Factors contributing to the surge include increased demand for foreign education, a revived interest in offline courses, and a supportive regulatory environment.

- (NBFCs), like HDFC Credila, are actively participating, offering digitized processes and loans up to ₹50 lakh without collateral.

ICRA Projects India’s GDP Growth to Mode...

ICRA Projects India’s GDP Growth to Mode...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

India’s GDP May Hit 8.1% in Q3FY26: SBI ...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...