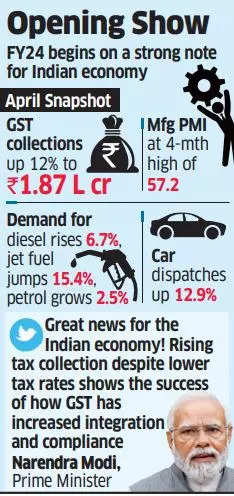

Record-high GST Revenue Collected in India for April 2023:

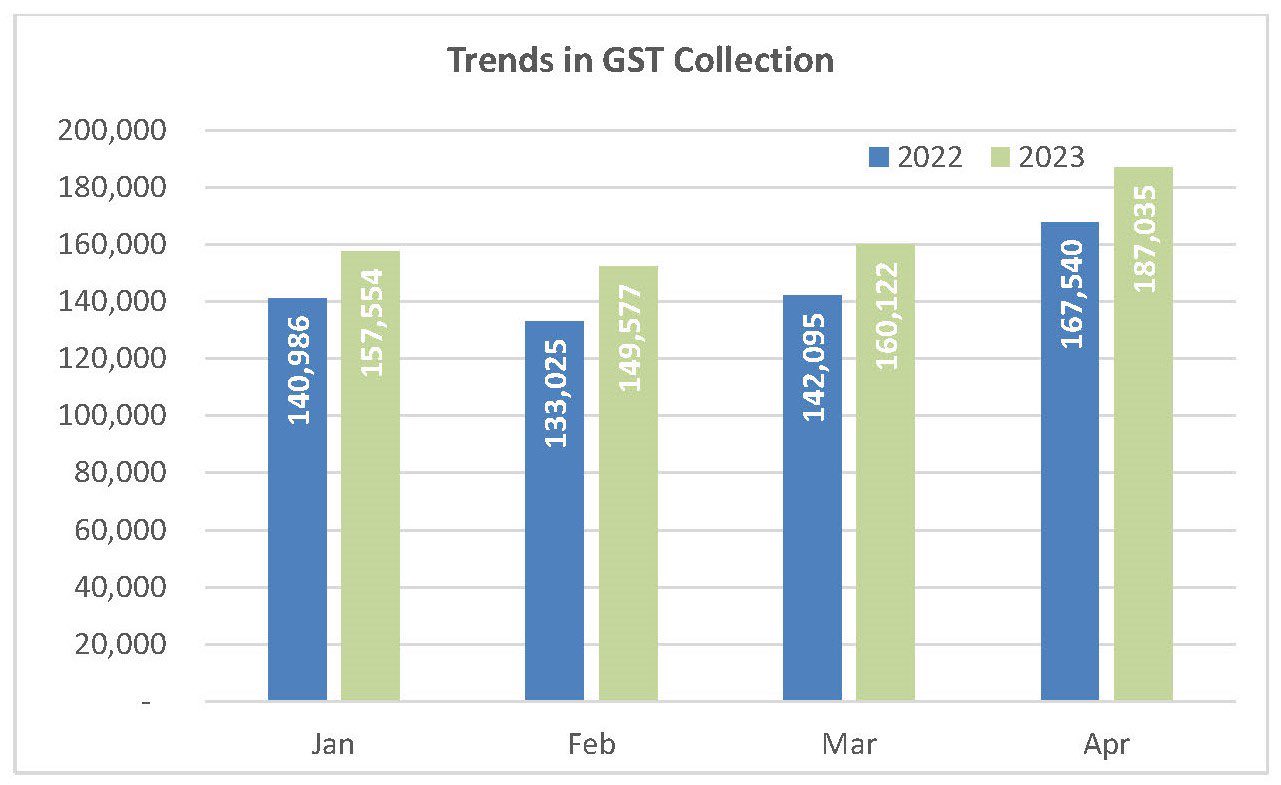

India’s gross GST revenues for April 2023 reached a record high of ₹1,87,035 crore, which is a 12% increase from last year’s highest tax tally of ₹1.67 lakh crore for the same month.

This article discusses the breakdown of the revenue collected and highlights the key factors contributing to the rise.

Buy Prime Test Series for all Banking, SSC, Insurance & other exams

Increase in Domestic GST Revenues:

The domestic GST revenues, including the import of services, rose 16% YoY in April. Although the figures for goods import were not revealed, they had increased 8% in March, according to the Finance Ministry.

Record-Breaking GST Compensation Cess Collections:

In April, GST Compensation Cess collections reached a new record of ₹12,025 crore, including ₹900 crore from imports, surpassing the previous high of ₹11,931 crore in February.

Highest Ever Single-Day GST Collection:

Taxpayers made a record-breaking GST contribution of ₹68,228 crore through 9.8 lakh transactions on April 20, which was the highest ever single-day GST collection.

Breakdown of GST Revenue Collection:

The gross GST revenue collected in April 2023 was ₹1,87,035 crore, of which CGST was ₹38,440 crore, SGST was ₹47,412 crore, IGST was ₹89,158 crore (including ₹34,972 crore collected on import of goods), and cess was ₹12,025 crore, according to the Finance Ministry.

Comparison with Last Year’s Figures:

The previous high collection of ₹1.68 lakh crore was in April last year. The ministry noted that the revenues for April 2023 are 12% higher than the GST revenues for the same month last year. Moreover, the revenues from domestic transactions (including import of services) during the month were 16% higher than the revenues from these sources during the same month last year.

Overall Fiscal Year Collection:

The total gross collection for the 2022-23 fiscal year stood at ₹18.10 lakh crore, 22% higher than the previous year.

Find More News on Economy Here

Which River is known as the Nile of Indi...

Which River is known as the Nile of Indi...

Which River is known as the Amazon of In...

Which River is known as the Amazon of In...

Shah Rukh Khan Debuts in Hurun Global Ri...

Shah Rukh Khan Debuts in Hurun Global Ri...