India’s foreign exchange reserves have soared to a new peak, reaching $642.631 billion in the week ending March 22, marking the fifth consecutive week of increase, according to the latest data from the Reserve Bank of India (RBI).

Key Statistics

- Continuous Growth: Prior to the week ending on March 22, the reserves surged by $6.396 billion.

- Composition: The foreign currency assets (FCA), the largest component, slightly declined to $568.264 billion, while gold reserves rose to $51.487 billion.

- Yearly Comparison: In 2023, RBI added approximately $58 billion to the forex reserves, whereas in 2022, there was a cumulative slump of $71 billion.

Understanding Forex Reserves

- Definition: Forex reserves, or foreign exchange reserves (FX reserves), are assets held by a nation’s central bank, primarily in reserve currencies such as the US Dollar, Euro, Japanese Yen, and Pound Sterling.

- Purpose: These reserves serve as a cushion against economic shocks, facilitate international trade, and help maintain stability in the domestic currency’s value.

Factors Influencing Fluctuations

- Import Costs: A significant decline in reserves in 2022 was attributed to the rise in the cost of imported goods.

- RBI Intervention: The central bank intervenes in the forex market to prevent excessive depreciation of the rupee against the US dollar. This intervention is aimed at maintaining orderly market conditions and curbing excessive volatility.

- Market Monitoring: The RBI closely monitors forex markets and intervenes as necessary, without a predetermined target level, to ensure stability in exchange rates.

India-US Vajra Prahar 2026: Special Forc...

India-US Vajra Prahar 2026: Special Forc...

Forex Reserves of India Hit Record High ...

Forex Reserves of India Hit Record High ...

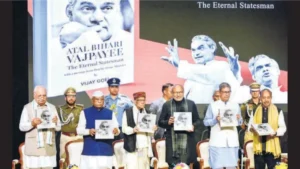

VP C. P. Radhakrishnan Unveils 'Atal Bih...

VP C. P. Radhakrishnan Unveils 'Atal Bih...