The latest “Men and Women” report by the National Statistical Office (NSO) reveals a stark financial disparity between men and women in India. While women own a significant portion of bank accounts, their share of total deposits remains disproportionately low, indicating a deep-rooted gender gap in financial status.

Key Findings

Bank Deposits

Ownership vs. Deposits: As of March 2023, women owned 36.4% (917.7 million) of the 2.52 billion individual bank accounts. However, only 20.8% (₹39 trillion) of the total ₹187 trillion deposited in these accounts belonged to women.

Urban-Rural Disparity: The gap is more pronounced in metropolitan areas, where women hold just 16.5% (₹1.9 trillion) of the deposits, compared to 30% (₹5.91 trillion) in rural areas. The higher rural percentage could be attributed to the widespread adoption of Jan Dhan accounts.

Employment in Banking Sector

Gender Disparity in Employment: Only 25% of bank employees are women, with 441,000 women working in banks compared to 1.32 million men.

Corporate Leadership

Senior Management: Women hold just 34,879 senior management positions, as opposed to 186,000 men in 2023. Although there’s been an increase from 23,685 women in 2017, the rise for men has been more substantial.

Board Membership: Women make up 762,000 of the total board members, while men account for 1.9 million. In other managerial roles, there are 738,000 women compared to 1.86 million men.

India’s Forex Reserves Fall $2.11 Billio...

India’s Forex Reserves Fall $2.11 Billio...

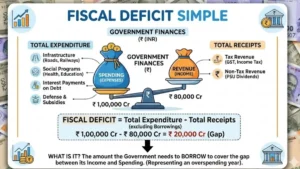

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s Fiscal Deficit Hits ₹9.8 Trillio...

India’s GDP Growth Slows to 7.8% in Q3FY...

India’s GDP Growth Slows to 7.8% in Q3FY...